Could Axiom Rival Established Crypto Exchanges? A Deep Dive

Axiom’s rise in DeFi highlights its revenue strength, wallet features, and trading tools. Learn how it compares with established crypto exchanges.

Miracle Nwokwu

September 15, 2025

Table of Contents

Axiom, a trading platform focused on decentralized finance, has drawn attention in the crypto space since its launch in early 2024. Built to simplify on-chain trading, it combines wallet functionality with advanced tools for buying and selling assets. As the platform reports strong revenue growth and recent feature enhancements, questions arise about its ability to compete with established players. This article examines Axiom's background, performance metrics, and key offerings.

Founding and Backing

Axiom was co-founded by Henry Zhang and Preston Ellis, both 22-year-old computer science graduates from the University of California, San Diego. The duo started the project in 2024, aiming to create an intuitive interface for DeFi trading. In a notable early achievement, Axiom secured funding from Y Combinator, the prominent startup accelerator known for supporting tech ventures like Airbnb and Stripe. The seed round brought in $500,000, providing resources for development and expansion. Y Combinator's involvement signals confidence in Axiom's model, which emphasizes speed and user control in a market often criticized for complexity. No other major backers have been publicly disclosed, but the accelerator's network could open doors to further investment.

Revenue and Market Position

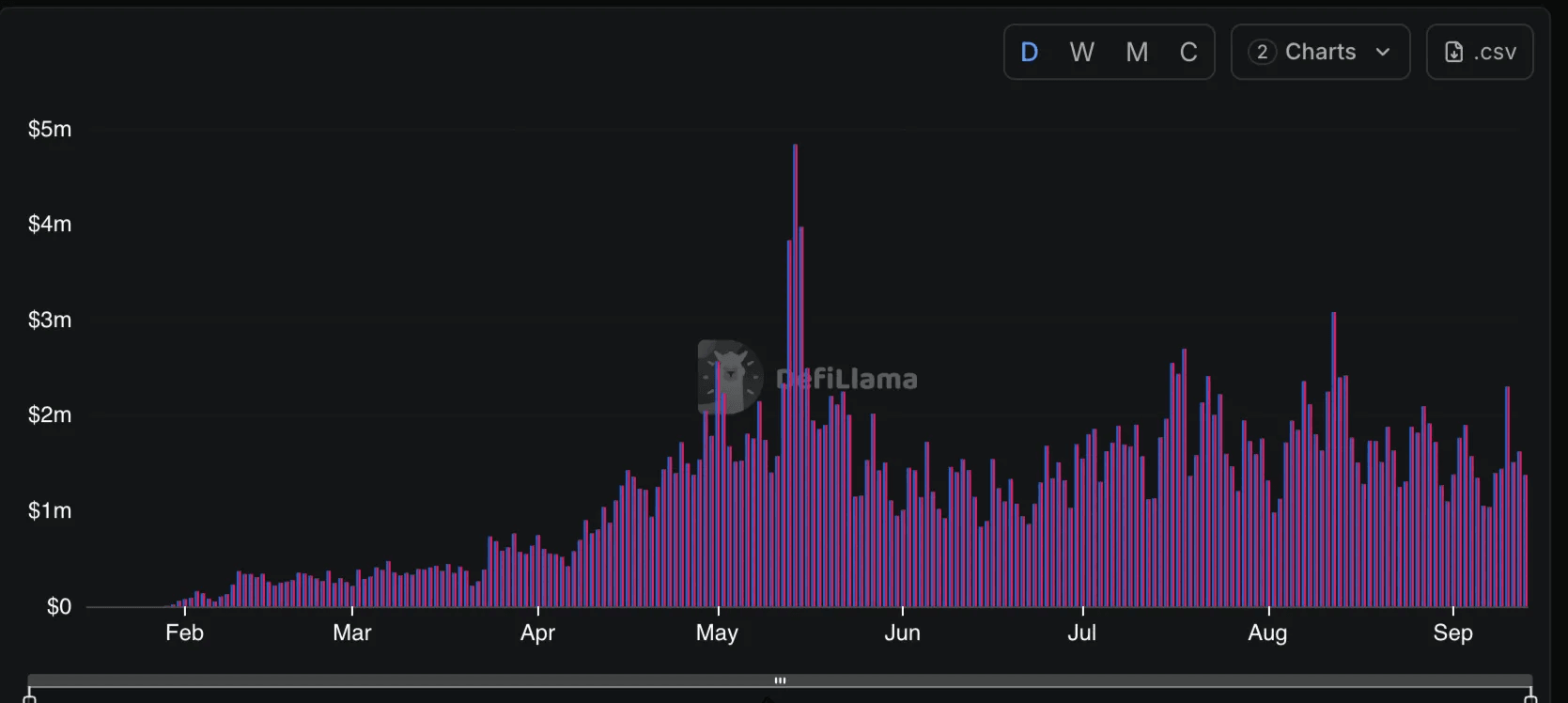

Financial data highlights Axiom's quick ascent. According to DeFiLlama's revenue dashboard, Axiom ranks fifth among protocols, generating at least $10.65 million in the past seven days as of mid-September 2025. This places it behind Tether, Circle, HyperLiquid, and Pump.fun, but ahead of many others in the sector. The figures reflect fees from trading activity, primarily on Solana-based memecoins and perpetuals.

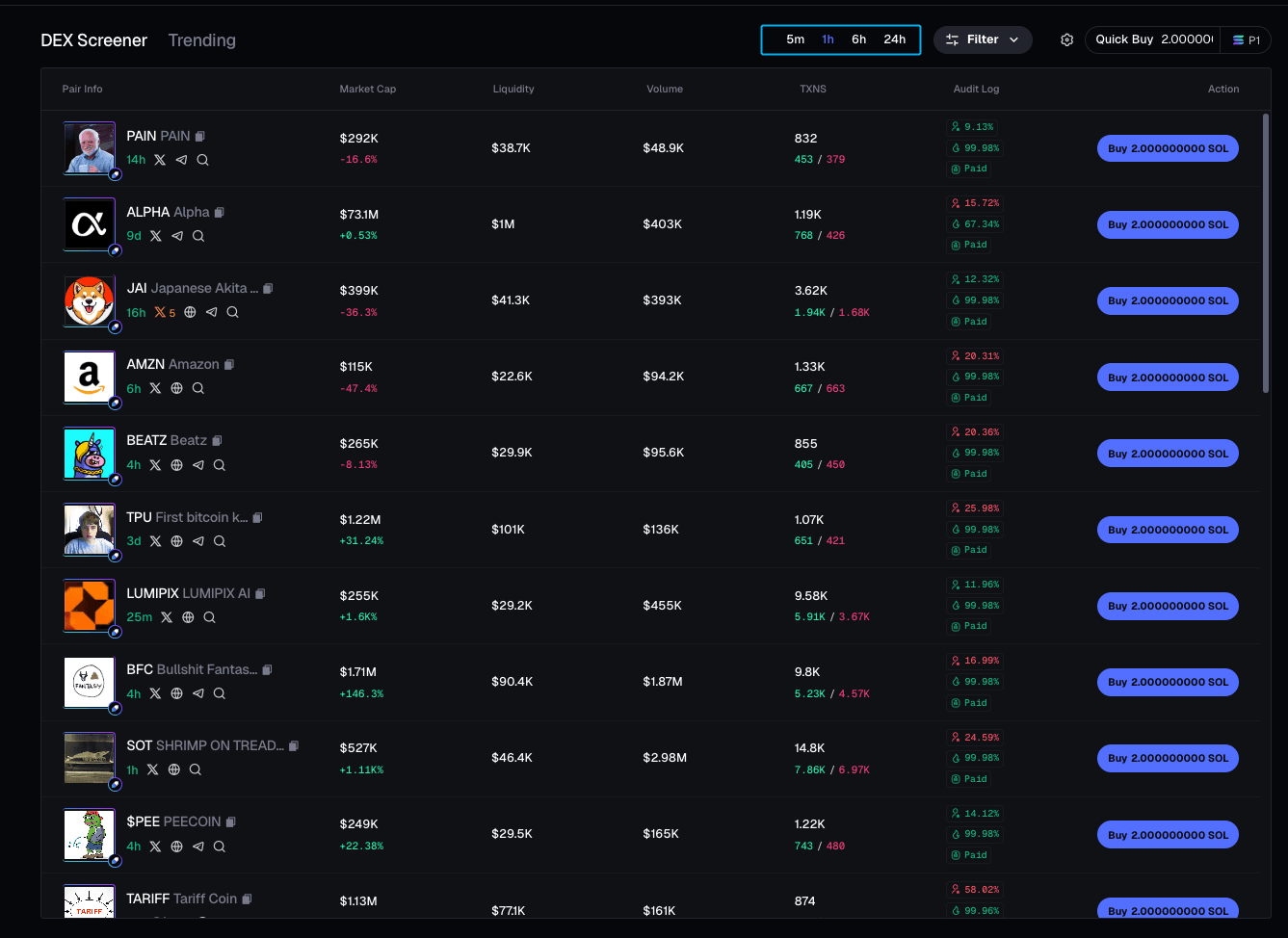

Broader reports underscore this momentum. By April 2025, Axiom had reached $10 million in monthly recurring revenue, with total earnings surpassing $100 million within four months of launch. Daily trading volume hit $100 million by mid-April, capturing about half of Solana's memecoin market share at the time. These numbers stem from high-volume users engaging with low-fee trades. Axiom's revenue in the last 30 days sits at approximately $47 million, only behind Pump.fun on Solana. These numbers are driven by its focus on popular assets like memecoins and yield-bearing products. Such performance positions Axiom as a revenue contender, though sustaining it will depend on broader market conditions.

Core Features and User Tools

At its foundation, Axiom operates as a hybrid crypto trading app and non-custodial wallet. Users maintain full control over their assets, with security handled through Turnkey's infrastructure, including air-gapped architecture to prevent unauthorized access. Currently, it supports Solana, with plans to add more chains in the future. The platform integrates multiple protocols, allowing trades of memecoins, perpetuals, and yield products in one interface.

Key tools help users discover and execute trades efficiently. The "Explore Tokens" section lets traders search for assets using filters like market cap or volume. "Pulse" provides real-time market pulses, showing trending tokens based on algorithmic signals, while "Similar Tokens" suggests comparable assets to diversify portfolios. Swapping occurs via a streamlined interface supporting one-click buys and sells, with options for limit orders to set specific prices. The portfolio tracker displays holdings, profit-and-loss (PNL) data, and analytics, including a calendar view of past performance.

Security remains a priority. The wallet uses advanced key management across blockchains, ensuring recovery without compromising funds. Users can track multiple wallets—up to 25 in recent updates—and monitor social signals, such as Twitter activity from key opinion leaders (KOLs). Rewards add an incentive layer: Trading earns Axiom Points, redeemable for SOL or other benefits, alongside a referral program that shares earnings from invited users.

For those new to DeFi, getting started involves connecting a Solana wallet via the app at axiom.trade. Fund it with SOL or tokens, then use the dashboard to scan for opportunities. Fees are competitive, often under 0.1% per trade, making it accessible for frequent traders.

Recent Developments and Updates

Axiom's team has rolled out frequent enhancements, as seen in announcements on its X account (@AxiomExchange). In late July 2025, updates included "Vision," a tool to identify KOL and insider wallets, alongside a revamped wallet tracker supporting up to 10,000 addresses. Pulse display settings expanded, adding migration market cap lines and funding data for top traders. Earlier, in July, the "Surge" feature introduced algorithmic alerts for market movements, with a new Pulse tracker and holder section overhaul.

June brought the fastest submission engine yet, a PNL calendar, and new leaderboards for rewards. Social integrations grew, covering platforms like Facebook and Twitch for tooltip previews. By early June, custom themes, fee tracking in PNL, and pump livestream support for tokens like Boop and Bonk were added. May's changes featured custom PNL cards, multi-wallet support, and previews for Instagram and YouTube.

These iterations address user feedback, improving speed and customization. For instance, the multi-wallet limit increase aids professional traders managing diverse portfolios. Axiom also supports dynamic launches on platforms like LaunchLabs, enhancing compatibility with Solana's ecosystem.

Points System and Airdrop Prospects

Axiom's points program encourages engagement. Users accumulate points through trades, referrals, and quests, which contribute to ranks and higher reward rates. This system has sparked interest in a potential airdrop, similar to those from projects like Arbitrum or Optimism. Users can sign up at axiom.trade, connect a wallet, and trade actively to build points. Eligibility often ties to volume or duration of use, though Axiom has not confirmed an airdrop.

Traders can boost chances by using referral codes for bonuses, like 10% off fees. However, outcomes remain uncertain, as token distributions depend on future decisions. For now, the program serves as a loyalty mechanism, potentially tying into broader tokenomics if Axiom issues its own token.

Looking Ahead

Axiom's blend of accessibility and depth appeals to Solana traders seeking an all-in-one solution. Its revenue trajectory and Y Combinator support provide a solid base, while ongoing updates keep it responsive to user needs. Whether it scales to rival giants like Binance or Uniswap hinges on multi-chain expansion, regulatory adaptation, and sustained adoption. For now, it offers practical tools for those navigating DeFi's demands. Interested users can explore the platform directly, starting with a wallet connection to test its features.

Sources:

- Axiom Pro Fees and Revenue Dashboard (DeFiLlama): https://defillama.com/revenue

- Axiom Exchange Official Documentation: https://docs.axiom.trade/

- Axiom Exchange Official Website: https://axiom.trade

- Axiom Official X Account (@AxiomExchange): https://x.com/AxiomExchange

Read Next...

Frequently Asked Questions

What is Axiom and how does it work?

Axiom is a decentralized trading platform and non-custodial wallet built on Solana. It allows users to trade memecoins, perpetuals, and yield products while maintaining full control of their assets. The app combines wallet functionality with advanced tools like token discovery, real-time market pulses, and profit-and-loss tracking.

Who founded Axiom and who are its backers?

Axiom was co-founded in 2024 by Henry Zhang and Preston Ellis, both computer science graduates from the University of California, San Diego. The project received early funding of $500,000 from Y Combinator, a startup accelerator known for backing companies like Airbnb and Stripe.

What features does Axiom offer to traders?

Axiom provides a hybrid wallet and trading interface with tools such as token exploration filters, algorithmic signals through "Pulse," wallet tracking for up to 25 addresses, and social sentiment monitoring. It also includes features like one-click swaps, limit orders, and a rewards system that grants users Axiom Points redeemable for SOL and other benefits.

Is Axiom planning an airdrop?

Axiom has not confirmed any official airdrop. However, its points program—earned through trading, referrals, and quests—has fueled speculation about a future token distribution, similar to projects like Arbitrum or Optimism. Users increase potential eligibility by actively trading and referring others on the platform.

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

Miracle Nwokwu

Miracle NwokwuMiracle holds undergraduate degrees in French and Marketing Analytics and has been researching cryptocurrency and blockchain technology since 2016. He specializes in technical analysis and on-chain analytics, and has taught formal technical analysis courses. His written work has been featured across multiple crypto publications including The Capital, CryptoTVPlus, and Bitville, in addition to BSCN.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens