Is ICE Network’s (ICE) Token Poised for a Major Move? Market Analysis

Is ICE Network (ICE) token on the cusp of a breakout? Key technical patterns hint at the possible next price direction.

Miracle Nwokwu

May 12, 2025

Table of Contents

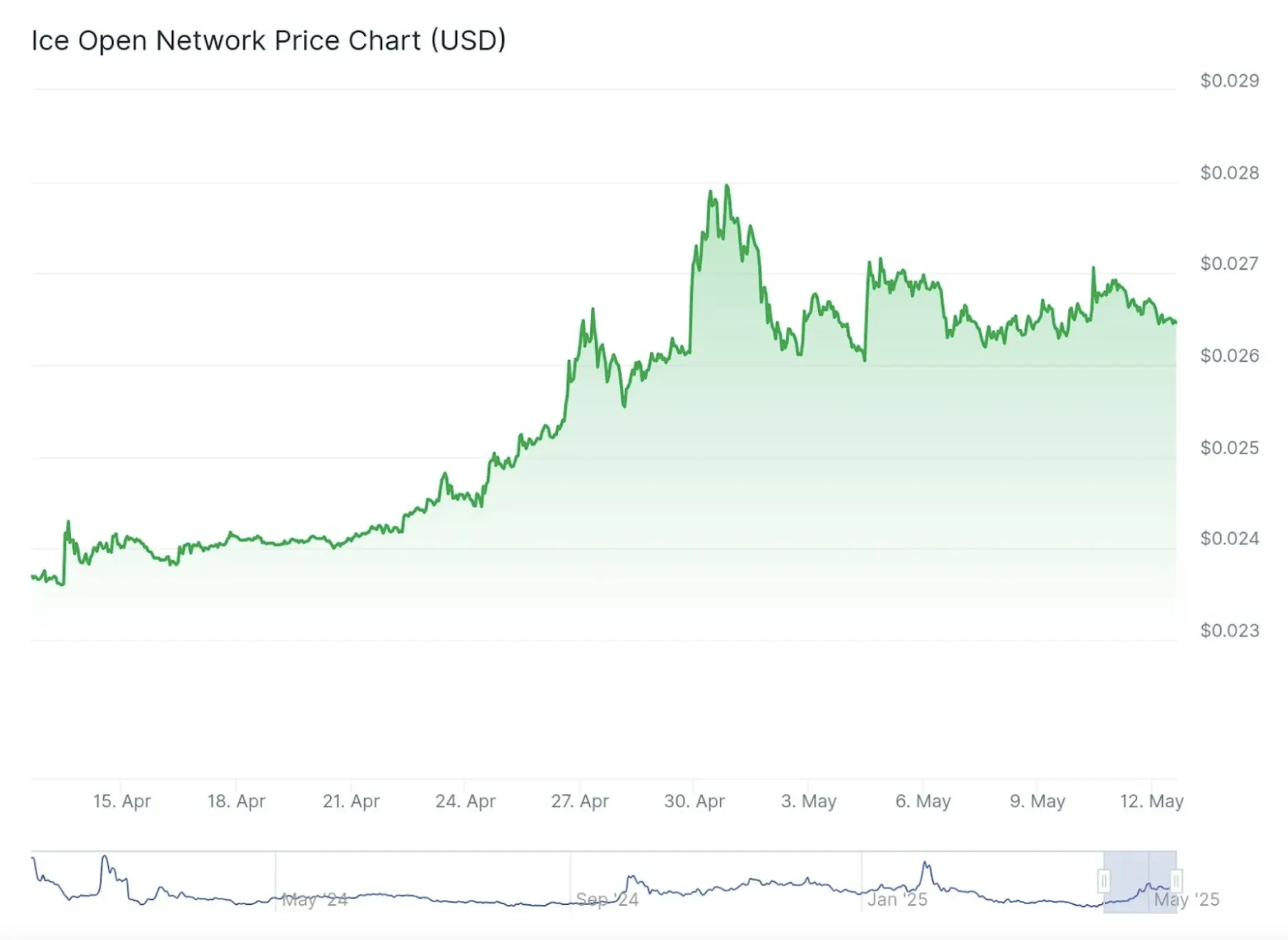

The ICE Network token is showing signs of life following a prolonged period of stagnation. Since dipping to a low of $0.0027 on April 7, the token has surged steadily, reflecting a broader uptick in market sentiment driven by Bitcoin and Ethereum.

Despite shedding 3% in the last 24 hours, ICE token (currently trading at $0.0064, per data from CoinGecko) has surged about 70% in the past 30 days, pushing its market capitalization to approximately $44 million. Ranked 821 in standings, the token has recorded a 24-hour trading volume of $7.6 million. But what’s fueling this potential shift, and could it lead to further breakout?

Project Developments Fueling Market Interest

Following the mainnet launch of the ICE Open Network on January 29, 2025, the project is nearing another critical juncture. ICE Network is gearing up for the launch of Online+, a decentralized app ecosystem. This milestone includes a significant transition from the $ICE ticker to $ION. The ION Bridge, which connects Binance Smart Chain to ION, has been reactivated following its earlier closure for maintenance. This update allows users to swap $ICE for $ION.

Adding to the momentum, Online+ received approval for release on both the Apple App Store and Google Play Store on May 4. This move broadens accessibility, potentially attracting a wider user base. The token is already listed on exchanges like Bitget, MEXC, OKX, and Uphold, with the latter joining the roster in late April. Such listings can boost liquidity and visibility, key drivers for price appreciation.

✅ Online+ has been approved by both the Apple #AppStore and Google #PlayStore.

— Ice Open Network (@ice_blockchain) May 4, 2025

This is a major milestone for the #ION ecosystem — and it can only mean one thing: the global launch is just around the corner, with the app release happening very soon.

🔥 Get ready. The new… pic.twitter.com/vu8DvtVGqs

ICE/USDT Chart: Technical Analysis

As seen below, the ICE/USDT daily chart on TradingView shows a recovery phase for the ICE token following a continuous decline from its $0.013 peak on January 28. The price has oscillated within a tightening range, forming a potential symmetrical triangle pattern. This pattern is often marked by converging trendlines and suggests a period of consolidation before a breakout in either direction.

Specifically, the ICE token price has recently formed a bullish pennant, a pattern that usually indicates an impending continuation of a strong upward price move. They appear when a market makes an extensive move higher, then pauses and consolidates between converging support and resistance lines.

A significant spike built up in mid-April, pushing the price to $0.008 highs, accompanied by a sharp volume surge and higher lows. This rally suggests strong buying interest, possibly tied to the project’s recent developments.

The ICE token price comfortably sits above the 20 and 50-day EMAs at $0.006 and $0.00534, respectively. The 200-day MA is also below the price at $0.0059. These areas are acting sufficiently as dynamic support as the ICE token decides its next direction.

Bullish Scenario

A bullish breakout above the upper trendline of the symmetrical triangle, ideally accompanied by increased volume, could signal the continuation of the recovery. This move could target the height of the triangle, around $0.008, and eventually higher towards a $0.01 psychological level and previous support zone. In the case of a bullish breakout, the EMAs and the lower trendline of the triangle will continue to act as support levels.

Bearish Scenario

Conversely, a bearish breakdown below the lower trendline of the symmetrical triangle could indicate a resumption of the downtrend. This potential downside target, based on the height of the triangle, could be around 0.005 or lower. Should price flip below, the EMAs and the upper trendline of the triangle will act as resistance levels.

The ICE/USDT chart is currently in a consolidation phase, with potential for a breakout or breakdown. Monitoring the price action within the symmetrical triangle, along with volume and key support/resistance levels, will be crucial in determining the next move. A breakout above the triangle could lead to a bullish rally, while a breakdown could trigger a bearish decline.

Conclusion

ICE Network’s recent performance and upcoming milestones suggest it could be on the cusp of a significant move. The combination of technical patterns and project developments paints a cautiously optimistic picture. Yet, the market’s volatility demands vigilance.

Whether ICE breaks out or breaks down will hinge mainly on the general market sentiment. Always diversify and assess your risk tolerance, as crypto markets remain unpredictable. The information provided in this article is for educational purposes only and should not be considered financial advice.

Read Next...

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

Miracle Nwokwu

Miracle NwokwuMiracle holds undergraduate degrees in French and Marketing Analytics and has been researching cryptocurrency and blockchain technology since 2016. He specializes in technical analysis and on-chain analytics, and has taught formal technical analysis courses. His written work has been featured across multiple crypto publications including The Capital, CryptoTVPlus, and Bitville, in addition to BSCN.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens