What is Momentum Finance? Binance’s New Listing

Built on Sui, Momentum Finance launches its MMT token on leading exchanges, marking growth in decentralized trading and yield solutions.

Miracle Nwokwu

November 5, 2025

Table of Contents

Momentum Finance's native token, MMT, began trading yesterday on multiple cryptocurrency exchanges, marking a significant step for the project built on the Sui blockchain. The token is now available on top-tier exchanges such as Binance, Upbit, Gate.io, and KuCoin, with trading pairs including USDT, USDC, BNB, and TRY on Binance.

Eligible users who participated in pre-launch activities or hold certain assets can check their allocations through Momentum's official airdrop portal. The token’s price surged sharply within its first 24 hours, reaching around $6.47 on Binance, before retracing to its current range under $1.

Overview of Momentum Finance

Momentum Finance positions itself as a comprehensive platform for trading and managing assets on the Sui blockchain, with plans to expand beyond. Launched in beta on March 31, it focuses on providing infrastructure for Sui-native assets initially, before incorporating cross-chain and real-world assets (RWAs). The project unfolds in three phases: starting with Sui ecosystem tools, then enabling cross-chain functionality via integrations like Wormhole, and finally incorporating tokenized RWAs such as securities and real estate. This phased approach aims to create a unified marketplace where assets can interact seamlessly, supported by Sui's high-performance features.

At its core, Momentum serves as a liquidity hub, combining decentralized finance (DeFi) elements with tools for both retail and institutional users. It leverages Sui's programmable transaction blocks for efficient, atomic operations—allowing users to bundle actions like swapping, adding liquidity, and claiming rewards in a single step, which reduces fees and risks.

Backing and Milestones

Momentum Finance has secured support from several prominent investors in the cryptocurrency space. In June 2025, the project raised funds in a strategic round valued at $100 million, led by OKX Ventures and including participation from Coinbase Ventures, Protagonist, and DNA Fund. Additional backers include the Sui Foundation, Circle, and Jump Crypto, providing a foundation for its expansion within the Sui ecosystem. These investments have helped fuel the platform's growth since its beta launch earlier in the year.

The project has hit several key milestones in recent months. To date, Momentum's decentralized exchange (DEX) has attracted over 1.68 million unique swap users and 1.42 million liquidity providers. Its total value locked (TVL) surpassed $600 million, while cumulative trading volume exceeded $25 billion. Daily volumes have reached upwards of $800 million at peaks, reflecting steady user adoption. Earlier figures show progression: TVL crossed $70 million in June, $130 million in July, and $240 million by September, before climbing further. In late October, Momentum extended its Hold Yield Phase 2 campaign until November 15, aiming to boost participation through incentives like liquidity rewards. Additionally, the platform integrated Bitcoin finance (BTCfi) pairs, adding over 15 options with more than $100 million in liquidity, enhancing cross-asset trading capabilities.

Key Products and Features

One of Momentum's flagship offerings is its DEX, a concentrated liquidity automated market maker (AMM) inspired by Uniswap v3. This design lets liquidity providers focus capital in specific price ranges, leading to tighter spreads and less slippage compared to traditional AMMs. The DEX supports retail-friendly interfaces with low fees and guides, while offering advanced tools for institutions, including deep liquidity and self-custody. Cross-chain support through Wormhole allows trading of assets from other blockchains, contributing to the platform's volume growth.

Complementing the DEX is MSafe, a multi-signature wallet for Move-based chains like Sui, Aptos, Movement, and IOTA. It handles treasury management, token vesting, and secure integrations via a dApp store. Trusted by protocols across these ecosystems, MSafe provides configurable protections and on-chain transparency, making it a tool for governance and capital handling.

xSUI, Momentum's liquid staking solution, enables users to stake SUI tokens for network rewards while keeping them liquid for DeFi activities. Users receive xSUI tokens, which can be used in lending, liquidity provision, or as collateral. This setup enhances capital efficiency, as staked assets earn yields without being locked away, and integrates with the DEX to boost overall liquidity.

The Token Generation Lab (TGL) acts as a launchpad for projects, connecting them with investors, exchanges, and communities. It emphasizes sustainable distribution, with fees partly returned to ecosystem participants like DEX users and NFT holders. TGL avoids upfront fees and locks launchpad tokens for 12 months to support liquidity, while funneling new projects into the DEX.

Vaults offer automated yield strategies, rolling out in phases from auto-rebalancing for single pairs to advanced options like leverage and multi-chain support. These allow users to deposit assets and earn without manual management, drawing in TVL and supporting ecosystem growth.

Finally, Momentum X introduces a compliance layer for tokenized assets, using Sui's tech for universal KYC/AML. Users verify once for access across assets, with on-chain enforcement ensuring regulatory adherence. This addresses fragmentation in RWA tokenization, promoting composability between crypto and traditional assets.

Tokenomics and Roadmap

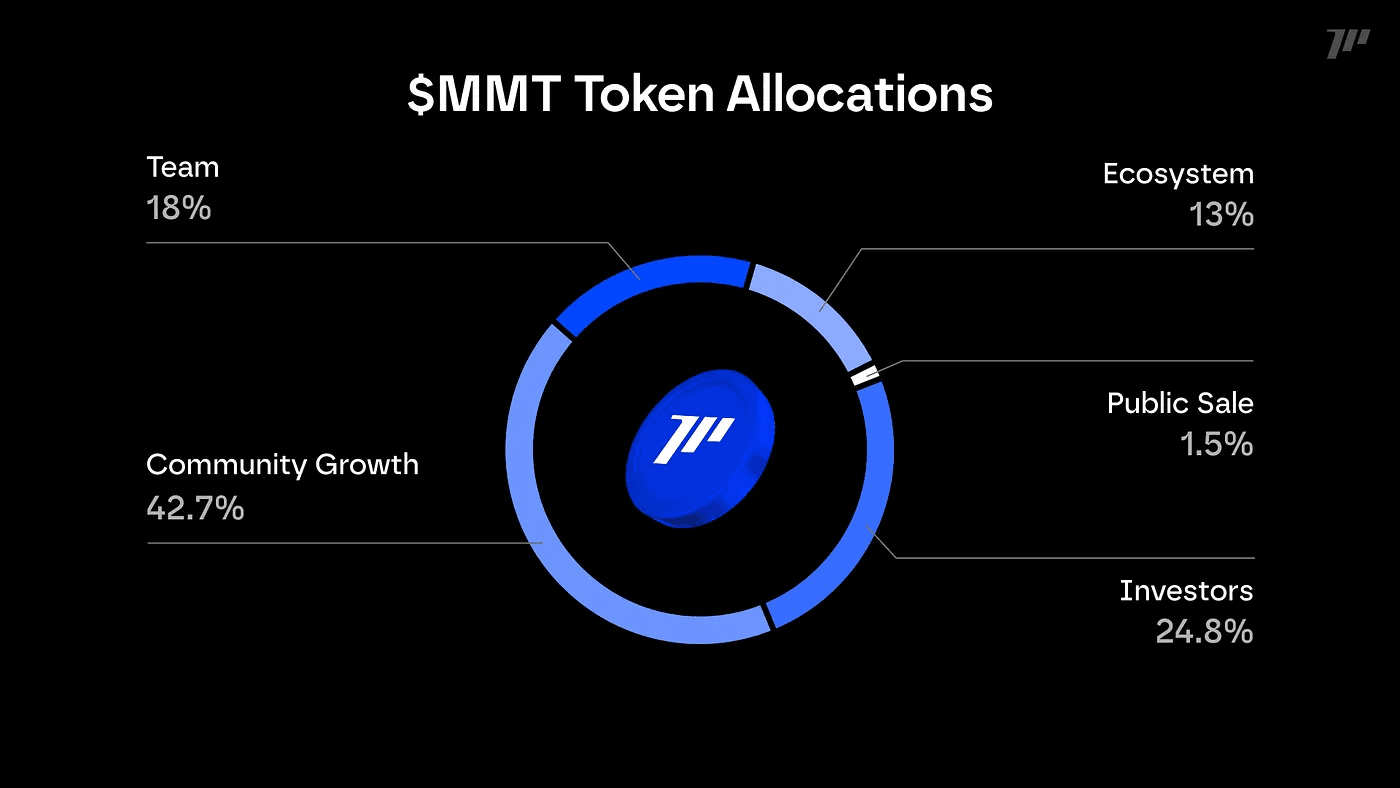

The MMT token has a total supply of 1 billion, with about 20.41% circulating at launch. Allocations include 13% for ecosystem development, 42.72% for community growth, 24.78% for investors (with vesting), 1.5% for public sale, and 18% for the team (over four years). MMT uses a vote-escrow model for governance, where bonding grants veMMT for voting on proposals and emissions. Emissions start 3-6 months post-launch under a ve(3,3) framework, rewarding liquidity providers and active governors.

Momentum's roadmap aligns with its phases. Live products include MSafe, DEX, xSUI, and vaults. Upcoming are a perpetual DEX in Q1 2026, TGL in Q1 2026, and Momentum X in Q2 2026. The vision extends to a platform where retail and institutional users trade diverse assets on-chain, bridging Web2 and Web3.

Sources:

- Momentum Finance Official Documentation: https://docs.mmt.finance/

- MMT Token Allocation and Unlocks (Medium): https://mmtfinance.medium.com/introducing-mmt-token-allocation-unlocks-b3f9f9feb8e6

- Momentum HODL Yield Campaign (Momentum on X): https://x.com/mmtfinance/status/1981760734792167780?s=46

Read Next...

Frequently Asked Questions

What is Momentum Finance?

Momentum Finance is a comprehensive platform for trading and managing assets on the Sui blockchain, offering tools like a DEX, liquid staking (xSUI), multi-signature wallet (MSafe), and automated yield vaults. It plans to expand to cross-chain and real-world assets.

What is the MMT token?

MMT is the native token of Momentum Finance, with a total supply of 1 billion. It launched on exchanges like Binance, supports governance via vote-escrow (veMMT), and rewards liquidity providers through emissions.

Who are the major backers of Momentum Finance?

Momentum Finance has raised over $100 million in funding, led by OKX Ventures, with participation from Coinbase Ventures, Protagonist, DNA Fund, and support from Sui Foundation, Circle, and Jump Crypto. These strategic investors have strengthened Momentum’s presence within the Sui ecosystem.

What is the roadmap for Momentum Finance?

The roadmap includes a perpetual DEX in Q1 2026, Token Generation Lab (TGL) in Q1 2026, and Momentum X for compliant tokenized assets in Q2 2026, aiming to bridge Web2 and Web3.

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

Miracle Nwokwu

Miracle NwokwuMiracle holds undergraduate degrees in French and Marketing Analytics and has been researching cryptocurrency and blockchain technology since 2016. He specializes in technical analysis and on-chain analytics, and has taught formal technical analysis courses. His written work has been featured across multiple crypto publications including The Capital, CryptoTVPlus, and Bitville, in addition to BSCN.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens