DoubleZero: Fiber Network Infrastructure for Blockchain

DoubleZero uses fiber infrastructure to boost blockchain speed. Analysis of N1 network technology, $28M funding, SEC clearance, and 2Z tokenomics.

Crypto Rich

October 6, 2025

Table of Contents

Despite billions of dollars invested in blockchain scaling software, validators still rely on the same public internet infrastructure that slows down streaming video and online gaming. DoubleZero aims to fix that bottleneck with dedicated fiber-optic networks. In late September 2025, the project secured a No-Action Letter from the SEC, confirming its 2Z token doesn't qualify as a security. With regulatory clarity in hand, the project aims to achieve blockchain speeds comparable to those of traditional financial systems, such as NASDAQ.

Instead of building another Layer 1 blockchain (like Ethereum) or a Layer 2 scaling solution (like Arbitrum), DoubleZero refers to itself as an "N1" network. This term refers to the physical network layer that underlies all blockchain protocols. It's not a new blockchain, but the "new internet" for existing ones. Think of it as an alternative to the public internet, but purpose-built for blockchain communication. Launched in late 2024, the project adheres to a single core principle: "Increase Bandwidth, Reduce Latency" (IBRL). While early work focuses on the Solana ecosystem, where the founders came from, the protocol works with any high-speed blockchain.

Background and History: Who Built DoubleZero?

A team combining blockchain, high-frequency trading, and telecommunications expertise founded DoubleZero in 2024. The key co-founders bring specialized knowledge:

- Austin Federa - Former Head of Strategy at Solana Labs

- Andrew McConnell - HFT network infrastructure specialist

- Mateo Ward - Carrier-grade fiber and shortwave technologies expert

The idea emerged during work on Solana's Firedancer client. Developers realized that public internet infrastructure created fundamental bottlenecks for high-performance blockchains. No amount of software optimization could fix these physical constraints. This insight led them to explore whether dedicated networks could solve problems that consensus algorithms alone couldn’t.

From Announcement to Funding

The DoubleZero Foundation announced the protocol on December 4, 2024. From the start, they positioned it as infrastructure rather than a blockchain platform. Funding followed quickly; a March 2025 token round raised $28 million at a $400 million valuation. Multicoin Capital and Dragonfly Capital led the round, with MH-Ventures and GSR among the participating investors.

Regulatory Breakthrough and Launch

The major regulatory milestone came on September 29, 2025, when DoubleZero secured a first-of-its-kind SEC No-Action Letter. The determination confirmed that 2Z doesn't qualify as a security and that programmatic token distributions to contributors aren't securities transactions. The mainnet beta was launched the next day, on October 2, 2025. Earlier that September, testnet staking went live, allowing users to stake SOL for dzSOL and support network testing before mainnet-beta deployment.

What Problem Does DoubleZero Address?

Blockchains struggle when they rely on public internet infrastructure designed for general web traffic, rather than high-frequency financial transactions. The problems pile up quickly:

- Congestion - Blockchain traffic competes with video streams and file downloads for bandwidth

- Routing inefficiencies - Latency compounds across multiple hops between validators

- Packet loss - Disrupts validator communication and forces retransmissions

- Jitter - Makes performance unpredictable even when the average latency looks acceptable

These constraints prevent blockchains from achieving the performance levels that traditional finance routinely handles. NASDAQ processes many thousands of transactions per second with microsecond latency. Most blockchains can't come close when they're limited by standard internet connections.

Why Software Alone Isn't Enough

Software optimizations help, but they eventually reach a limit. A validator can run perfectly optimized code and still depend on internet service providers and routing protocols built for different purposes. DoubleZero argues that addressing these fundamental infrastructure constraints removes bottlenecks that software alone cannot.

The solution? A dedicated global fiber-optic network that bypasses public internet congestion entirely. Utilizing multicast protocols, low-latency routing, and dark fiber infrastructure, the network aims to achieve speeds up to 10 times that of standard connections. This hardware-software combination could enable supported chains to process up to 1 million transactions per second.

How Does DoubleZero's Network Architecture Work?

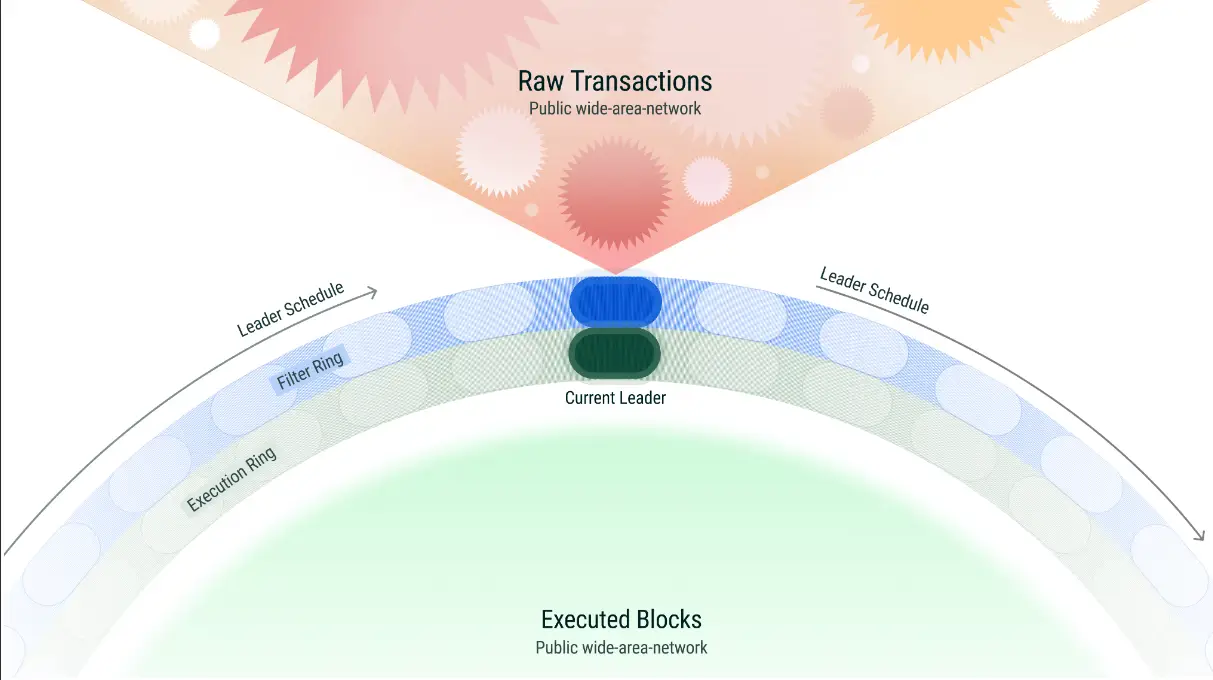

Two interconnected rings form the core design. The outer ring interfaces with the public internet and handles connections to users and applications. The inner ring manages optimized private blockchain traffic between validators and nodes. Critical consensus communication travels through dedicated pathways instead of competing for bandwidth on shared infrastructure.

Decentralized Infrastructure Contributions

Building the network happens in a decentralized way. Participants contribute unused bandwidth, optical equipment, or fiber capacity in return for token rewards. Rather than one company owning everything, ownership spreads across contributors. These might include:

- Data centers with excess fiber capacity

- Telecommunications providers with unlit dark fiber

- Operators with optical equipment positioned on useful routes

Liquid staking lowers the barriers to entry. Validators can stake SOL to receive dzSOL, thereby joining the network without the need for specialized hardware or negotiating fiber access agreements. Meanwhile, development stays open-source. Malbec Labs and the DoubleZero Foundation contribute to repositories that became public in October 2025, enabling community-driven development.

Technical Implementation

The architecture utilizes multicast protocols that efficiently distribute data to multiple recipients simultaneously. Routing algorithms pick paths that minimize delays based on real-time network conditions, not just availability. Dark fiber, installed cables that sit unused, gets activated specifically for blockchain traffic.

Core repositories became publicly available in October 2025, featuring contributions from Malbec Labs and the DoubleZero Foundation on GitHub. This open-source shift enables external developers to review code, propose improvements, and build applications on top of the infrastructure, supporting community-driven development.

This design targets blockchains achieving 1 million transactions per second. Initial work focuses on Solana, but the architecture supports any distributed system needing high-bandwidth, low-latency communication.

What is the 2Z Token's Role in the Network?

The native $2Z token keeps the network running through several key functions:

- Contributor rewards - Bandwidth and fiber providers earn programmatic rewards based on actual usage metrics

- Network access fees - Users pay for connectivity in 2Z tokens

- Network security - Staking mechanisms secure the infrastructure and generate rewards

The SEC determination removed significant regulatory uncertainty for U.S.-based operations. The ruling confirmed that 2Z functions as an infrastructure utility rather than a security, creating a compliance framework for programmatic distributions.

Token Distribution Debate

The allocation structure, which favors teams and investors over the community, has drawn some criticism. Critics highlight allocations like the 28 percent to market maker Jump Trading, viewing it as favoring insiders. However, founders emphasize long-term locks and programmatic rewards to align with network utility. SEC compliance adds regulatory oversight that could deter scams. Still, skepticism persists in some corners of the community.

Economic Model

Programmatic emissions reward ongoing contributions to network capacity. Distribution ties to measurable infrastructure additions. A contributor adding fiber capacity in a new region earns rewards as long as that infrastructure stays operational and gets used. Contributors earn based on the bandwidth provided. Users pay based on usage. Stakers secure infrastructure through economic bonds.

Development Progress: From Announcement to Mainnet

Multiple development phases connected the announcement to the mainnet (beta) launch. The December 4, 2024 announcement introduced the protocol concept and explained why dedicated infrastructure could solve blockchain performance limitations that software approaches can't fully address.

Key Development Milestones

The March 2025 funding round accelerated development and enabled the initial fiber agreements. The testnet phase identified technical issues, optimized routing algorithms, and refined contributor rewards, all of which were addressed before the mainnet beta launch. Community members who participated provided feedback that shaped final design decisions.

Regulatory approval and mainnet launch happened within days in October 2025, suggesting careful coordination to ensure legal compliance before token distribution began. Open-source code releases let external developers examine the codebase and contribute improvements.

Post-Launch Priorities

Post-launch priorities center on several key areas:

- Fiber coverage expansion - Visualized through maps showing areas turning blue as capacity joins.

- Validator integrations - Simplifying connection setup and reducing technical barriers.

- Multi-chain support - Adapting for different consensus mechanisms and data structures beyond Solana.

- Mainnet stability - Moving from beta to full mainnet based on metrics and community feedback.

Ecosystem, Partnerships, and Community Building

Several projects have integrated DoublZero's infrastructure:

- Pyth Network - Delivers oracle price feeds faster

- Crypto.com - Added 2Z token trading for liquidity

- Flash Trade - Enabled leveraged trading with improved connectivity

- DFlow - Incorporated the network into DEX aggregation services

Validators, including Unruggable and Figment, joined the network. These established operators lend credibility through their participation, which is essential because the entire value proposition depends on improving validator communication speed.

As of early October 2025, the network has achieved rapid adoption, nearing 25 percent of Solana's stake with over 40 points of presence and 10x capacity upgrades from testnet. This early traction demonstrates validator interest in dedicated infrastructure for high-performance blockchain communication.

Community Engagement

Community building primarily occurs through Discord, with close to 73,000 members, where users earn roles through verification and content creation. The verification system filters out bots from genuine participants. Contributors who produce educational content, identify bugs, or help others get recognition, and sometimes receive additional token allocations.

The X account has grown to over 60,000 followers. Audio spaces enable real-time discussion where community members ask questions and founders explain technical decisions. The social media focus stays on technical updates rather than price speculation.

Does DoubleZero Represent a New Scaling Approach?

Most blockchain projects focus on software: consensus mechanisms, data structures, sharding schemes, and computational efficiency. Ethereum implements sharding. Solana optimizes parallel processing. Layer 2 solutions move computation off-chain. All these approaches assume the underlying internet infrastructure stays constant.

Physical Layer vs. Software Optimization

DoubleZero takes a different view. Software approaches eventually hit constraints imposed by the physical layer. By addressing this foundation, the project aims to eliminate bottlenecks that persist despite software improvements.

High-frequency trading firms did something similar, investing in dedicated fiber connections to shave milliseconds because those milliseconds generated trading advantages worth millions.

Economic Viability Questions

The economic model differs from high-frequency trading firms that justified infrastructure costs through direct trading profits. Blockchain validators rely on block rewards, transaction fees, and token incentives to cover infrastructure expenses.

The project's testnet phase provided initial performance data. Full validation will come from broader adoption across multiple chains and real-world usage conditions.

Regulatory Precedent

The SEC determination has created a framework on how infrastructure tokens can achieve compliance, potentially offering a template for other projects seeking regulatory certainty.

Conclusion

DoubleZero launched mainnet-beta with $28 million in backing, SEC regulatory clearance, and fiber-optic infrastructure, targeting 10x speed improvements for blockchains. The project addresses infrastructure bottlenecks that software optimization alone cannot resolve, with early integrations from Pyth Network, Crypto.com, and various other Solana ecosystem projects demonstrating initial adoption.

The token allocation structure and hardware requirements create different decentralization trade-offs than software-only protocols. However, long-term token locks and regulatory compliance provide some assurance.

Real-world performance will determine whether dedicated blockchain infrastructure becomes the next scaling frontier or remains a specialized solution for high-performance applications. The approach requires coordination across technical, economic, and regulatory dimensions while navigating the practical challenges of building a global physical infrastructure.

For more information, visit the official DoubleZero website and follow @doublezero on X for updates.

Sources

- DoubleZero on X: Announcements (December 2024 - October 2025).

- DoubleZero Website: General Information.

- Alea Research: "DoubleZero: Rewiring Blockchain Networking - What You Need to Know” (2025).

- DoubleZero/ Malbec Labs: Technical documentation.

- Github.com: Malbec Labs and DoubleZero Foundation’s repositories.

- Cryptorank.io: Funding Round information.

Read Next...

Frequently Asked Questions

What makes DoubleZero different from Layer 1 and Layer 2 blockchains?

DoubleZero doesn't process transactions itself. It provides dedicated fiber-optic infrastructure that existing blockchains use to communicate faster between validators and nodes, functioning as network infrastructure rather than a blockchain platform.

Why did DoubleZero secure an SEC No-Action Letter for its token?

The letter confirms that 2Z doesn't qualify as a security under federal law. This regulatory clarity allows compliant U.S. operations and provides a legal framework for programmatic token distributions to contributors.

What does IBRL mean for DoubleZero's approach?

IBRL stands for "Increase Bandwidth, Reduce Latency." This principle guides the project's focus on enhancing blockchain performance through physical fiber infrastructure, rather than relying solely on software optimization.

Can DoubleZero support blockchains other than Solana?

Yes. While initial integrations focus on Solana due to the founders' backgrounds, DoubleZero works with any blockchain architecture and can support distributed systems that require low-latency, high-bandwidth connections.

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

Crypto Rich

Crypto RichRich has been researching cryptocurrency and blockchain technology for eight years and has served as a senior analyst at BSCN since its founding in 2020. He focuses on fundamental analysis of early-stage crypto projects and tokens and has published in-depth research reports on over 200 emerging protocols. Rich also writes about broader technology and scientific trends and maintains active involvement in the crypto community through X/Twitter Spaces, and leading industry events.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens