Japan's First Ethereum Treasury Comes to Life with $180M Investment

Quantum Solutions raises $180M from ARK Invest and others to create Japan’s first Ethereum-based corporate treasury.

Soumen Datta

October 1, 2025

Table of Contents

Quantum Solutions, a Tokyo-listed information technology firm, has raised $180 million (about 250 billion won) from global investors to launch Japan’s first Ethereum (ETH) treasury. The strategic investment includes participation from ARK Invest, Nasdaq-listed Strategy and Susquehanna International Group (SIG), and Hong Kong-based Integrated Asset Management (IAM).

The funds will allow Quantum Solutions to acquire more than 100,000 ETH and manage it as part of a corporate treasury strategy, establishing the company as Japan’s first Ethereum treasury-listed corporation.

A treasury strategy involves corporations holding and managing assets—including cash and digital currencies—to generate revenue. Quantum Solutions’ initiative is modeled after trends in the U.S. market, where ETH-holding companies trade at significantly higher price-to-book ratios (PBR) than Bitcoin (BTC) treasury firms.

Data indicates ETH treasuries often have PBRs three times higher than BTC equivalents, reflecting strong market interest in ETH as a core digital infrastructure asset.

Strategic Investors and Global Capital Alignment

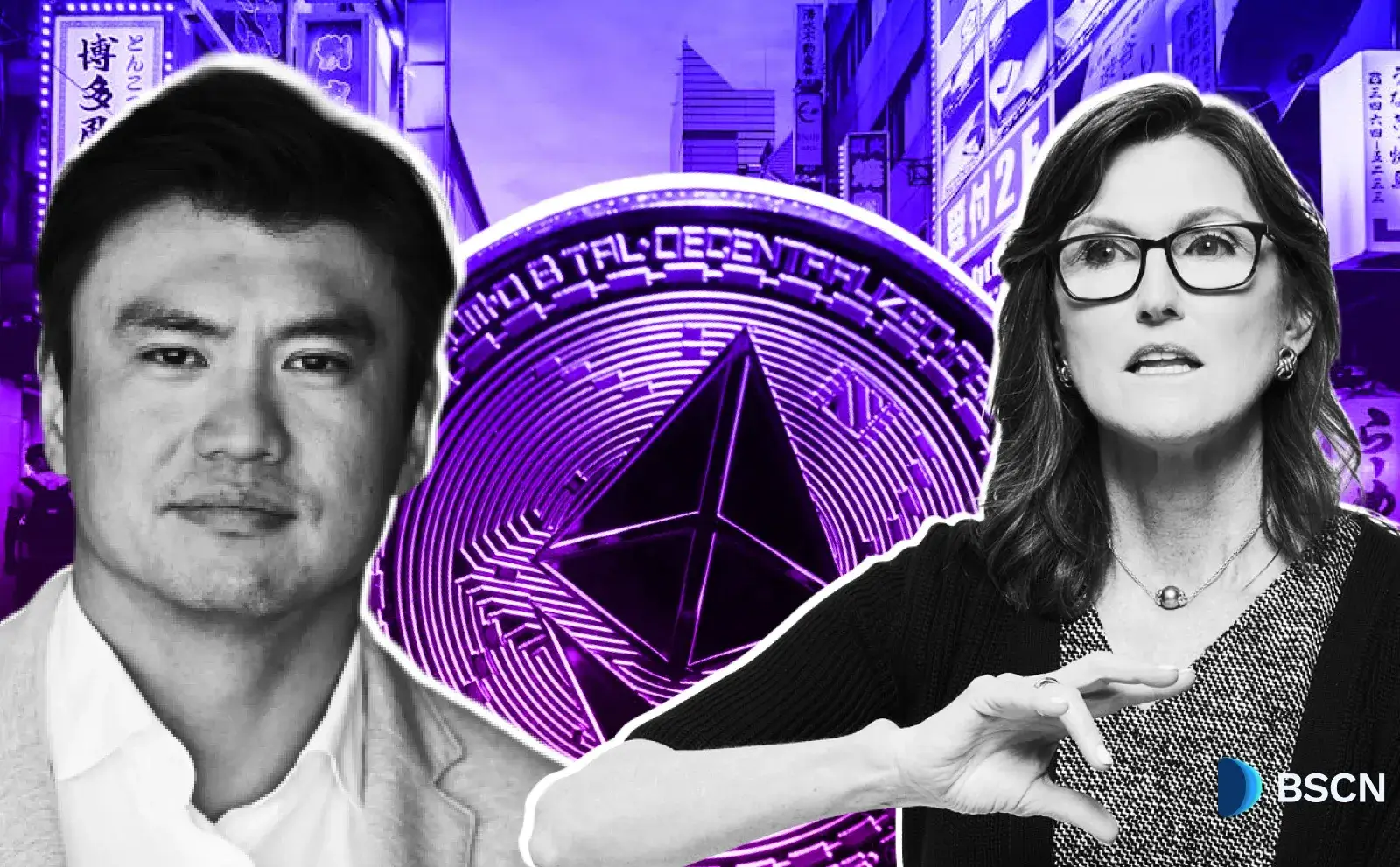

The $180 million raise indicates strong interest from international “smart money.” ARK Invest, led by Cathie Wood, sees ETH as a key component of future financial systems. Wood commented, “Ethereum is a core asset of future financial services and digital infrastructure,” adding that ARK Invest aims to develop institutional-grade Ethereum custody in Japan alongside Quantum Solutions.

SIG, investing via CVI Investments, brings a portfolio including early positions in ByteDance and Strategy Inc., and possesses significant capital firepower to accelerate Quantum’s ETH accumulation and support future fundraising rounds. IAM, the largest shareholder of Forbes Media, enhances Quantum’s international financial credibility and reputation.

Quantum Solutions CEO Francis Zhou noted that collaboration with ARK, SIG, and IAM allows the company to accelerate growth, marking a significant vote of confidence for Tokyo’s equity markets. For Japanese investors, it represents one of the largest foreign-backed crypto-linked equity investments since Warren Buffett’s purchases in major trading companies.

Fundraising Mechanics and Capital Structure

The $180 million round was executed via convertible bonds and warrants with both floating and fixed strike prices, issuing roughly 44 million shares—nearly doubling Quantum’s existing share capital. Notably, none of the instruments were priced at a discount, indicating that investors are targeting long-term value creation rather than short-term gains.

- First tranche: JPY 22.1 billion (approx. $150 million)

- Total round: JPY 26 billion (approx. $180 million)

The capital will primarily fund ETH accumulation for Quantum’s treasury, while also providing flexibility for potential yield-generating activities that leverage ETH’s utility in decentralized finance and smart contract applications.

Ethereum Treasury Strategy and Market Context

Quantum Solutions’ ETH treasury strategy focuses on accumulating a large ETH position while exploring opportunities to enhance returns on corporate balance sheets. Unlike BTC, which primarily serves as a store-of-value, ETH is foundational for blockchain applications, enabling a mix of organic and inorganic growth strategies.

U.S. market data suggests that listed ETH treasury companies trade at a price-to-book multiple of 7.72x, more than three times that of BTC treasury companies. The trend is upward, with PBRs increasing by over 20% in September alone. This demonstrates sustained investor appetite for ETH treasury exposure and validates Quantum’s approach.

Quantum also leverages its operational expertise in AI computing, GPU hosting, and IP gaming, which allows the company to pursue opportunities beyond conventional Real World Asset (RWA) sectors. Analysts suggest that Quantum’s notional PBR, currently below 30% of the U.S. market median, provides room for capital accumulation and potential valuation growth as ETH holdings expand toward the target of 100,000 ETH.

Japan’s government support for blockchain initiatives, coupled with clearer regulations, is creating an investor-friendly environment for digital assets. While U.S. companies like Bitmine (NASDAQ: BMNR) and SharpLink Gaming (NASDAQ: SBET) have already achieved market visibility with ETH treasury strategies, Japan lacked a listed benchmark. Quantum Solutions fills this gap, establishing a model for other corporations interested in digital asset treasuries.

Technical Considerations for ETH Treasury Management

Quantum Solutions’ ETH treasury will require robust infrastructure to manage custody, risk, and compliance. Key technical considerations include:

- Institutional-grade custody: Ensuring secure storage and multi-signature access to ETH holdings.

- Yield strategies: Utilizing decentralized finance protocols and staking mechanisms for ETH to generate incremental revenue.

- Blockchain analytics: Monitoring transaction activity, on-chain risk, and regulatory compliance.

- Liquidity management: Balancing ETH accumulation with potential market impact from large transactions.

The integration of these elements will define the operational effectiveness of Japan’s first ETH treasury-listed company.

Conclusion

Quantum Solutions’ $180 million fundraising establishes Japan’s first Ethereum corporate treasury. Quantum will be able to expand its capital base, treasury, and treasury by aligning with global institutional investors and leveraging Ethereum's blockchain technology. The initiative highlights the growing integration of digital assets into traditional equity markets and sets a benchmark for future ETH treasury strategies in Japan.

Resources:

Quantum Solutions to Soar Past 100,000 ETH as Landmark Investment from SIG x ARK x IAM Crowns Japan's ETH Champion - report by The Globe and Mail: https://www.theglobeandmail.com/investing/markets/markets-news/ACN%20Newswire/35093252/quantum-solutions-to-soar-past-100-000-eth-as-landmark-investment-from-sig-x-ark-x-iam-crowns-japan-s-eth-champion/

Bitmine Ether Holdings Announcement: https://www.prnewswire.com/news-releases/bitmine-immersion-bmnr-eth-holdings-exceed-1-15-million-tokens-valued-in-excess-of-4-96-billion-and-largest-eth-treasury-in-world-302526216.html

SharLink Transaction Data From Arkham Intelligence: https://intel.arkm.com/explorer/address/0x6F37216B54EA3fe4590aB3579faB8fD7f6DcF13F

Read Next...

Frequently Asked Questions

What is an Ethereum treasury?

An Ethereum treasury is a corporate strategy where a company holds and manages ETH as an asset to generate revenue and strengthen its balance sheet.

How much Ethereum does Quantum Solutions plan to hold?

Quantum Solutions aims to accumulate over 100,000 ETH as part of its corporate treasury strategy.

Who invested in Quantum Solutions’ $180 million raise?

The round included ARK Invest, Nasdaq-listed Strategy and Susquehanna International Group (SIG), and Hong Kong-based Integrated Asset Management (IAM).

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

Soumen Datta

Soumen DattaSoumen has been a crypto researcher since 2020 and holds a master’s in Physics. His writing and research has been published by publications such as CryptoSlate and DailyCoin, as well as BSCN. His areas of focus include Bitcoin, DeFi, and high-potential altcoins like Ethereum, Solana, XRP, and Chainlink. He combines analytical depth with journalistic clarity to deliver insights for both newcomers and seasoned crypto readers.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens