Bullish Factors Behind the Surge in Maple's $SYRUP Token

Maple Finance's SYRUP token has shocked the industry in recent days. We take a look at some of the factors that could be behind it...

UC Hope

June 25, 2025

Table of Contents

Maple Finance, a leading Decentralized Finance (DeFi) platform specializing in institutional lending, has been making headlines with its impressive growth and innovative offerings. At the heart of this success is the $SYRUP token, which has seen a significant surge in value in recent months. The token is currently priced at $0.6173, with a market capitalization of approximately $687 million and a fully diluted valuation (FDV) of about $734 million.

This article explores the bullish factors driving the $SYRUP token's rise, based on a detailed thread posted by @Rendoshi1 on X on June 14, 2025, and supported by the latest market data and news updates.

Recent Growth in Total Value Locked (TVL) and Revenue

One of the key drivers behind the $SYRUP token's surge is Maple Finance's remarkable growth in total value locked (TVL), which now exceeds $2.4 billion, according to DeFiLlama. This represents a fourfold increase since the beginning of 2025. The platform's cumulative revenue has also surpassed $3 million, a significant rise from the previous year.

This financial growth, potentially generating $15 million in free cash flow, underscores Maple Finance's operational efficiency and market appeal, boosting investor confidence in the $SYRUP token.

Strategic Expansion to the Solana Ecosystem

Maple Finance's expansion to the Solana blockchain, announced on June 5, 2025, is another significant factor contributing to the $SYRUP token's bullish trend. Powered by Chainlink's Cross-Chain Interoperability Protocol (CCIP), this move deployed the syrupUSDC stablecoin on Solana with $500,000 in incentives and $30 million in liquidity.

The expansion taps into Solana's $10 billion stablecoin ecosystem, offering a high-speed, high-capacity environment that enhances accessibility for a broader range of users, from institutions to advanced DeFi participants. This strategic move has raised the syrupUSDC cap to $50 million after $20 million was deposited in just four days, signaling strong market adoption.

Innovative Product Offerings

Maple Finance's introduction of new products has further fueled the $SYRUP token's growth. The platform offers syrupUSDC, a liquid yield coin providing a fixed yield of approximately 6.5% APY, bridgeable from Ethereum to Solana. Additionally, high-yield loans backed by over-collateralized assets like Bitcoin, Ether, and Solana have unlocked new opportunities for institutional investors.

A recent post by Jonaso revealed that the SyrupUSDC has the highest yield amongst stablecoins in the blockchain industry. Since the start of the year, the product gas increased by 10x, making it the fastest-growing yield-bearing stablecoin after Ethena and Sky.

Additionally, new offerings, such as syrupUSDC/syrupUSDT for USDC/USDT lenders with up to 10% annualized yield and "Drip Rewards" convertible into staked $SYRUP tokens, as well as Bitcoin yield products and structured notes, demonstrate the platform's commitment to innovation, driving demand for the token.

Strong Institutional Partnerships

Maple Finance's partnerships with major institutional players have solidified its position as a premier on-chain asset manager, positively impacting the $SYRUP token. The platform has collaborated with Cantor, a global investment bank with over 5,000 institutional clients, to provide Bitcoin-backed financing up to $2 billion.

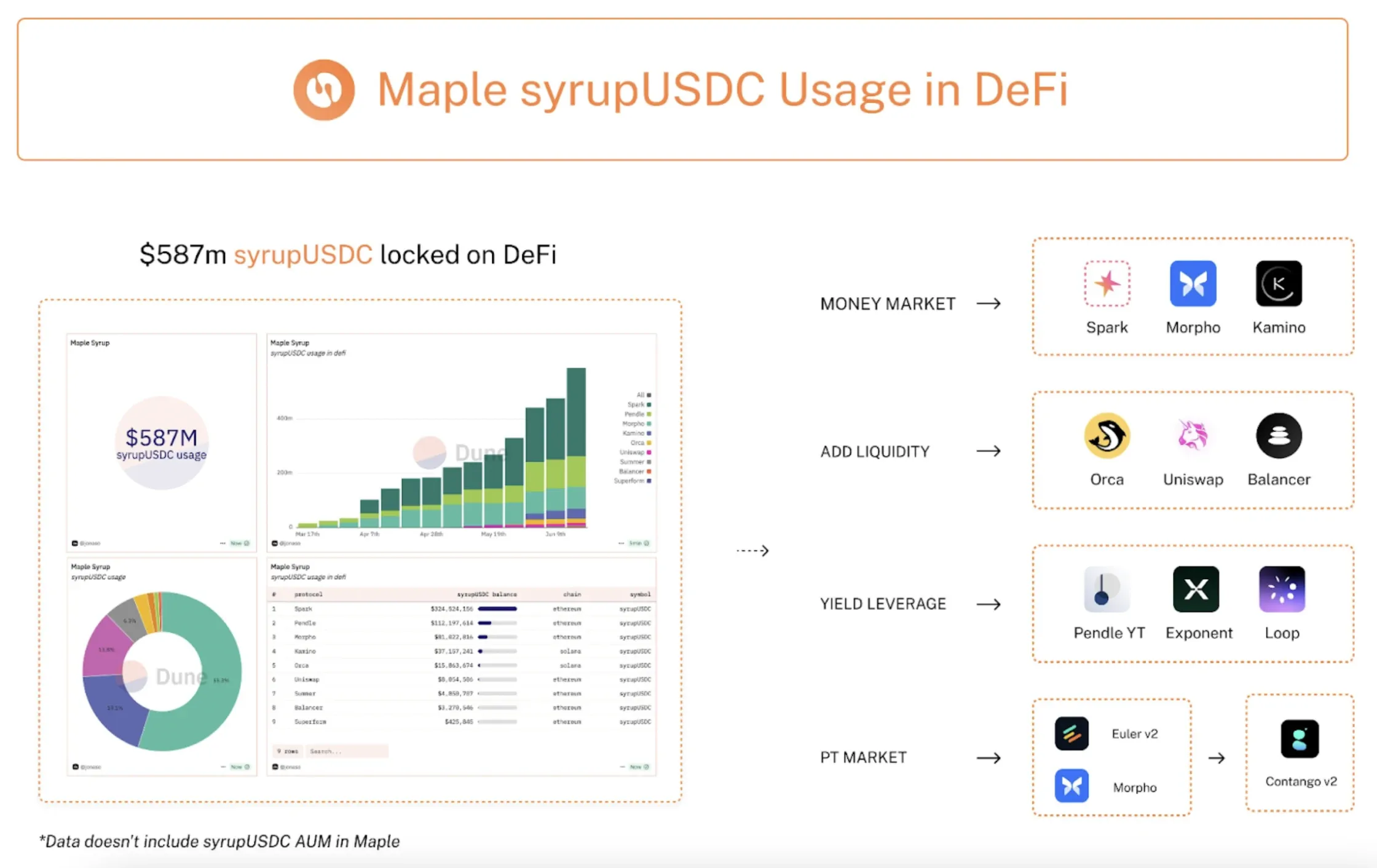

Another key partnership with Bitwise, which manages $12 billion in assets, marks its first DeFi allocation via Maple. Additional backers, including Circle, Coinbase, Galaxy, and Anchorage, along with recent collaborations with Spark, Morpho, Pendle, Marinade, Lido, and Kamino, highlight the platform's robust network, enhancing the token's credibility and value.

Favorable Tokenomics and Buyback Program

The $SYRUP token's tokenomics play a crucial role in its bullish outlook. With 90% of the 1.18 billion total supply already circulating and approximately 40% staked, the risk of future unlocks is minimized. Maple Finance's buyback program, which uses fees to repurchase $SYRUP tokens and distribute them to stakers, introduces a deflationary potential that could further increase the token's value.

Currently, the circulating supply stands at 1.11 billion $SYRUP, supporting a market cap of $687 million, a notable rise from the $503 million mentioned in the Rendoshi thread on June 14, 2025.

Competitive Positioning and Future Outlook

Despite competition from platforms like Blockrock’s BUIDL and Ethena Finance, Maple Finance is well-positioned for a multi-chain future. The platform aims to reach $4 billion in assets under management (AUM) by the end of 2025, leveraging its Solana expansion and partnerships with Solana-native protocols like Kamino and Orca. The current FDV of $734 million, compared to higher valuations of similar protocols, suggests significant growth potential for the $SYRUP token, aligning with the optimistic narrative presented in the Rendoshi thread.

Maple Finance's journey to this point includes a notable recovery from the 2022 FTX crash, when deposits plummeted 97% from over $900 million to $25 million following Orthogonal Finance's $36 million loan default. The platform has since rebuilt its reputation, with outstanding loans now at $882 million and a TVL surpassing previous highs. This resilience, combined with recent strategic moves, has restored investor trust, further propelling the $SYRUP token's value.

The $SYRUP token's price reflects a 30% increase from the estimated $0.4661 on June 14, 2025, based on the thread's FDV data. The 24-hour trading volume surpassing $190M, indicates robust market activity, according to CoinMarketCap.

Conclusion: A Promising Future for $SYRUP

The surge in Maple Finance's $SYRUP token is underpinned by strong TVL growth, strategic expansion to Solana, innovative products, strong institutional partnerships, favorable tokenomics, and a successful recovery from past challenges.

With a target of $4 billion AUM and a current valuation that suggests room for growth, the $SYRUP token is poised for continued success in the DeFi space. Investors and enthusiasts can stay updated via platforms like X, where detailed insights, such as those from @Rendoshi1, continue highlighting the platform's potential.

Read Next...

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

UC Hope

UC HopeUC holds a bachelor’s degree in Physics and has been a crypto researcher since 2020. UC was a professional writer before entering the cryptocurrency industry, but was drawn to blockchain technology by its high potential. UC has written for the likes of Cryptopolitan, as well as BSCN. He has a wide area of expertise, covering centralized and decentralized finance, as well as altcoins.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens