Core DAO Announces Buildathon Winners: A Look at the Top Builders

The winners offer practical examples of how developers can leverage Core DAO’s features for real-world applications.

UC Hope

October 9, 2025

Table of Contents

Core DAO announced the winners of its Core Connect Global Buildathon on October 8, 2025, highlighting four projects that advance Bitcoin DeFi on its Layer 1 blockchain. The event, which drew over 200 submissions, culminated in four projects sharing the top honors after a selection process that included 13 semifinalists and a grand finale featuring five main finalists, along with two wildcard entries.

Each winning team received $10,000 in CORE tokens, $10,000 in AWS Activate credits, eligibility for the Core Starter Program, six months of gas rebates on the Core mainnet, and technical support from Core DAO's developer relations and business development teams.

Overview of the Core Connect Global Buildathon

The Core Connect Global Buildathon launched on June 2, 2025, as an online hackathon hosted on DoraHacks, running until August 10, 2025. Organized by Core DAO, the event encouraged developers to build decentralized applications in various categories, including BTCfi, DeFi, AI, gaming, Web3 infrastructure, and SocialFi. Participants competed for up to $1.2 million in total rewards, including up to $500,000 in funding from Core Ventures, $400,000 in monthly token incentives through the Builders' Incentive Program, and $200,000 in development perks via the Core Starter Program.

The structure featured regional meetups across five continents from June to August 2025, with in-person gatherings in locations such as New Delhi, to foster collaboration and networking. Finalist selection occurred by August 20, 2025, followed by a semi-final demo day in early September. The grand finale took place in October 2025, aligning with TOKEN2049 in Singapore, where top teams pitched their projects. Travel scholarships were provided to finalists by the blockchain platform. The buildathon focused on projects that increase total value locked, daily active users, and transaction volume on Core, with a priority on technical integration with Bitcoin's ecosystem.

From the initial pool of over 200 projects, organizers narrowed it to 13 semifinalists. The five main finalists were Agent Daredevil, BitMax, CorePilot, LiquidSat, and OrangeTerminal, with two additional wildcard entries advancing to the finale. The judging criteria focused on innovation, technical feasibility, and alignment with Core's BTCfi goals, such as enabling Bitcoin-native financial primitives without the need for bridges or wrappers.

A Quick Look at The Winners

Below is a list of the four selected winners based on the announcement tweet from the Core Builders X account on October 8:

1/4 🥁 Announcing the winners of the Core Connect Global Buildathon!

— Core Builders (@corechain_devs) October 8, 2025

What a journey! From over 200+ projects, 13 reached the semifinals, and 5 projects, along with 2 wildcard entries, made it to the grand finale.

Meet the winners of the buildathon👇 pic.twitter.com/VrhTTXcBgC

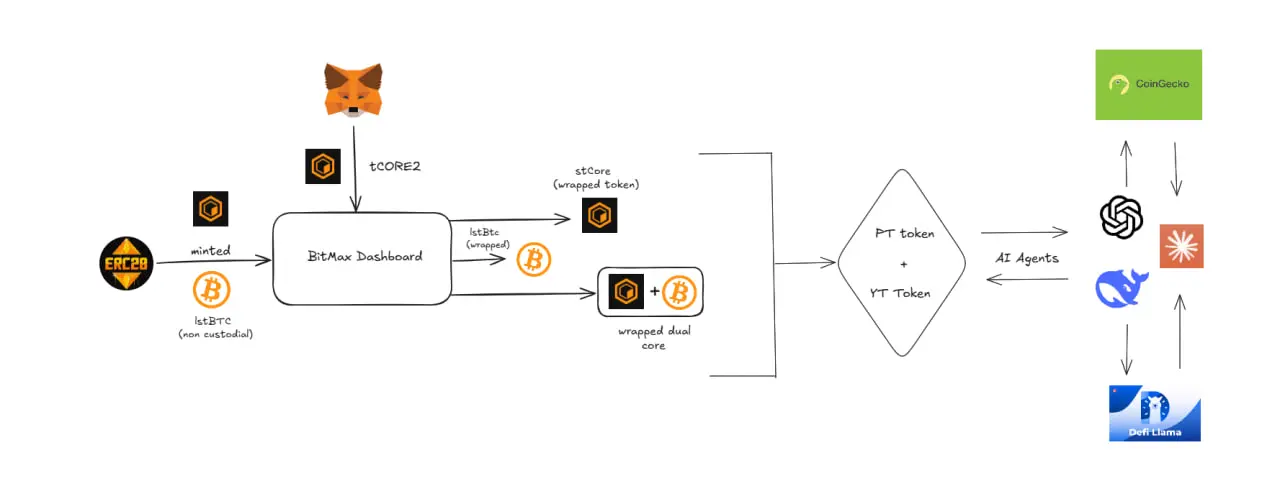

BitMax: AI Integration for Bitcoin DeFi Strategies

BitMax emerged as one of the winners with its AI-powered DeFi ecosystem tailored for Bitcoin and Core assets on the Core blockchain. The project integrates artificial intelligence to optimize DeFi strategies, including staking and liquidity management. Specifically, BitMax uses AI algorithms, such as Long Short-Term Memory models for yield prediction, Proximal Policy Optimization for strategy decisions, and the Kelly Criterion for risk assessment, to maximize yields while mitigating risks from market volatility. It tokenizes yields generated from staked assets, separating positions into Principal Tokens for redeeming the original amount at maturity and Yield Tokens for capturing future yields, allowing users to trade or leverage these within the Core ecosystem.

Technical details include AI-driven analysis for strategy selection, where machine learning models assess historical yield rates, staking trends, market volatility, and real-time data on liquidity pools and staking opportunities. This approach enables automated adjustments to positions, such as dynamic staking ratios and liquidity allocation, reducing the need for manual intervention.

BitMax operates without centralized custodians, relying on Core's smart contracts for execution, with contracts deployed on the Core testnet. The frontend uses ReactJS, the backend employs FastAPI, and the system includes an Automated Market Maker for trading tokenized yields. The project's focus aligns with Core's emphasis on BTCfi, where Bitcoin holders can participate in DeFi without leaving the Bitcoin network.

A deployed application is available, with code repositories on GitHub at https://github.com/karar189/BitMax-Staking-App/tree/fix/contracts and https://github.com/sceptejas/BitMaxFinal.

CorePilot: Automated Staking Optimization on Core

CorePilot won for its smart staking layer on the Core blockchain, which automates validator selection and introduces liquid staking. The protocol uses algorithms to identify under-utilized validators with the highest annual percentage rates, based on variations in staked BTC, CORE, and hash power under Core's Satoshi Plus consensus. This automation streamlines the staking process, allowing users to delegate assets without manual research of validators, while improving network decentralization and reducing risks like stake concentration.

A key feature is liquid staking, where staked assets receive a liquid representation in the form of pCORE tokens that track positions, accrue optimized rewards, and remain usable in other DeFi applications while earning staking rewards. This prevents capital lockup, a common issue in traditional staking. CorePilot integrates directly with Core's consensus mechanism, ensuring compatibility with Bitcoin staking yields, and provides an API for third-party projects to incorporate its optimization logic, such as in yield aggregators or vault strategies.

The protocol is live on the Core mainnet, and interested users can visit the website to learn more.

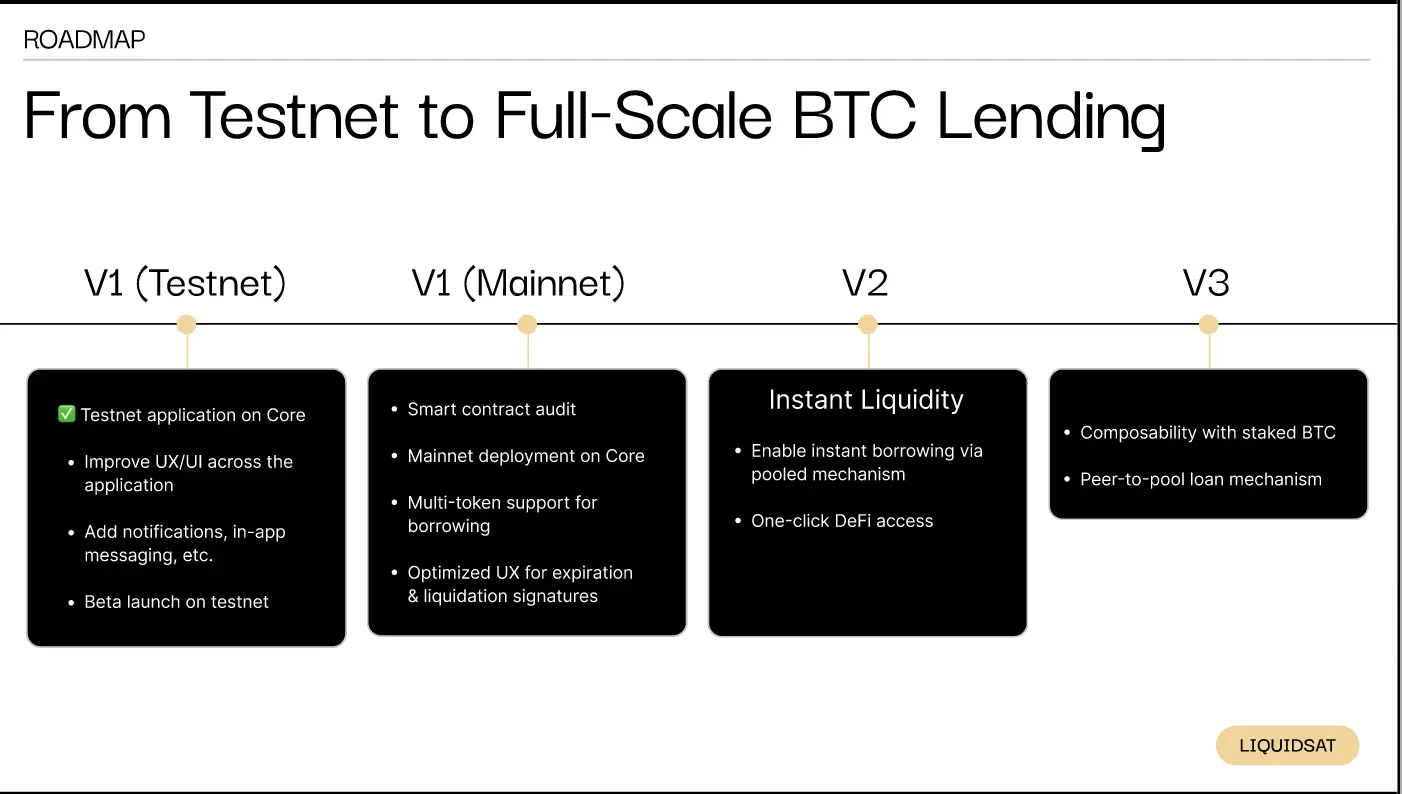

LiquidSat: Trustless BTC Lending Without Custody Transfer

LiquidSat secured a place in the list of winners with its self-custodial BTC lending protocol on Core, enabling users to borrow stablecoins against Bitcoin collateral without transferring asset custody. The system facilitates direct BTC-backed loans, where borrowers receive stablecoins while retaining control of their Bitcoin. Security is handled through Bitcoin Script contracts, which enforce loan terms trustlessly, eliminating the need for bridges or asset wrappers that introduce additional risks.

In operation, LiquidSat uses Bitcoin's scripting language to create conditional transactions that release collateral only upon default or repayment. This method leverages Core's interoperability with Bitcoin, allowing seamless integration of BTC as collateral in EVM-based DeFi. Generally, the protocol addresses a core challenge in BTCfi: enabling lending without compromising Bitcoin's self-custody principle. Refer to the project’s PitchDeck for more information, including its roadmap for future development.

Orange Terminal: AI Assistant for Bitcoin DeFi Tasks

OrangeTerminal was recognized for its AI-powered co-pilot designed for Bitcoin DeFi on Core. Functioning as an AI assistant with a chat-based interface, it simplifies user interactions with DeFi protocols, handling tasks like transaction execution, portfolio monitoring, and strategy recommendations through real-time data aggregation for staking, dual staking, lending, borrowing, and liquidity pools. Developer Shantanu Sakpal describes it as a one-stop application for all Bitcoin DeFi needs, integrating natural language processing to interpret user queries and execute actions on Core.

The tool uses AI to streamline complex operations, such as optimizing yields or managing liquidity, making DeFi accessible to non-technical users. It includes features like cross-protocol APY comparison, BTC and CORE staking support, lending and borrowing opportunity finding, and one-click transaction execution via smart contract calls.

The technical stack comprises Next.js 15 with Vercel AI SDK for the frontend, serverless functions for the backend, data from Core staking APIs and protocols like Colend, and a fine-tuned GPT model for DeFi context. The protocol’s website provides further details on its integration.

Conclusion

The Core Connect Global Buildathon demonstrates Core DAO's commitment to expanding Bitcoin's role in DeFi through targeted developer incentives and technical support. The four winners each address specific aspects of BTCfi, from AI optimization and automated staking to trustless lending and user-friendly interfaces. These projects utilize Core's EVM compatibility and Bitcoin integration to deliver functional tools that enhance yield generation and asset utility.

As Core continues to grow its ecosystem, these protocols offer practical examples of how developers can leverage the network's features for real-world applications. Readers interested in BTCfi should monitor these projects for mainnet deployments and further updates.

Sources:

- Core Builders on X: https://x.com/corechain_devs/status/1975939827788132799

- Core DAO Blog: https://coredao.org/blog/introducing-core-connect-global-buildathon

- DoraHacks Hackathon Page: https://dorahacks.io/hackathon/core-connect-global-buildathon/detail

Read Next...

Frequently Asked Questions

What are the winners of the Core Connect Global Buildathon?

The winners are BitMax, an AI-powered DeFi ecosystem for Bitcoin; CorePilot, a smart staking layer with validator optimization; LiquidSat, a self-custodial BTC lending protocol; and Orange Terminal, an AI co-pilot for Bitcoin DeFi tasks.

What rewards do the buildathon winners receive?

Each winning team gets $10,000 in CORE tokens, $10,000 in AWS Activate credits, eligibility for the Core Starter Program, six months of gas rebates on the Core mainnet, and technical support from Core DAO.

How does the Core blockchain support Bitcoin DeFi?

Core utilizes EVM-compatible smart contracts and Bitcoin-native timelocks for non-custodial staking, facilitating low-cost DeFi interactions with Bitcoin assets without the need for custody transfer.

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

UC Hope

UC HopeUC holds a bachelor’s degree in Physics and has been a crypto researcher since 2020. UC was a professional writer before entering the cryptocurrency industry, but was drawn to blockchain technology by its high potential. UC has written for the likes of Cryptopolitan, as well as BSCN. He has a wide area of expertise, covering centralized and decentralized finance, as well as altcoins.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens