What Is Genius and How It Works: Exploring the on-chain Terminal for DeFi Traders

Genius is a non-custodial on-chain trading terminal delivering private, high-speed, cross-chain execution for professional DeFi traders.

UC Hope

January 14, 2026

Table of Contents

Genius is a privacy-focused, non-custodial on-chain trading terminal designed to give professional traders the centralized-exchange execution speed and discretion they need while preserving full user ownership.

Backed by YZi Labs, the platform targets a long-standing structural weakness in decentralized finance, which is the inability to execute large positions across chains without exposing intent, fragmenting liquidity, or degrading execution quality. Genius consolidates spot trading, perpetuals, pre-launch tokens, portfolio yield, and advanced analytics into a single interface that treats blockchains as back-end infrastructure rather than user-facing complexity.

This article explains how Genius works, why YZi Labs invested, and what distinguishes the terminal from existing DeFi aggregators and wallets, with a focus on architecture, execution, privacy, and real trading workflows.

Why YZi Labs Invested in Genius

YZi Labs announced an investment in Genius on January 13, 2026, aligning with its thesis of backing infrastructure that delivers centralized-exchange speed, liquidity aggregation, and privacy without custody risk. The firm’s position is that centralized exchanges outperform not because they are centralized, but because they are fast, discreet, and consolidated. DeFi, by contrast, has struggled with fragmented liquidity, public transaction visibility, and operational friction.

Genius is designed as a direct response. It is chain-agnostic, signatureless, and programmatic, removing wallet pop-ups, token approvals, and network switching from active trading. From YZi Labs’ perspective, execution quality and discretion are the missing components preventing DeFi from serving professional capital at scale.

The investment also brought Changpeng Zhao on as an advisor. Armaan Kalsi, Co-founder & CEO of Genius, has described Genius as an attempt to build an “on-chain Binance,” with privacy and execution control as the defining advantages rather than leverage or retail-facing features.

The Structural Problem Genius Is Solving

The Transparency Constraint in DeFi

Public blockchains are transparent by design. While this supports auditability, it creates a disadvantage for traders moving meaningful size. Every transaction broadcasts intent in real time, making large entries or exits vulnerable to front-running, copy trading, and adverse price movement.

For professional traders, this results in consistent alpha loss. Strategies that are routine in centralized venues often become inefficient on-chain, particularly when liquidity is thinly spread across multiple networks and venues.

Fragmentation and Operational Friction

Fragmentation amplifies the problem. Executing a cross-chain strategy typically requires multiple wallets, approvals, bridges, and front ends. Aggregators can improve price routing, but they do not eliminate the need to manage infrastructure manually.

The outcome is a high-friction workflow involving RPC errors, gas estimation, and interface switching. These factors discourage sustained, high-frequency participation and favor smaller, slower trades.

Genius Terminal: Core Design Principles

Genius is built around the idea that the terminal itself is the product. Protocols are treated as APIs, bridges as background plumbing, and vaults as configuration settings. The trader interacts with one environment.

The core principles include:

- Chain-invisible execution without manual bridging or wrapping

- Signatureless workflows with no wallet pop-ups during trading

- A unified portfolio covering spot, perpetuals, pre-launch assets, and yield

- Fully non-custodial architecture with user-held keys

- Privacy-focused execution that limits information leakage while remaining auditable

These principles shape both the user experience and the underlying execution logic.

How Genius Works

Aggregated Liquidity Across Multiple Networks

Genius aggregates liquidity from more than 300 decentralized exchanges across over 10 blockchains, including Ethereum, Solana, BNB Chain, Base, Arbitrum, Avalanche, Optimism, Polygon, and Sui. Liquidity is presented as a shared execution layer rather than isolated pools.

Orders are atomically routed, so balances across different chains behave as one. For traders, this removes the need to pre-position capital or think in terms of network boundaries.

Spot Markets and Asset Discovery

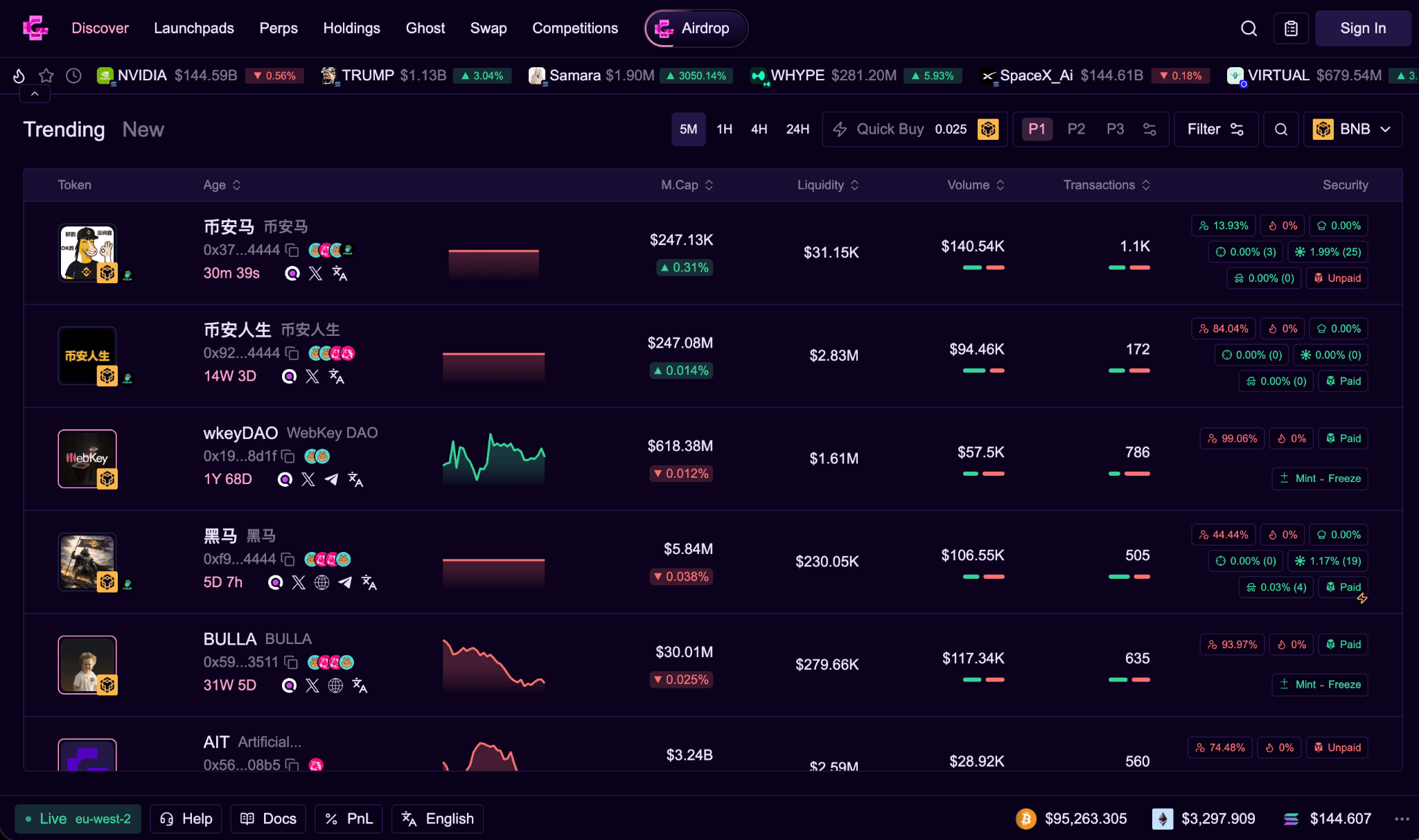

All spot markets are accessible from a single tab and are grouped by functional categories, including majors, gas tokens, stablecoins, DeFi assets, and memecoins. A dedicated memes view surfaces trending and newly verified tokens sourced from DexScreener, independent of the chain.

Each asset opens into a full analytics view, allowing discovery, analysis, and execution within the same environment.

Advanced Analytics and Market Intelligence

Real-Time Asset Data

The asset header displays live price, trading volume, market capitalization, liquidity, and holder count. Users can adjust time intervals, switch between networks, and confirm verification status directly from this view.

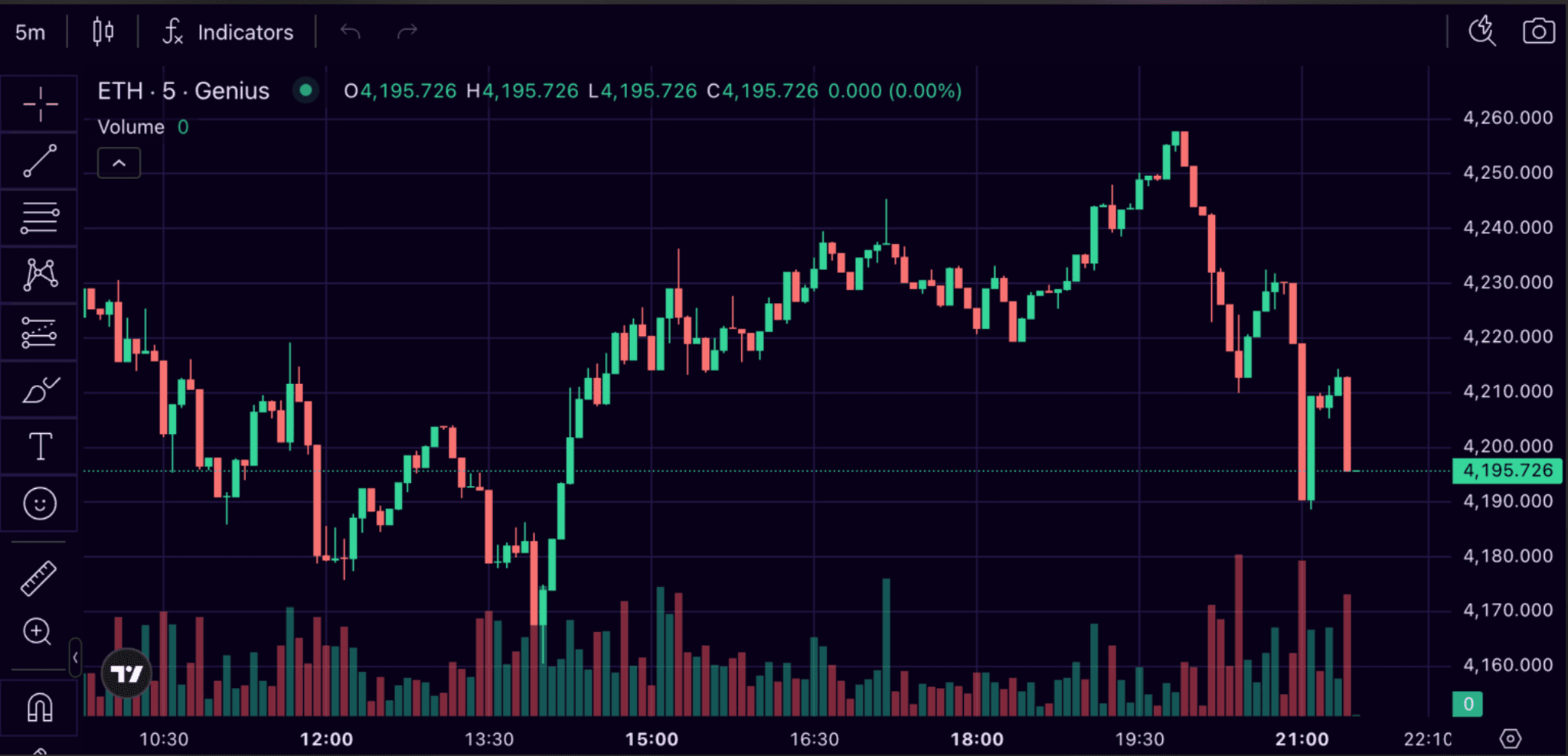

Integrated Technical Analysis

Genius embeds TradingView charting tools directly into the terminal. Traders can apply indicators, draw trendlines, annotate setups, and switch timeframes without leaving the platform. Oscillators, moving averages, Fibonacci tools, and pattern recognition are all available for immediate use.

Holder and Trader Intelligence

The holder panel lists the largest wallets for a given token, showing percentage ownership, token amounts, and USD value. Visualizations highlight concentration risk and changes over time.

The traders panel tracks the most active and profitable addresses, including realized and unrealized PnL, balances, and recent activity. This supports behavioral analysis and strategy research rather than chasing social signals.

Privacy Architecture and Ghost Orders

MPC-Based Execution Design

Genius’s primary privacy mechanism is its Ghost Order system, built using Multi-Party Computation. The system generates ephemeral clusters of wallets that can be coordinated simultaneously, allowing a single strategy to execute across many addresses without publicly linking them to a common source of funds.

Externally, activity appears distributed. Internally, execution remains coordinated and verifiable through cryptographic proofs.

Non-Custodial by Construction

Despite this abstraction, Genius remains non-custodial. Users never transfer control of private keys, and no centralized intermediary can access or freeze funds. Privacy is achieved through execution design rather than asset custody or obfuscation.

Security Signals, Not Guarantees

Each asset includes a security panel with an audit score derived from third-party scanners. Checks cover sellability, tax mechanics, holder concentration, and trading behavior. Any failed checks are clearly disclosed with supporting data.

The platform emphasizes that these scores are for informational purposes only and do not constitute guarantees, reinforcing a realistic risk assessment.

Perpetual Markets and Hyperliquid Integration

Genius integrates directly with Hyperliquid, providing access to deep perpetual liquidity and order books from within the terminal. No additional fees are added beyond Hyperliquid’s own fee structure.

Spot balances can be converted to Hyperliquid USDC via a gas-free, signatureless process, with confirmation times typically ranging from 1 to 30 seconds. Positions can be managed without leaving the Genius interface.

Pre-Launch Token Access Across Ecosystems

Genius aggregates pre-launch token markets across several chains:

- Solana listings from active and upcoming launchpads

- BNB Chain listings sourced directly from Four.Meme

- Avalanche pre-launch markets via Arena

- Base chain launches surfaced through Zora

Listings update in real time as liquidity becomes available, allowing immediate execution without monitoring multiple platforms.

Portfolio-Native Yield

Idle balances can earn yield directly from the Genius dashboard. Yield positions are integrated into the core portfolio view rather than treated as separate strategies, reinforcing the terminal’s role as a unified execution and capital management environment.

User Experience and Execution Flow

Genius is designed to minimize operational friction. Active trading does not require wallet pop-ups, token approvals, or manual gas management. Execution is prioritized over configuration.

At launch, the platform has operated with zero trading fees, reducing marginal costs for high-volume users and early adopters.

Rewards and Points System

Season One of the Genius points program runs from January 15 to March 16, 2026, with 200 million Genius Points distributed weekly.

Points accrue primarily from spot trading volume, with one point awarded for every $100 traded before multipliers. A streak multiplier activates after seven consecutive trading days and resets after one inactive day.

There are eight progression levels based on cumulative spot volume and transaction count. Higher levels unlock increasing multipliers and cash-back percentages, beginning at Level 4. Multipliers apply only to spot volume, and referral activity is excluded.

Genius in 2026 and Beyond

Genius does not compete directly with individual protocols, wallets, or aggregators. Instead, it sits above them. Routing engines, bridges, and vaults are abstracted into background services, while the trader interacts with a single execution environment.

The distinction is not feature breadth but execution focus. Genius assumes its users are already active, informed, and deploying size.

As of January 2026, Genius is live with spot trading, perpetuals, analytics, and rewards. A public beta of its privacy layer is planned for the second quarter of 2026, with a broader open-access launch later in the year.

Long-term adoption will depend on liquidity depth, reliability during volatile conditions, and the effectiveness of its privacy mechanisms in real market environments. The YZi Labs investment signals confidence in this direction, but execution will ultimately determine relevance.

Conclusion

Genius is designed to address execution quality rather than narratives. By abstracting chain complexity, prioritizing private execution, and unifying spot, perpetuals, pre-launch access, and analytics, it targets the operational gaps that have limited professional participation in DeFi.

YZi Labs’ backing reflects a view that the next phase of decentralized finance will be shaped by execution infrastructure, not by isolated protocols. Genius positions itself squarely in that layer, offering a terminal intended to be used as a primary trading environment rather than explained as an experiment.

Sources:

- YZi Labs Announcement: Investment in Genius

- Genius Website: Trading Interface and overview

- Genius Documentation: Markets, Rewards, Ghost orders, and technical information

Read Next...

Frequently Asked Questions

What makes Genius different from a DEX aggregator?

Aggregators focus on price routing. Genius unifies execution, analytics, privacy, and portfolio management into a single trading environment.

Is Genius custodial?

No. Genius is fully non-custodial. Users retain control of their private keys at all times.

When will Genius’s full privacy features be available?

A public beta of the privacy layer is expected in Q2 2026, with a broader launch planned for late 2026.

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

UC Hope

UC HopeUC holds a bachelor’s degree in Physics and has been a crypto researcher since 2020. UC was a professional writer before entering the cryptocurrency industry, but was drawn to blockchain technology by its high potential. UC has written for the likes of Cryptopolitan, as well as BSCN. He has a wide area of expertise, covering centralized and decentralized finance, as well as altcoins.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens