CMC20 Explained: CoinMarketCap’s New Index Token Hits PancakeSwap

Learn how CoinMarketCap’s CMC20 token works on PancakeSwap, including index design, rebalancing, features, and DeFi integrations.

Soumen Datta

November 18, 2025

Table of Contents

CoinMarketCap’s recently launched CMC20 token is a tradable crypto index token that tracks the top 20 cryptocurrencies by market capitalization. It allows investors to gain broad market exposure through a single asset and is now available for trading on PancakeSwap.

🚀 Introducing CMC20: Crypto’s First DeFi-Enabled Tradable Index Token.

— CoinMarketCap (@CoinMarketCap) November 17, 2025

CoinMarketCap is proud to announce $CMC20, the first DeFi-native tradable crypto index token on @BNBCHAIN. Your single-trade gateway to diversified exposure across the top 20 crypto assets.

Built in… pic.twitter.com/5oIfjJeBKw

What Is CMC20?

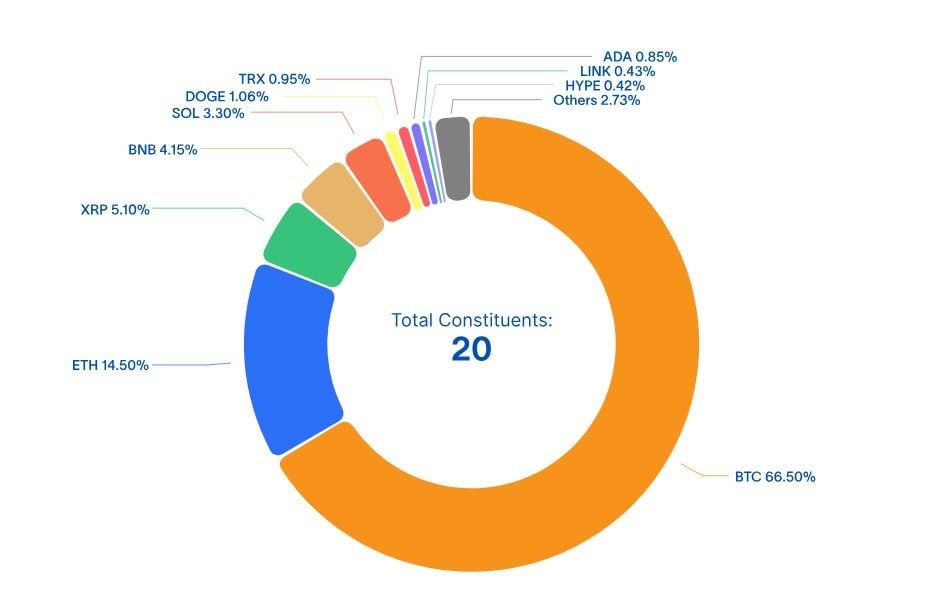

CMC20 is a decentralized, onchain index token developed by CoinMarketCap in collaboration with Reserve Protocol. It represents a basket of the top 20 cryptocurrencies by market cap, including Bitcoin, Ethereum, Solana, XRP and more. However, the index excludes stablecoins, wrapped tokens, and assets that face regulatory limitations such as Monero.

Launched on November 17, CMC20 operates as a Decentralized Token Folio (DTF) on BNB Chain. DTFs are onchain baskets of multiple assets packaged into a single token, created using Reserve’s infrastructure.

CMC20 is the first DeFi-enabled and fully tradable crypto index token native to BNB Chain.

Why CoinMarketCap Introduced CMC20

CoinMarketCap says the crypto market has become increasingly noisy. With over 27 million tokens in existence and an estimated 50,000 new launches every day, investors struggle to filter quality assets from short-lived projects.

CMC20 was created to serve as:

- A transparent, investable benchmark

- A market-cap-weighted index

- A single asset offering diversified exposure

- A way to reduce the need for manual portfolio construction

- A tool that both retail and institutional investors can use in DeFi strategies

CoinMarketCap CEO Rush Luton described the token as a crypto analogue to the S&P 500 but tailored for decentralized markets.

“CMC20 serves as crypto’s version to the S&P 500, delivering diversified exposure to crypto’s largest, most liquid assets in a single trade, backed by transparent methodology and permissionless infrastructure,” Luton stated.

How CMC20 Works

CMC20 includes the top 20 cryptocurrencies by market cap except stablecoins, wrapped tokens, and assets with regulatory barriers.

Key Features

- Rebalanced monthly

The index updates at the end of each month to reflect market-cap changes. - Onchain issuance and redemption

Reserve Protocol handles minting and redeeming, ensuring a transparent and verifiable process - Fully tradable

Unlike reference-only indexes, this token is designed for active use, including trading, hedging, and collateral use across DeFi. - Deployed by Lista DAO

The team behind Lista DAO manages deployment on BNB Chain.

Supported Ecosystem Integrations

CMC20 is accessible through:

- Trading on PancakeSwap

- Minting and redeeming via the Reserve dApp

- Trust Wallet

- Ongoing support from centralized exchanges, decentralized exchanges, platforms, and fintech apps

Future integrations include lending markets and yield-based utilities.

CMC20 Launch and Market Timing

The token was released on a difficult trading day. Bitcoin fell below $90,000 for the first time in nearly seven months, and Ether slipped under $3,000. As a result, early CMC20 buyers faced a 4.73% 24-hour decline, compared to the broader market’s 4.18% drop.

CMC20 is heavily weighted toward dominant crypto assets. BTC, ETH, XRP, and BNB make up a large share of the index due to their market caps.

Yet despite the launch-day volatility, CMC20’s index history offers useful context. The token was assigned a base value of $100 on January 1, 2024. By the time of writing, it was trading at $193—up almost 93% from the start of the year. Over that same period, Bitcoin rose 107%, and Ether increased 29%.

Over the last year, the index is roughly flat and remains 29.5% below its October 6 high of $275.48.

CMC20 vs. Other Crypto Index Products

CMC20 enters a growing field of index-linked crypto instruments.

Onchain Index Tokens: CMC20 vs. S&P DM50

S&P recently announced the Digital Markets 50 Index (DM50), which blends 15 cryptocurrencies with 35 publicly listed crypto companies. A tokenized version is being developed by Dinari.

The key differences:

- CMC20 → pure crypto exposure, 20 assets, onchain, DeFi-enabled

- DM50 → hybrid equity-crypto exposure, off-chain methodology, token still in development

Traditional Multi-Asset ETPs

European issuers like CoinShares and 21Shares offer multi-asset crypto ETPs, but these remain off-chain and centralized. They track baskets of assets through custody accounts rather than decentralized smart contracts.

U.S. Regulatory Environment

The SEC has not approved multi-coin ETFs under the Securities Act of 1933. Some issuers have used the Investment Company Act of 1940 to launch limited products, but such funds rely on derivatives and backed securities instead of spot assets. They cannot offer full spot exposure.

In contrast, CMC20 is permissionless and operates entirely onchain.

Institutional Use Cases

CMC20 is designed to integrate into advanced trading frameworks. Institutions can leverage the asset for:

- Delta-neutral strategies

Balancing long and short positions with index exposure. - Collateralized lending

Using the token in lending markets as transparent, verifiable collateral. - Automated portfolio rotation

Programmatically managing exposure through smart contracts. - Onchain auditability

Every component of the index is verifiable through Reserve’s infrastructure.

These features allow firms to treat CMC20 as a building block within DeFi strategies rather than a passive benchmark.

Conclusion

CMC20 brings an onchain, tradable index structure to the BNB Chain ecosystem. It tracks the top 20 cryptocurrencies by market capitalization and can be minted, redeemed, or traded without centralized intermediaries. The token offers a structured, rules-based way to achieve diversified exposure while supporting DeFi use cases for both institutional and retail users. Its monthly rebalancing, transparent methodology, and onchain auditability position it as a functional tool within a growing ecosystem of crypto index products.

Resources:

CoinMarketCap X platform: https://x.com/CoinMarketCap

CMC20 price action: https://coinmarketcap.com/currencies/coinmarketcap-20-index/

Announcement - Introducing CMC20: Crypto’s answer to the S&P 500 has arrived: https://coinmarketcap.com/currencies/coinmarketcap-20-index/

Read Next...

Frequently Asked Questions

What does the CMC20 token track?

CMC20 tracks the top 20 cryptocurrencies by market capitalization, excluding stablecoins, wrapped tokens, and privacy-focused assets.

Where can I trade or mint CMC20?

CMC20 can be traded on PancakeSwap and accessed through Trust Wallet. Minting and redemption occur on the Reserve dApp.

How often is CMC20 rebalanced?

The index is rebalanced monthly to adjust weights and update the included assets based on market-cap rankings.

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

Soumen Datta

Soumen DattaSoumen has been a crypto researcher since 2020 and holds a master’s in Physics. His writing and research has been published by publications such as CryptoSlate and DailyCoin, as well as BSCN. His areas of focus include Bitcoin, DeFi, and high-potential altcoins like Ethereum, Solana, XRP, and Chainlink. He combines analytical depth with journalistic clarity to deliver insights for both newcomers and seasoned crypto readers.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens