What is Ostium? Trade Perpetual Contracts on Real World Assets

Ostium is a decentralized, Arbitrum-based protocol for trading perpetual contracts on real-world assets such as forex, commodities, and stocks via synthetic, oracle-driven exposure.

UC Hope

December 10, 2025

Table of Contents

Ostium is a decentralized exchange protocol developed by Ostium Labs that enables users to trade perpetual futures contracts on real-world assets, including forex pairs, commodities, indices, stocks, and major cryptocurrencies, all on the Arbitrum blockchain. The platform provides synthetic price exposure to these assets without requiring physical ownership or tokenization, using stablecoins like USDC as collateral and oracle networks for real-time pricing.

As of December 2025, Ostium has expanded its reach with over $25 billion in trade volume, more than $213 million in open interest, and a user base exceeding 15,000 traders, following a recent $20 million Series A funding round that brings its total funding to $24 million.

What is Ostium and Ostium Labs?

Ostium refers to the protocol created by Ostium Labs, a company focused on building decentralized trading infrastructure for on-chain finance. At its core, Ostium is an open-source, decentralized exchange deployed on Arbitrum, an Ethereum Layer-2 network. It allows users to gain leveraged exposure to off-chain assets through synthetic perpetual contracts, enabling traders to bet on price movements without holding the underlying assets.

The protocol distinguishes itself by bridging traditional finance markets with blockchain technology. Unlike centralized exchanges or brokers, Ostium operates without intermediaries, ensuring self-custody of funds and transparent operations verifiable on the blockchain. Users interact with smart contracts that handle trades, settlements, and liquidity provision.

Ostium Labs, the development entity, oversees the protocol's evolution, while the Ostium Interface serves as a user-friendly web application for accessing these features. Governance is in development, with plans to shift toward community-driven decisions.

Launched amid growing demand for on-chain diversification, Ostium addresses limitations in existing decentralized finance platforms by supporting assets typically traded off-chain. It uses Oracle feeds to pull real-time prices, enabling positions in assets such as gold, oil, stock indices, and currency pairs. This setup avoids the complexities of asset tokenization, such as legal hurdles or custody issues, and caters to traders seeking short- to mid-term leveraged positions.

As of late 2025, Ostium has processed significant activity, reflecting its adoption in the decentralized perpetuals space. The platform's design emphasizes permissionless access, where anyone with a compatible wallet and USDC can participate without account approvals or geographic restrictions.

Which Team is Behind Ostium Protocol?

Ostium is led by co-founders Kaledora Kiernan-Linn and Marco Antonio Ribeiro, who initiated the venture in 2022 after crossing paths at Harvard and each completing brief tenures at Bridgewater Associates. Alongside their team, they secured a $3.5 million investment round on October 6, 2023, with backing from notable entities including General Catalyst, LocalGlobe, Susquehanna International Group (SIG), GSR, Balaji Srinivasan, LedgerPrime's Shiliang Tang, and additional contributors.

Furthermore, Ostium has secured a grant from the Arbitrum Foundation to advance its technical development and expansion.

The Push for Greater Diversification: Why Was Ostium Created?

According to its documentation, Ostium’s creation stems from evolving trends in on-chain finance and a recognized gap in asset diversification options available to cryptocurrency traders.

Following the depths of the 2022-2023 bear market, the cryptocurrency sector demonstrated resilience in certain areas, particularly as stablecoins maintained stable market capitalizations and saw increased adoption in emerging economies amid economic volatility. This period also highlighted growing institutional acceptance, exemplified by the approval of spot bitcoin exchange-traded funds, which signaled broader integration between crypto and traditional finance.

This integration operates in both directions: while cryptocurrencies are increasingly incorporated into mainstream financial products, traditional assets are being brought onto blockchain rails through mechanisms like stablecoins and tokenized equities. As a result, capital has tended to remain on-chain even during downturns, with users de-risking into less volatile options rather than exiting the ecosystem entirely. This shift is supported by improvements in user experience and the availability of on-chain diversification tools, such as tokenized U.S. Treasurys and gold, which have attracted significant total value locked.

However, despite these advancements, opportunities for true on-chain diversification into non-crypto assets remain constrained. This is evident: decentralized finance protocols excel at serving traders with tools like perpetuals, but the real-world assets being tokenized largely cater to passive investors. This leaves a void for traders seeking leveraged, directional exposure to off-chain assets without the logistical challenges of full tokenization, such as establishing on-chain equivalents or navigating regulatory frameworks.

Ostium was created to fill this specific gap. By developing a protocol for oracle-based synthetic perpetuals, Ostium Labs aimed to provide on-chain price exposure to real-world assets like forex, commodities, indices, and stocks, alongside blue-chip cryptocurrencies.

What are the Key Features of Ostium?

Ostium offers several core functionalities that set it apart in the decentralized trading landscape. These features prioritize user control, market access, and operational transparency.

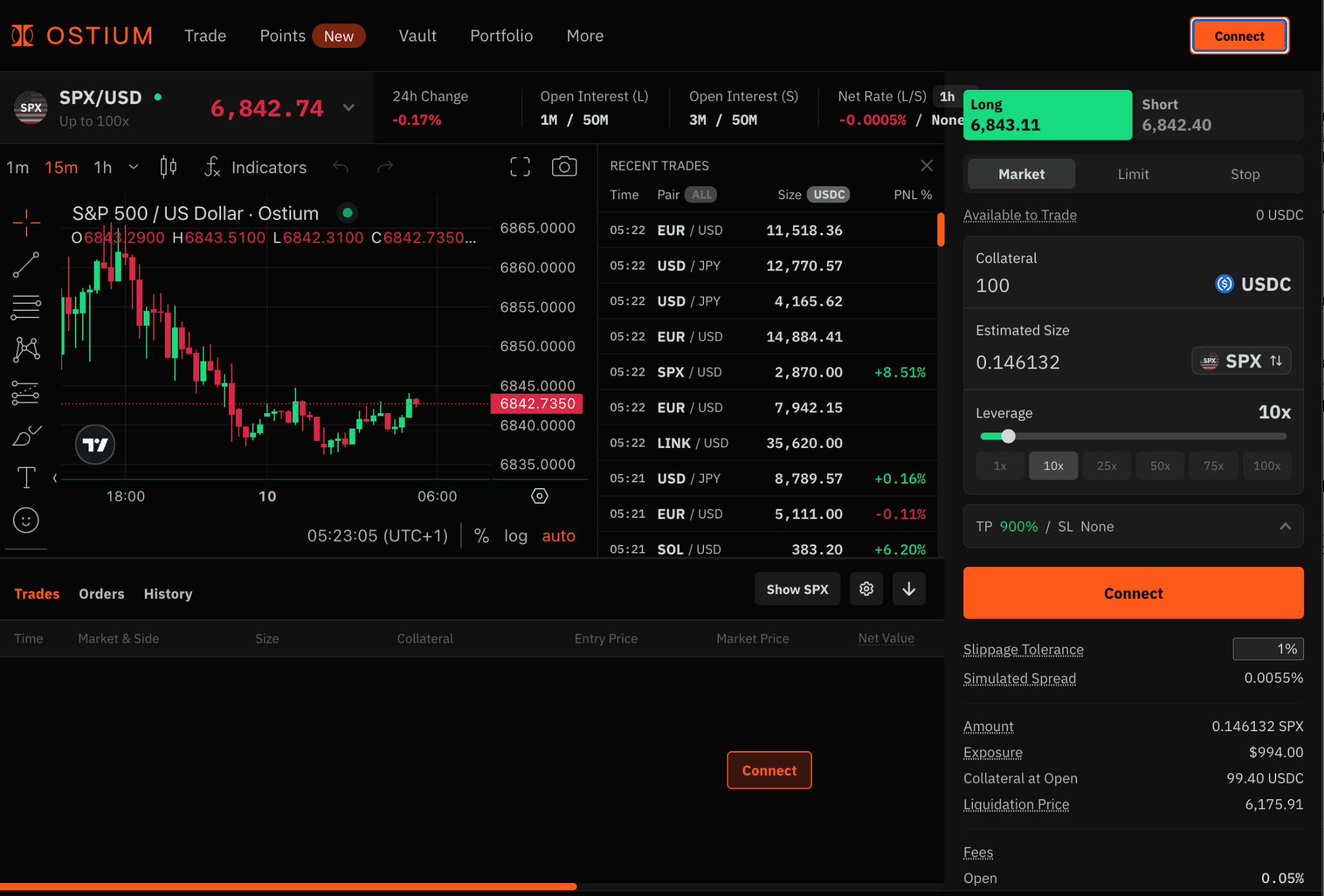

Broad Asset Coverage: Users can trade perpetual contracts on a wide range of categories, including forex (e.g., EUR/USD, USD/JPY), commodities (e.g., gold, WTI crude oil, copper), indices (e.g., S&P 500, US100), individual stocks (e.g., TSLA, NVDA, MSFT), and cryptocurrencies (e.g., bitcoin, ether). This unifies the macro and crypto markets in a single interface.

High Leverage Options: Positions support up to 200x leverage on select markets, with built-in guardrails, including liquidation thresholds, position-size caps, and day-trading rules for stocks, to manage risk.

Self-Custody and Instant Access: Funds remain in users' wallets, with no broker approvals required. Deposits and withdrawals occur instantly via stablecoins, avoiding the freezes or restrictions common on centralized platforms.

Transparent Fee Structure: Opening fees range from 3 to 10 basis points based on the asset, with no closing fees for standard exits. Ongoing costs include rollover fees for non-crypto assets (reflecting carry costs like interest differentials) and funding fees for crypto pairs (based on open interest imbalances). All fees are publicly viewable on-chain.

Order Types and Automations: Supports market, limit, and stop orders, along with take-profit and stop-loss settings. Automations handle liquidations and triggers for reliable execution.

Liquidity Provision: Users can deposit USDC to mint liquidity provider tokens (OLP), earning a share of protocol fees while backing trades.

One-Click Trading and Gas Sponsorship: Features such as session keys and gas-fee coverage simplify interactions, reducing the need for repeated transaction approvals.

Auditable Operations: Every trade, volume, and fee is recorded on-chain, allowing users to verify pricing, liquidity, and executions without relying on third-party reports.

These elements make Ostium suitable for crypto-native traders expanding into traditional assets and traditional finance participants entering blockchain-based trading.

How Does Ostium Work? Technical Breakdown

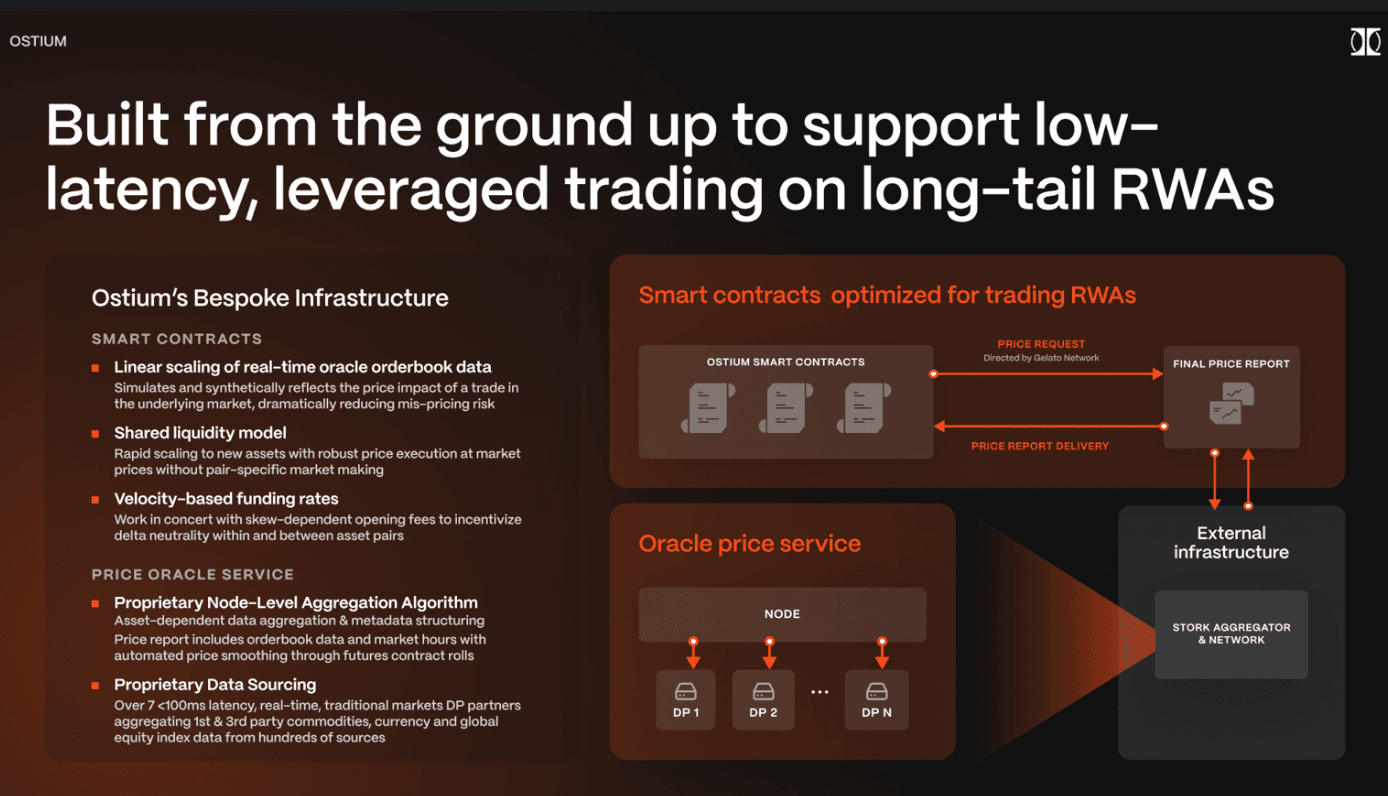

Ostium's Blockchain Architecture

Ostium's system is built on Arbitrum, an Ethereum Layer-2 solution that reduces transaction costs and increases speed while keeping the network decentralized. The core of the protocol consists of smart contracts that allow users to gain price exposure to assets outside the blockchain, such as stocks or commodities, through synthetic contracts. This is done using data from oracles rather than tokenizing those assets.

The Liquidity Vault Mechanism

The protocol centers on a single liquidity vault stored on the blockchain that collects USDC stablecoin deposits from liquidity providers. This vault serves as the counterparty in trades when there is an imbalance in open positions. Providers receive OLP tokens in exchange for their deposits and earn 30% of the fees charged when positions are opened, distributed immediately. The vault monitors its collateral level: if it drops below 100%, it charges additional fees on rollovers and liquidations, plus any net gains or losses from traders at settlement; if it's at or above 100%, it collects only opening fees.

Oracle-Based Pricing System

Asset prices are sourced from external oracles to ensure accuracy. For real-world assets like forex or commodities, the Stork Network delivers updates every fraction of a second, accounting for trading hours, public holidays, contract changes, and the difference between buy and sell prices from established exchanges.

For cryptocurrencies, Chainlink provides fast, low-delay data feeds with comparable reliability. Relying on oracles allows access to assets without on-chain tokens. Still, it carries risks such as delayed or incorrect data, which are reduced by using distributed, independent oracle networks.

Automation and Wallet Integration

Tasks such as closing losing positions, executing stop orders, and activating limit orders are managed automatically by services like Chainlink Automations or Gelato Functions, ensuring decentralized, consistent performance.

The protocol works with wallets compatible with the Ethereum Virtual Machine and uses multi-party computation to create wallets for users signing up via email securely.

Risk Management Features

To handle risks, Ostium employs fees that adjust based on conditions:

- Funding fees increase more sharply as open positions become unbalanced to motivate traders to even them out

- Rollover fees transfer real-market expenses, such as interest rate differences, directly to users

- For crypto trades, maker fees (lower) apply to low-leverage positions that help balance imbalances, while taker fees (higher) apply otherwise.

- If a position's value falls below the required margin, it is liquidated, with any incentives paid to liquidity providers.

Overall, Ostium adheres to a pool-based perpetuals model, minimizing liquidity fragmentation and enabling rapid asset onboarding. Audits and open-source code enhance security, though users must acknowledge the risks of smart contracts and oracles.

Practical Example: Inside The Ostium Trading Engine

The trading engine powers Ostium's core functionality, enabling seamless on-chain perpetual contract execution. It operates through a combination of smart contracts, oracles, and the liquidity vault to match trades and settle profits and losses.

When opening a position, the engine pulls Oracle prices to determine entry points, applies leverage, and calculates the required collateral. Traders specify long or short directions, order types, and optional take-profit/stop-loss levels. The vault acts as the initial counterparty, with liquidity providers bearing directional exposure during imbalances.

Fees compound per block to reflect risks: funding adjusts for skew, rollover covers carry costs, and opening fees vary by maker/taker status. For example, low-leverage trades that reduce imbalances qualify for reduced maker fees (e.g., 1-20x), while other trades incur higher taker rates.

Executions occur fully on-chain, with automations monitoring prices for triggers. Stock trades follow day-trading rules, allowing higher intraday leverage but auto-closing positions before market close, with lower overnight limits.

The engine supports peer-to-peer market making, where users can provide quotes, but primarily relies on the pooled model for efficiency. This design outsources price discovery to liquid off-chain markets via oracles, allowing quick listings without on-chain equivalents.

How to Get Started: Step-by-Step Tutorial

Getting started with Ostium requires a wallet, USDC funds, and basic familiarity with blockchain interfaces. Here's a detailed guide:

Step 1: Set Up a Wallet. If you don't have one, use Ostium's email sign-up to get a gasless, multi-party computation wallet. For advanced users, connect an EVM-compatible wallet like MetaMask, Rabby, or Coinbase Wallet via the app at app.ostium.io.

Step 2: Fund Your Wallet. Acquire USDC on Arbitrum. Options include purchasing with a credit card or via SEPA transfer (for EU users), bridging from other chains, or transferring from centralized exchanges such as Binance, Coinbase, or Kraken.

Step 3: Connect to the Platform. Visit https://app.ostium.com/trade, click "Connect," and select your wallet or email option. Approve the connection for session keys to enable one-click trading without repeated signatures.

Step 4: Deposit Collateral. Transfer USDC to your connected account. Deposits are instant and visible on-chain.

Step 5: Select and Open a Trade. Browse markets using the selector to find assets such as EUR/USD, gold, the S&P 500, or Bitcoin. Choose long/short, order type (market, limit, stop), position size, leverage, and optional take-profit/stop-loss. Review fees and confirm; the engine handles execution.

Step 6: Manage Positions. Monitor in the portfolio tab. Adjust collateral, edit orders, or partially close. For closures, select "Close" and specify full or partial amounts.

Step 7: Withdraw Funds. After closing positions, transfer USDC back to your external wallet instantly.

New users can enter their email address to receive potential incentives, such as a 2x points boost under the Ostium Points Program. Always start with small positions to understand risks, and review market hours for non-crypto assets.

What are Ostium’s Recent Innovations and Present Status?

Ostium has seen substantial growth and investment. In early December, Ostium Labs secured a $20 million Series A round co-led by General Catalyst and Jump Crypto, with participation from Wintermute and others, bringing total funding to $24 million. This follows a $3.5 million raise in 2023 and builds on the protocol's momentum in the real-world asset perpetuals sector.

Innovations include the launch of the Ostium Points Program in March 2025, under which users earn points based on trading volume, potentially leading to airdrops or other rewards. The platform has integrated one-click trading, session keys, and gas sponsorship to enhance user experience. Proprietary price quoting, licensed from exchanges, allows faster asset additions.

Current status highlights robust metrics: over $25 billion in cumulative trade volume, $213 million in open interest, and more than 15,000 active traders. Several outlets have compared Ostium to platforms such as Hyperliquid, highlighting its potential in on-chain global markets. Backed by investors including Coinbase Ventures, Wintermute, and Balaji Srinivasan, Ostium continues to expand its listings and refine its oracle infrastructure amid growing institutional adoption of decentralized finance.

Conclusion: Evaluating Ostium's Position in On-Chain Trading

Ostium is a specialized protocol for perpetual trading in real-world assets that combines self-custody, high leverage, and broad market access through oracle-driven synthetics. Its key features support a range of asset classes, with transparent fees and automation, while the technical setup on Arbitrum ensures scalability. The trading engine's pool-based model facilitates efficient executions, and straightforward onboarding makes it accessible.

With recent funding and user growth, Ostium demonstrates viability in merging traditional and decentralized markets, underscoring its role in expanding on-chain opportunities.

Sources

- Coingecko Blog - What is Ostium?

- Documentation - Ostium’s Technical details, Features, Guide, etc.

- Website - Launch Application.

- X Account - Recent Updates.

- Linity - Ostium Review.

- CryptoRank - Ostium Funding Rounds.

- Coindesk - Ostium Raises $20M Series A.

Read Next...

Frequently Asked Questions

What assets are available for trading on Ostium?

Ostium supports perpetual contracts on forex pairs such as EUR/USD, commodities such as gold and oil, indices including the S&P 500, stocks such as TSLA, and cryptocurrencies such as bitcoin, all settled in USDC.

How does Ostium ensure pricing accuracy for real-world assets?

The platform uses Stork Network oracles for non-crypto assets to deliver sub-second updates with bid-ask data, market hours, and rollovers, while Chainlink handles crypto pricing.

What are the main risks associated with using Ostium?

Risks include leverage-induced liquidations, oracle data failures, smart contract vulnerabilities, and market closures for non-crypto assets, advising users to risk only affordable capital.

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

UC Hope

UC HopeUC holds a bachelor’s degree in Physics and has been a crypto researcher since 2020. UC was a professional writer before entering the cryptocurrency industry, but was drawn to blockchain technology by its high potential. UC has written for the likes of Cryptopolitan, as well as BSCN. He has a wide area of expertise, covering centralized and decentralized finance, as well as altcoins.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens