Aptos Deep Dive: Parallel Execution Powers Global Trading

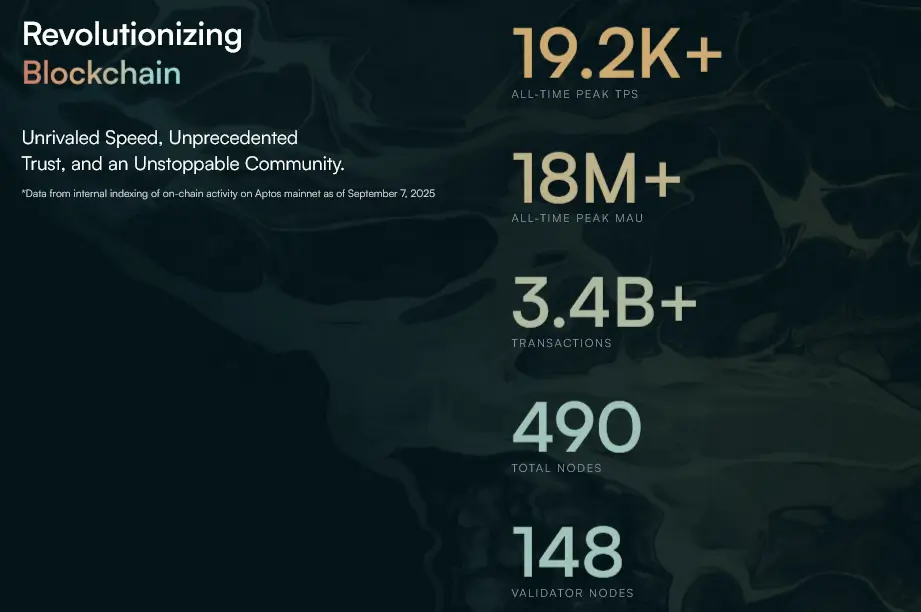

Aptos processes 3.4B+ transactions with 19.2K TPS using Move programming language. A deep dive into the ex-Meta blockchain, challenging Ethereum's dominance.

Crypto Rich

September 12, 2025

Table of Contents

Aptos is approaching 3.4 billion processed transactions with 19,200+ peak TPS using Move programming language and parallel execution. This makes it one of the fastest production blockchains for real-world applications, currently supporting around 10 million monthly active users while handling billions in DeFi volume.

Born from Meta's abandoned Diem project, former Meta engineers, led by CEO Avery Ching, built this platform specifically for global financial infrastructure. Unlike typical blockchain projects chasing trends, Aptos uses Block-STM parallel processing to solve real scalability problems through careful engineering.

What Makes Aptos Different from Other Blockchains?

Aptos separates itself from competitors through two major innovations: a safer programming language and true parallel processing. These aren't incremental improvements—they represent fundamental architectural choices that address blockchain's biggest problems.

Move Programming Language Advantages

Aptos stands out through Move, a Rust-inspired programming language that Meta originally developed for Diem. Here's why this matters: while Solidity treats digital assets like account balances that can be manipulated, Move treats them as "resources"—objects that can't be copied or lost by accident.

Think of it this way. Traditional smart contracts are like bank ledgers, where numbers can be changed if you know the right tricks. Move resources work more like physical objects—you can't duplicate a dollar bill just by writing code. This prevents the double-spending attacks and reentrancy bugs that have cost other blockchains hundreds of millions.

Parallel Execution Architecture

The real innovation comes from parallel execution. Most blockchains process transactions one at a time, like a single-lane highway. Bitcoin handles about 15 transactions per second this way. Ethereum manages around 30.

Aptos built a multi-lane highway instead. Its Block-STM V2 engine runs thousands of transactions simultaneously across multiple CPU cores. When transactions conflict—like two people trying to spend the same money—the system detects this automatically and replays only the affected ones. The result? Sub-second block times with 19,200+ peak TPS during real usage.

This architecture proved itself during the Tapos gaming surge in May 2024. According to Aptos, the network handled 326 million transactions over a three-day period without congestion or fee spikes. That's the kind of stress test that breaks most blockchains.

Developer experience receives equal attention through Aptos Build SDK and social account abstraction. Petra Wallet, downloaded over 1 million times, enables gasless transactions and social recovery through Google or Apple OAuth integration. These features eliminate traditional barriers, like seed phrases, that prevent mainstream cryptocurrency adoption.

How Did Aptos Emerge from Meta's Diem Project?

Meta's Libra project promised to revolutionize payments for billions of users worldwide. The plan looked solid on paper: partnerships with Visa, Mastercard, and Uber would create a stablecoin network that could serve the unbanked globally.

But Washington had other ideas. U.S. lawmakers worried about a private company controlling monetary policy on such a massive scale. Regulatory pressure mounted until Meta finally shut down Diem in January 2022, selling its assets for $200 million.

Mo Shaikh (stepped down as CEO) and Avery Ching (current CEO), former Diem leadership team members, founded Aptos Labs in 2021 with over 100 ex-Meta engineers. The team secured $200 million in seed funding from various investors, including Coinbase Ventures and a16z Crypto, followed by $150 million in a Series A funding round from Jump Crypto, Multicoin Capital, and FTX Ventures (before it collapsed).

Early Development Challenges

Aptos mainnet launched in October 2022 amid significant controversy. Initial performance fell short of expectations, with TPS dropping to seven transactions per second due to validator idling—far below the promoted 130,000 theoretical maximum. Community criticism focused on tokenomics, with 51% of APT supply allocated to team members and investors subject to 12-month lockups.

The team addressed these concerns through systematic improvements. Validator incentives are aligned through 7% initial staking rewards (proposed reduction to 3.79% via AIP-119) and fee-burning mechanisms. Network performance stabilized throughout 2023 as validators optimized operations and transaction volume increased organically.

Partnerships accelerated in 2024 with NBCUniversal for fan experiences and Japanese expansion through the acquisition of HashPalette. Avery Ching's congressional testimony advocated for practical cryptocurrency applications, echoing Diem's original mission of financial inclusion while operating under decentralized governance.

Why Does Move Programming Language Matter?

Move's design philosophy prioritizes safety through resource semantics that prevent common vulnerabilities in smart contracts. Digital assets exist as first-class resources with ownership enforced at the language level, eliminating double-spending possibilities that plague other blockchain platforms.

Move 2.0 enhances developer productivity with generics and traits for complex decentralized applications. The language's linear type system ensures resources cannot be accidentally copied or discarded, providing mathematical guarantees about program behavior that auditors can verify formally.

Technical Implementation Benefits

In practice, Move's advantages become apparent in high-value applications. Real-world asset tokenization requires absolute certainty about asset ownership and transfer mechanisms. Traditional programming languages rely on external validation, while Move's resource model makes ownership violations impossible at the language level.

The ecosystem benefits from this security foundation. Aave V3's first non-Ethereum deployment chose Aptos specifically for Move's safety guarantees in lending protocols. BlackRock's BUIDL token distribution of $70+ million in dividends relies on Move's resource semantics to ensure accurate allocation without double-spending risks.

Developer adoption accelerated through comprehensive tooling. The Aptos Framework offers pre-built modules for common operations, including token creation, multi-signature accounts, and oracle integration. This reduces development time while maintaining security standards that institutional users require for production applications.

What Performance Metrics Define Aptos Network?

According to the Aptos homepage, the network runs on:

- 490 total nodes with 148+ active validators spread across different regions

- 99.99% uptime since launch with no major outages or security breaches

- Sub-400ms transaction finality, three times faster than most competing blockchains

- 20% additional latency reduction through the Raptr consensus upgrade

Speed matters in finance, and Aptos delivers through smarter voting mechanisms and optimized consensus.

Real-World Usage Statistics

Monthly active users average around 10 million, driven by a diverse range of application categories beyond speculative trading.

DeFi volumes surged 310% quarter-over-quarter to $9 billion, supported by over $1.2 billion in stablecoin liquidity, including USDC and USDT.

Gaming applications demonstrate network capability under extreme load. The Tapos game reportedly generated 326 million transactions in 3 days, stress-testing parallel execution without performance degradation. Active addresses increased 19% over 30 days, indicating sustained user engagement rather than temporary speculation.

Cross-chain connectivity expanded through Chainlink CCIP integration, making Aptos the first Move-compatible blockchain to support this infrastructure. The integration connects Aptos to 60+ blockchain networks, enabling seamless USDC transfers to Solana and other ecosystems.

How Secure and Reliable Is Aptos Network?

Aptos builds security from the ground up through its modular architecture and Move programming language foundation. Byzantine Fault Tolerance consensus can withstand up to 33% malicious validators while maintaining network liveness and transaction processing.

Network uptime has maintained 99.99% availability since the mainnet launch without major security incidents. Post-quantum cryptography upgrades protect against future computational threats, while modular architecture isolates potential failures.

Security Validation Through Usage

Real-world asset tokenization worth $723 million demonstrates institutional confidence in network security. Projects like PACT's micro-lending for credit inclusion and Echo Protocol's $275 million total value locked in Bitcoin liquid staking rely on Move's safety guarantees for protecting user funds.

The network's resilience was tested during high-traffic periods without security compromises. Unlike other blockchains that experienced exploits during periods of network congestion, Aptos maintained its security properties while processing record transaction volumes. This performance validates the architecture's design for production-scale financial applications.

What Applications Drive Aptos Ecosystem Growth?

Aptos hosts over 330 projects, but the quality matters more than quantity. Major institutions are investing substantial funds in these applications, not just experimenting with small amounts.

DeFi Leadership Applications

Aave, the lending giant, chose Aptos for its first expansion beyond Ethereum. Why? Move's security model made the risk-reward calculation work for a protocol handling billions in user deposits. When you're responsible for that much money, every safety feature counts.

The trading volumes speak for themselves. ThalaSwap V2 and Merkle Trade have processed a lifetime volume of $24 billion. Echo Protocol locked up $275 million in Bitcoin staking services. These aren't theoretical use cases—they're live applications serving real users with real money.

Real-World Asset Integration

Tokenized real-world assets reached $723 million in value, including diverse categories from BlackRock's BUIDL money market fund to PACT's micro-lending for underserved credit markets. These applications require the mathematical certainty that Move's resource model provides.

Stargate's Circle Transfer Protocol (CCTP) supports native USDC transfers between Aptos and other major blockchains. This infrastructure eliminates wrapped token risks while providing institutional-grade settlement finality for cross-chain transactions.

Gaming and AI Applications

Gaming leads user acquisition with applications like Tapos generating tens of millions of daily transactions. The network's parallel execution makes it ideal for real-time gaming applications that require instant state updates without congestion.

AI and Decentralized Computing

Artificial intelligence represents Aptos' next frontier. Pictor Network shows how this works in practice—it connects people with spare GPU power to AI developers who need computing resources. Users earn money from their idle hardware while AI companies get affordable processing power.

The bigger opportunity lies where AI meets physical infrastructure. Aptos' speed makes it ideal for applications that require rapid data processing and instant rewards. Picture smart contracts that automatically compensate compute providers the moment they finish a task, with verification happening on-chain in real time.

This creates new possibilities for data markets. AI companies constantly need fresh, diverse datasets to train their models. Aptos can serve as the payment rails for this emerging economy, handling micro-transactions between data providers and AI developers across multiple blockchain networks.

Panana prediction markets and APTree's 100 million droplet distribution demonstrate ecosystem diversity beyond traditional categories. These applications benefit from Aptos' low fees and fast confirmation times, enabling micro-transactions that are economically unfeasible on high-fee networks.

How Does Aptos Enable Cross-Chain Interoperability?

Building bridges between blockchains isn't just a nice feature for Aptos—it's central to the platform's strategy. The network treats cross-chain connectivity as infrastructure, not an afterthought.

Chainlink and Multi-Network Integration

Chainlink's Cross-Chain Interoperability Protocol (CCIP) integration makes Aptos the first Move-based blockchain to access this infrastructure. This integration, live since early September 2025, exemplifies Aptos' modular design for long-term interoperability. Think of CCIP as a secure messaging system that facilitates communication between different blockchains. It enables token transfers and data sharing across 60+ networks, positioning Aptos as a hub for applications like Aave's GHO stablecoin and Stargate's CCTP.

The NEAR protocol partnership takes a different approach. Instead of forcing users through complex bridging steps, it allows them to simply state what they want to accomplish. Want to swap Bitcoin for Ethereum tokens? Merely express that intent, and the system handles the technical details behind the scenes. This connects Aptos to 20+ additional networks while making cross-chain transactions feel effortless.

Enterprise and Mobile Integration

Microsoft's enterprise partnership brings Aptos into boardrooms and IT departments. The collaboration focuses on hybrid applications—systems that combine blockchain settlement with existing business software. For a supply chain manager, this might mean tracking goods on Aptos while continuing to use familiar enterprise tools for day-to-day operations.

How Does Aptos Governance Work?

The Aptos Foundation operates from Switzerland, stewarding network development while maintaining a distance from day-to-day operations. Think of it as the network's constitutional framework—providing structure and funding while letting the community make key decisions.

Those decisions happen through Aptos Improvement Proposals (AIPs). Token holders vote on everything from technical upgrades to economic parameters. AIP-119 currently proposes cutting staking rewards from 7% to 3.79%—a move designed to ensure long-term sustainability as transaction volume grows. No single entity controls these votes.

Community and Partnership Development

The Aptos Collective program engages creators through exclusive access, AMAs, and events. Monthly active users, averaging around 10 million, participate in governance discussions and ecosystem development initiatives that shape network evolution.

Strategic partnerships amplify development efforts through collaboration with major technology and financial companies:

- Google Cloud and AWS for infrastructure support

- Mastercard for payment integration and financial services

- NBCUniversal for media applications and fan experiences

- Microsoft for AI integration and enterprise solutions

These relationships provide enterprise validation while expanding potential use cases beyond traditional DeFi applications.

The $200+ million grants program accelerates ecosystem development through initiatives like LFM funding for AriesMarkets and AmnisFinance. Accelerator programs like Ankaa support early-stage projects, while events like Aptos Experience connect developers with institutional partners.

What Challenges Does Aptos Face?

Every blockchain faces reality checks, and Aptos is no exception. User retention is the top concern. Active addresses peaked at 1.56 million in February, then plummeted 40% to 644,000 by April.

Markets explain some of this volatility. However, such a user exodus suggests deeper problems with engagement and stickiness. People tried Aptos, then left. The question is whether they'll come back.

Tokenomics remain controversial too. Half of the tokens were allocated to team members and investors—a distribution that raises questions about decentralization, regardless of the lockup periods. Perception matters in crypto. Many users prefer projects with broader, more community-focused token allocations.

Market Differentiation Challenges

Competition intensifies as other blockchains improve performance and add features. Solana's established DeFi ecosystem and Ethereum's institutional adoption create significant network effects that Aptos must overcome through superior technology and user experience.

The Meta connection remains both an asset and a liability. Former Diem team members bring enterprise development experience, but regulatory scrutiny of Meta's blockchain initiatives continues to affect the perception among some users and institutions that prefer completely independent projects.

Developer onboarding requires continued improvement despite Move's security advantages. The learning curve for developers familiar with Solidity creates adoption barriers, though comprehensive grant programs and educational initiatives address these challenges through training resources.

What Does Aptos Future Roadmap Include?

The development roadmap focuses on practical improvements rather than speculative features. Key upcoming developments include:

- X-Chain Accounts for seamless multi-chain operations

- Framework-level central limit order books (CLOB) for high-frequency trading

- Complete Raptr consensus upgrade with an additional 20% latency reduction

- Event-driven transactions for automated portfolio rebalancing

These upgrades target institutional applications that require precise execution and minimal interface complexity.

Technical Innovation Pipeline

Shelby integration with NEAR protocol creates a unified layer for AI and data services. Instead of different blockchains operating in isolation, projects can share resources and liquidity. Cross-chain swaps become seamless, connecting Aptos to 20+ additional networks.

Bitcoin finance represents the next big opportunity. Bitcoin holders want yield, but they're cautious about security. Aptos' Move programming language and proven track record make it an attractive platform for Bitcoin-denominated financial products. The infrastructure can handle the scale and security requirements that institutional Bitcoin holders demand.

The emphasis on capital efficiency and real-world utility signals maturation from experimental blockchain to production financial infrastructure. These developments target the billions of dollars in institutional capital seeking blockchain exposure through proven, reliable platforms.

Conclusion

Three years ago, Meta's blockchain dreams died in regulatory hearings. Today, those same engineers are building something that might actually work.

Aptos isn't perfect. The user retention numbers show growing pains, and the tokenomics still raise eyebrows. But the underlying technology delivers on its promises. With transactions approaching 3.4 billion and around 10 million monthly users, this isn't vaporware—it's infrastructure that institutions are betting real money on.

Whether Move programming and parallel execution can compete with Ethereum's massive head start remains the open question. Early signs suggest the answer might be yes.

To learn more, visit the official Aptos website and follow @Aptos on X for the latest updates.

Sources:

- Aptos Labs - Official research

- DeFiLlama - Aptos TVL and Protocol Analytics

- Messari - Aptos H1 2025: The Global Trading Engine Accelerates

- CoinMarketCap - Market data

- Aptos Developer Documentation

- Aptos Blockchain Architecture

- Aptos Foundation Official

- Aptos Developer Portal

- Aptos Core Repository

- Cryptorank.io - funding round information

- rwa.xyz - Real World Assets (RWA) data

Read Next...

Frequently Asked Questions

What makes Aptos different from Ethereum?

Aptos uses Move programming language with resource-based asset management and parallel execution through Block-STM, enabling 19,000+ TPS with sub-second finality compared to Ethereum's sequential processing.

How secure is the Move programming language?

Move prevents common smart contract vulnerabilities through compile-time verification and resource semantics that make double-spending mathematically impossible, with no major exploits since mainnet launch.

Which major applications run on Aptos?

Aave V3 for lending, BlackRock's BUIDL token distribution, Echo Protocol's $275 million Bitcoin staking, and Tapos gaming, which reportedly processed over 100 million daily transactions, demonstrate real-world usage.

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

Crypto Rich

Crypto RichRich has been researching cryptocurrency and blockchain technology for eight years and has served as a senior analyst at BSCN since its founding in 2020. He focuses on fundamental analysis of early-stage crypto projects and tokens and has published in-depth research reports on over 200 emerging protocols. Rich also writes about broader technology and scientific trends and maintains active involvement in the crypto community through X/Twitter Spaces, and leading industry events.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens