Fraction AI Introduces Signature Agents, Allowing Users to Create and Share Their Own Agents

Fraction AI introduces Signature Agents, letting users build and share AI agents that autonomously manage stablecoins on-chain via Stable-Up.

UC Hope

January 9, 2026

Table of Contents

Fraction AI has introduced Signature Agents, a new feature that allows users to create, deploy, and share personalized AI agents that autonomously manage stablecoins on-chain. Introduced on January 5, 2026, the feature expands Fraction AI’s Stable-Up protocol by turning individual trading and risk strategies into verifiable, reusable agents. The release directly answers a growing demand in decentralized finance for user-defined automation that is transparent, auditable, and non-custodial.

This article explains what Signature Agents are, how they work, and why they matter within Fraction AI’s broader effort to combine reinforcement learning, blockchain infrastructure, and stablecoin-based DeFi.

Overview of Fraction AI

Fraction AI is a decentralized platform that trains and evolves AI agents in competitive, on-chain environments. Built on Base, an Ethereum Layer-2 network developed by Coinbase, the platform enables users to create AI agents using natural-language prompts rather than code.

Fraction AI combines reinforcement learning with blockchain execution. Agents operate in short, structured sessions within specialized spaces where they compete, generate data, and earn rewards. Performance data feeds back into training loops, allowing agents to improve over time. The system is designed to be trustless, transparent, and composable with other on-chain protocols.

As of early 2026, Fraction AI reports more than 192,500 users, 152,400 deployed agents, and 3.7 million completed sessions on mainnet. The current production release is version v0.0.1, with staking and additional governance features planned.

The project raised $6 million in 2024 and is backed by investors including Sandeep Nailwal, Illia Polosukhin, and Michael Heinrich, as well as firms such as Borderless Capital, Anagram, The Spartan Group, and Symbolic Capital. Governance and incentives across the ecosystem are coordinated through the $FRAC token, which is used to distribute rewards and support community decision-making on data quality and protocol standards.

From Agent Training to DeFAI

Fraction AI’s early focus was on agent training and data generation. In 2025, the platform expanded into DeFi, a shift often described as DeFAI, in which AI agents automate capital allocation rather than merely generate outputs or predictions.

Key milestones during 2025 included more than 30 million agent sessions completed on testnet, the deployment of over one million agents on mainnet, and more than $1 million distributed in rewards. Fraction AI also launched the ALFA prediction market with NEAR Protocol and integrated with DeFi protocols such as Morpho, Avantis, and Euler. These integrations provided access to yield strategies backed by more than $1 billion in underlying total value locked.

Within this context, Stable-Up became Fraction AI’s primary financial product.

What Is Stable-Up?

Stable-Up is a yield-generating protocol for stablecoins that uses AI agents to manage deposits across on-chain environments. Instead of leaving USDC idle, users deposit funds into curated silos that are actively managed by agents trained to evaluate yield, risk, and liquidity conditions.

Each silo is overseen by a core agent, such as Tatsu, Noam, Arjun, Morris, or Zach, who routes capital according to predefined risk profiles. Agents monitor markets continuously and rebalance positions based on outcomes from previous allocations.

Since launch, Stable-Up has attracted more than $100 million in total value locked. The protocol offers an average yield of around 7 percent APY on stablecoins and Fractals, the platform’s point system that can later be redeemed for $FRAC tokens. Long-term staking increases Fractal rewards through a time-based multiplier.

Stable-Up integrates with protocols such as Avantis, an on-chain perpetuals exchange on Base that offers USDC vaults, and Morpho, which supports collateralized lending strategies. All allocations are subject to internal validation checks before funds are routed, and there are no custody transfers or lockups.

Introduction to Signature Agents

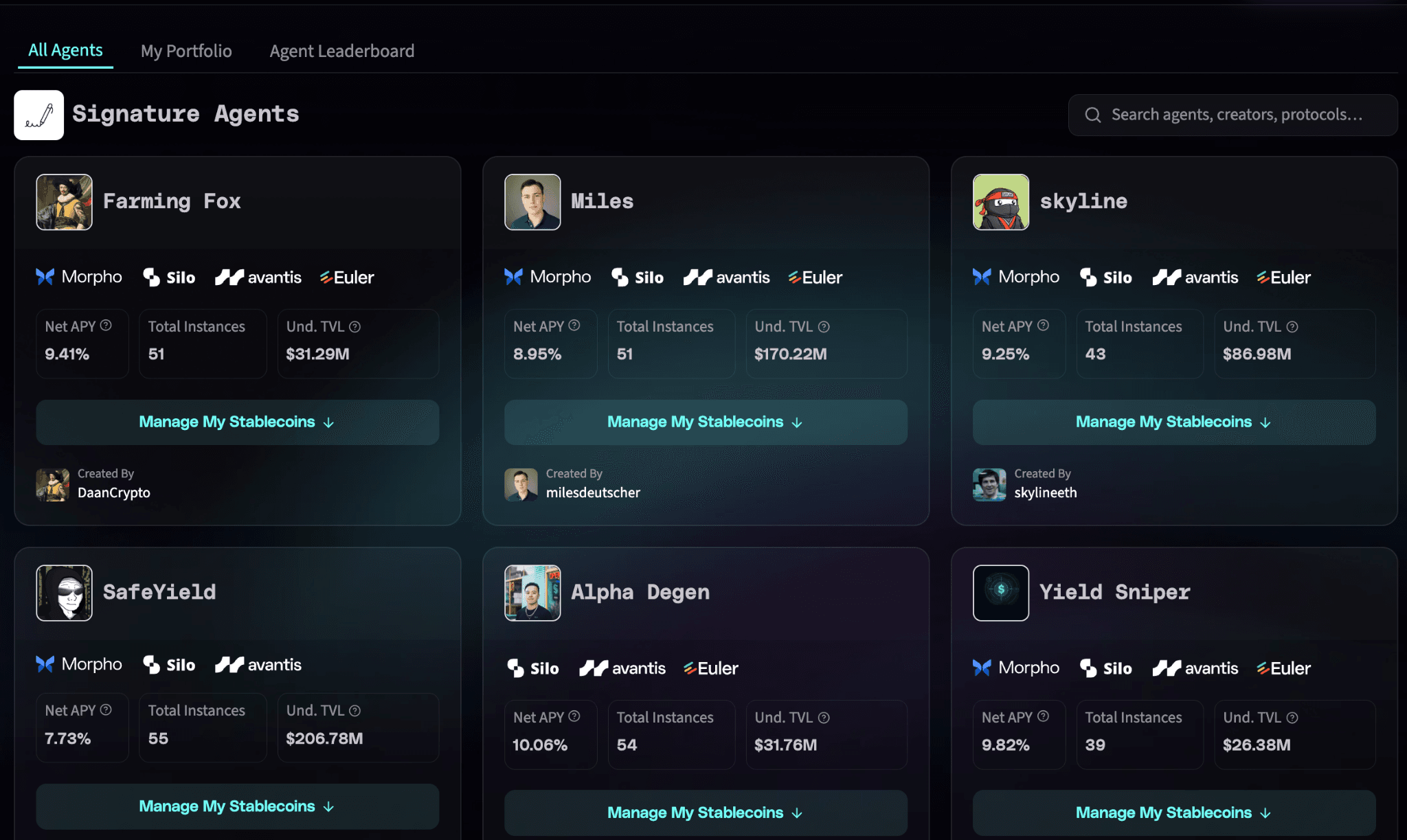

Signature Agents extend Stable-Up by allowing individual users to define how stablecoins should be managed and to package that logic into a shareable AI agent. Rather than relying only on core silos, users can now deploy agents that reflect personal strategies, such as conservative yield preservation, balanced allocation, or higher-risk optimization.

Starting the New Year with a Banger. Today, we’re introducing Signature Agents inside Stable-Up, built on Base.

— Fraction AI (@FractionAI_xyz) January 5, 2026

Signature Agents let users create and share their own agents, each shaped by how its creator thinks about using stablecoins. Access starts with FOXX NFT holders,… pic.twitter.com/brJdpnZ3Ap

Each Signature Agent represents the creator’s mental model for stablecoin use. These models are expressed in plain language during agent creation and then executed autonomously on-chain. Other users can choose to deploy those agents, making strategy performance visible and comparable.

At launch, Fraction AI featured Signature Agents created by well-known crypto traders and commentators, covering a range of approaches from safety-first to aggressive yield optimization. These agents were presented as reference strategies rather than endorsements.

How Signature Agents Work

Signature Agents are built on the same technical foundation as Fraction AI’s core agents but add customization and portability.

Users create agents through a natural-language interface without writing code. They specify objectives, risk tolerance, and allocation logic, which are then translated into agent behavior via APIs compatible with large language models.

Agents operate primarily on Base, where transaction fees are low and execution times are short. They can interact with multiple DeFi protocols without taking custody of funds. Capital remains under user control while agents execute predefined actions.

For yield optimization, agents track APYs across supported protocols and adjust allocations based on market conditions and historical performance. Risk assessment is continuous, allowing agents to reduce exposure or rebalance when conditions change.

For microtransactions and settlements, Signature Agents can use systems such as Coinbase’s x402 protocol, which enables HTTP-based on-chain payments, and Google Cloud’s Agent Payments Protocol, which supports credentialed, verifiable transactions.

All agent actions are recorded on-chain. Performance history is publicly visible, allowing creators to build a reputation based on measurable outcomes rather than claims.

Access and Distribution

Signature Agents initially launched for FOXX NFT holders, with access prioritized by NFT tier. FOXX NFTs also provide higher Fractal multipliers, early access to features, and participation in private missions.

Fraction AI plans to expand access gradually through the Stable-Up application. To use Signature Agents, users need a compatible wallet connected to Base. No coding experience or additional infrastructure is required.

Broader Implications for Stablecoins and AI

Stablecoins processed an estimated $12 trillion in transaction volume in 2024, with total supply reaching approximately $300 billion in 2025. Within this scale, Signature Agents frame stablecoins as active coordination tools rather than passive stores of value.

Institutional adoption of AI-driven automation is already underway, with some financial institutions testing or planning deployments. Regulatory developments, such as the U.S. GENIUS Act, and integrations by companies like Visa and Stripe suggest growing acceptance of programmable financial infrastructure.

Fraction AI’s approach does not merge these trends into a single system. Instead, it provides infrastructure that allows AI agents to interact with existing DeFi protocols under transparent, on-chain rules.

Conclusion

Signature Agents extend Fraction AI’s existing architecture by introducing user-defined automation into stablecoin management. By enabling individuals to encode and share their own strategies, the platform adds flexibility while preserving transparency and control. Within the Stable-Up framework, Signature Agents function as a practical mechanism for deploying AI in DeFi, emphasizing measurable performance, verifiable execution, and on-chain accountability.

Sources:

- X Post: Signature Agents Announcement

- Stable-Up Dapp: Signature Agents

Read Next...

Frequently Asked Questions

What is a Signature Agent in Fraction AI

A Signature Agent is a user-created AI agent that autonomously manages stablecoins based on a defined strategy using Fraction AI’s Stable-Up protocol.

Do Signature Agents require coding skills?

No. Agents are created using natural-language prompts, and execution is handled automatically by the platform.

How are Signature Agents evaluated?

All agent actions and performance data are recorded on-chain, allowing users to review historical results before deploying an agent.

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

UC Hope

UC HopeUC holds a bachelor’s degree in Physics and has been a crypto researcher since 2020. UC was a professional writer before entering the cryptocurrency industry, but was drawn to blockchain technology by its high potential. UC has written for the likes of Cryptopolitan, as well as BSCN. He has a wide area of expertise, covering centralized and decentralized finance, as well as altcoins.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens