Chainlink CCIP Connects Hong Kong CBDC and Australian Stablecoin While Powering HashKey HSK

These two integrations highlight Chainlink’s growing role as the backbone of global digital finance, connecting both permissioned and permissionless ecosystems through scalable, secure infrastructure.

Soumen Datta

June 10, 2025

Table of Contents

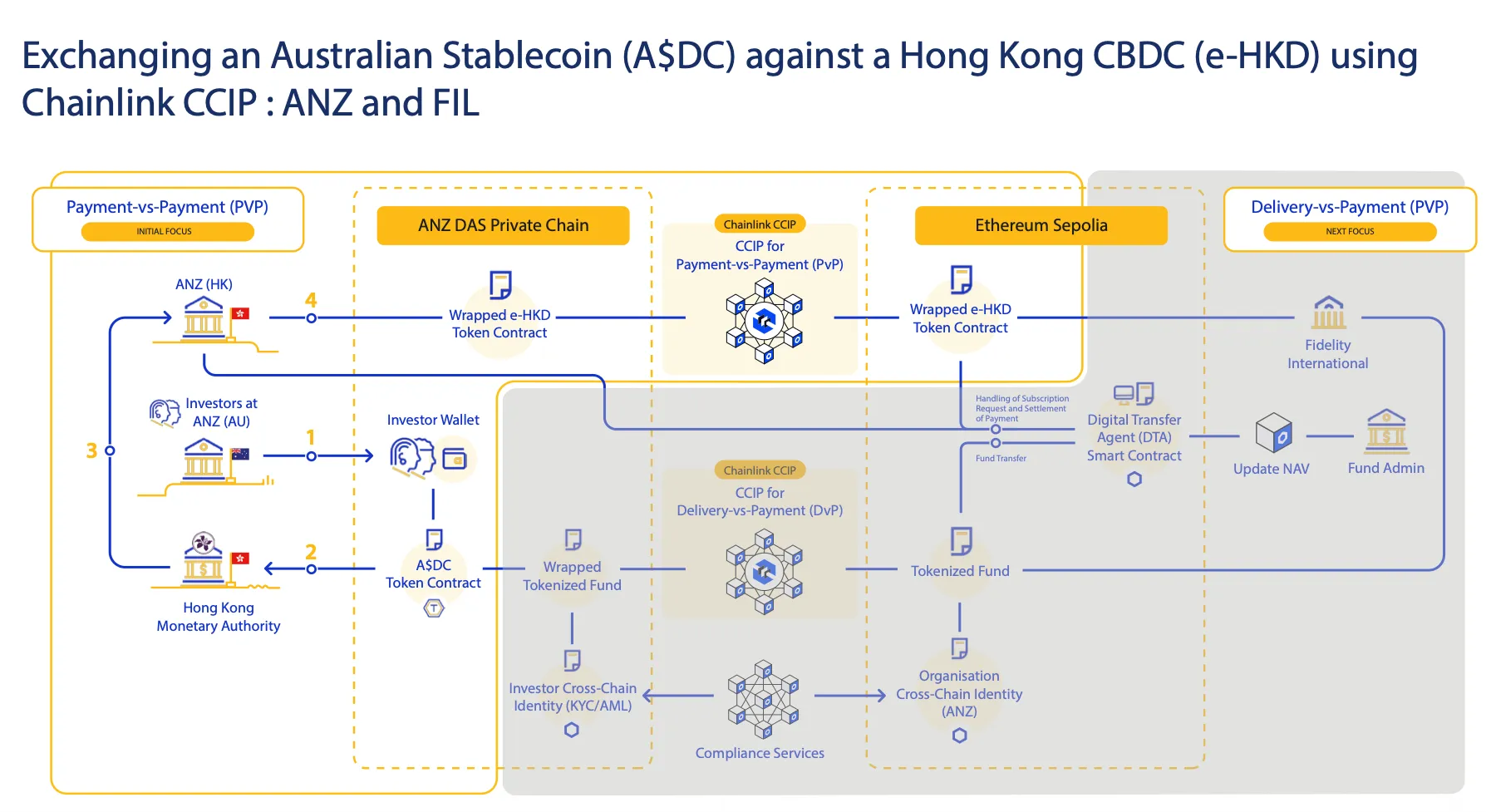

Chainlink's Cross-Chain Interoperability Protocol (CCIP) enables the exchange between Hong Kong’s central bank digital currency (e-HKD) and Australia’s AUD-backed stablecoin (A$DC).

This development is part of Phase 2 of the e-HKD+ pilot program led by the Hong Kong Monetary Authority (HKMA). The initiative involves a real-world simulation of cross-border investment in tokenized money market funds. It uses programmable digital money and aims to bring near-instant settlements to what was once a sluggish, risk-prone process.

Chainlink CCIP Bridges Private and Public Blockchains

The pilot connected ANZ’s private DASChain to Ethereum’s Sepolia testnet using Chainlink’s CCIP. This allowed an Australian investor to convert A$DC into e-HKD, then use the digital Hong Kong dollar to buy a tokenized money market fund managed in Hong Kong.

The outcome is instant transaction settlement with lower risk and minimal friction. The entire process, traditionally taking 2–3 days, completed in seconds—even during off-hours and weekends. It shows how programmable digital currencies can streamline capital markets and increase global accessibility.

Visa’s Tokenized Asset Platform (VTAP) was used to create and transfer digital currencies. Chainlink CCIP handled the execution logic, supporting delivery-versus-payment (DvP) and payment-versus-payment (PvP) mechanisms. On-chain identity checks and smart contract compliance were managed using Chainlink’s services. Token standards ERC-20 and ERC-3643 were also tested for security and regulatory alignment.

Real-World Benefits for Investors and Institutions

This pilot illustrates how blockchain can modernize fund access. It allows Australian investors to directly participate in Hong Kong-based investment products using digital currency, without the need for intermediaries.

Fidelity International and ChinaAMC, both of whom have previously issued tokenized funds, provided the investment products for this trial. Their participation shows that major asset managers see blockchain not as hype but as critical infrastructure for the future of fund distribution.

With tokenized assets expected to exceed $2 trillion by 2030, this test lays foundational work for scalable and secure capital markets.

CBDC and Stablecoin Use Cases Expand

The pilot also explores the synergy between permissioned and permissionless chains. Private blockchains offer controlled environments and compliance. Public chains like Ethereum provide global distribution and transparency. Chainlink CCIP enables both to communicate securely.

The HKMA’s Phase Two pilot, launched in September 2024, includes 11 consortiums working on CBDC use cases. These range from programmable payments to cross-border token transfers. The final reports are expected by the end of 2025.

HashKey Chooses Chainlink CCIP

In another move demonstrating CCIP’s growing dominance, HashKey Chain has tapped Chainlink to bridge its native token HSK across chains including Arbitrum and Base. Using the Cross-Chain Token Standard (CCT), the HSK token now operates with enhanced programmability, secure transfers, and seamless interoperability.

HashKey Chain is a Layer 2 blockchain focused on regulatory compliance. By adopting CCT, developers on HashKey gain control over token behavior and can integrate HSK into a growing ecosystem of cross-chain DeFi applications.

CCIP-backed apps like Transporter and XSwap will make HSK easily accessible to users across supported networks. As CCIP expands support, HSK’s reach will grow alongside it.

Robust Security and Developer Control

Chainlink CCIP is known for its defense-in-depth model, secured by decentralized oracle networks (DONs) that have handled over $21 trillion in on-chain value. These networks also underpin DeFi platforms with a combined TVL of $75 billion at their peak.

HashKey and its developers benefit from the latest CCIP features. These include message batching to lower gas costs, integration with non-EVM chains, and the new Token Developer Attestation tool for cross-chain control.

Johann Eid, Chainlink Labs’ Chief Business Officer, summed up the collaboration:

“With CCIP as the canonical bridge, HSK becomes a seamlessly composable asset across leading chains, opening the door for developers to integrate it into a growing universe of cross-chain applications.”

Chainlink Live on Solana

Chainlink CCIP v1.6 is now live on the Solana mainnet, enabling seamless and secure cross-chain transfers between Solana and major networks like Ethereum, BNB Chain, and Arbitrum.

With this upgrade, projects such as Maple Finance, Shiba Inu, and Backed Finance can bring over $19 billion worth of tokenized assets into Solana’s high-speed, low-cost environment.

By adopting Chainlink’s Cross-Chain Token (CCT) standard, these assets can move across chains without compromising performance or security. First-time adopters of the standard include ElizaOS, The Graph, Pepe, and Zeus Network.

Read Next...

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

Soumen Datta

Soumen DattaSoumen has been a crypto researcher since 2020 and holds a master’s in Physics. His writing and research has been published by publications such as CryptoSlate and DailyCoin, as well as BSCN. His areas of focus include Bitcoin, DeFi, and high-potential altcoins like Ethereum, Solana, XRP, and Chainlink. He combines analytical depth with journalistic clarity to deliver insights for both newcomers and seasoned crypto readers.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens