Was October 2025 Avalanche's Best Month in History?

October 2025 marked Avalanche's record month with over 100 million active addresses, peak C-Chain gas usage, and key DeFi/RWA developments.

UC Hope

November 3, 2025

Table of Contents

October 2025 marked a period of substantial activity for the Avalanche blockchain network, with records set in user engagement and transaction volume, positioning it as one of the platform's strongest months to date.

Data from the network showed over 100 million monthly active addresses across its blockchain ecosystem, the highest figure recorded, alongside peak gas usage and the second-highest transaction count on the C-Chain. These metrics, detailed in Avalanche's official updates, indicate a surge in adoption driven by developments in decentralized finance, real-world assets, and infrastructure.

Network Metrics Highlight Surge in Activity

Avalanche's C-Chain, the primary smart contract layer, processed its second-highest monthly transaction volume in October 2025, exceeding 1 billion across the network. Gas usage on the C-Chain reached an all-time high, reflecting increased computational demands from applications and users. Additionally, the total value locked in the ecosystem climbed to more than $2.2 billion, the largest since 2022, while decentralized exchange trading volume surpassed $12 billion.

October:

— Avalanche🔺 (@avax) November 1, 2025

• Highest month ever for active addresses across L1s

• Highest month for gas usage on C-chain

• 2nd highest month for transactions on C-chain

Keep going. 🔺 pic.twitter.com/fw2yJhILHD

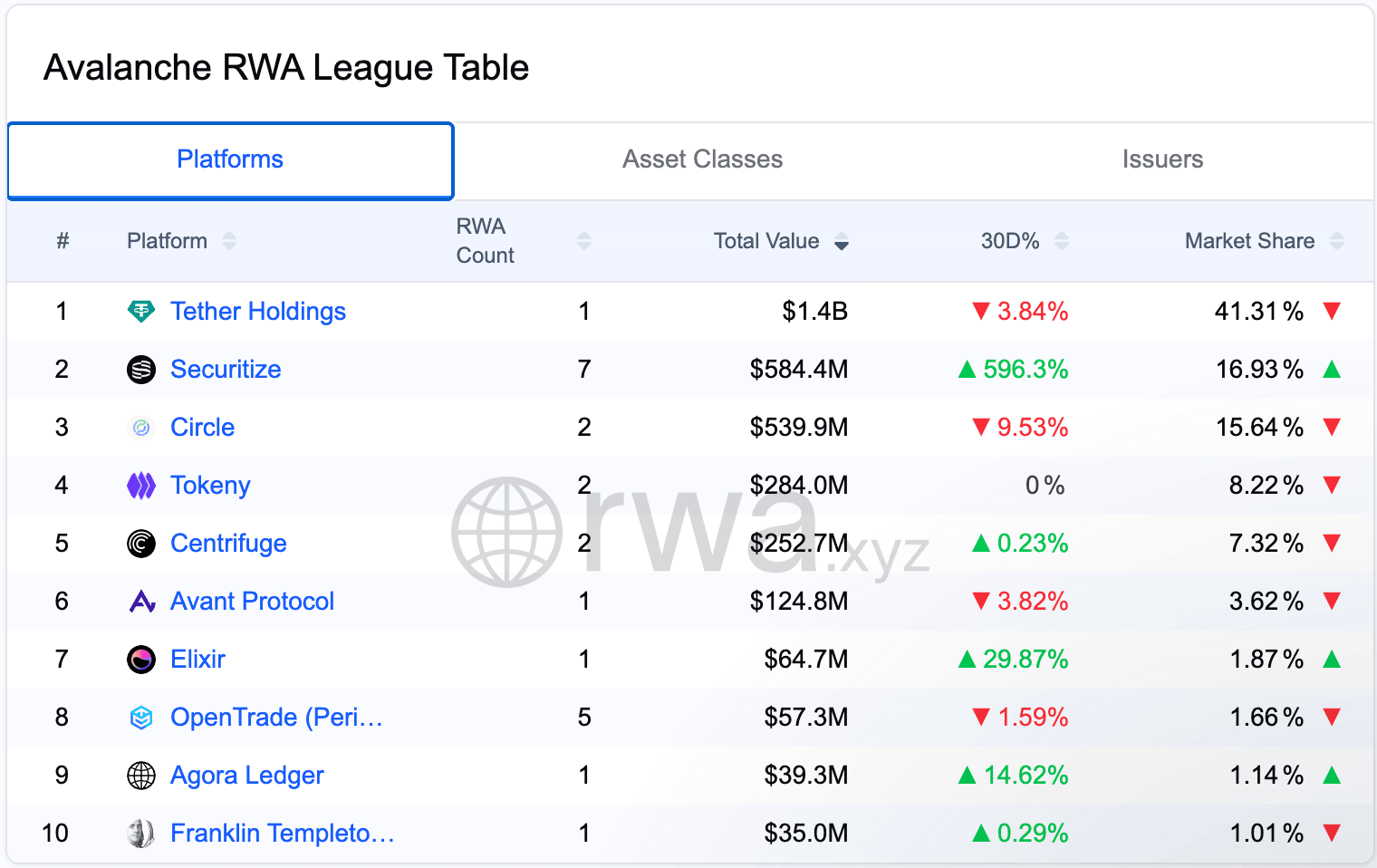

Speaking of TVL, one contributing factor is the adoption of Real World Assets (RWAs) on the chain. RWAs on Avalanche expanded by 68%, reaching a total value of $1.24 billion across 42 distinct assets. This growth stemmed from integrations with traditional financial institutions, which contributed to the platform's overall transaction throughput.

The network's subnet architecture, which supports custom blockchains, enabled this expansion, with subnets like Beam achieving 22,000 active users during gaming events.

Key Developments in DeFi and Real-World Assets

Several initiatives advanced during the month within the DeFi and RWA ecosystem. BlackRock's BUIDL fund added $500 million in tokenized assets on Avalanche, making it the second-largest chain for this product after Ethereum and pushing the total real-world asset value past $1.2 billion, according to RWA.xyz.

CruTrade introduced over $60 million in tokenized fine wine, enabling on-chain trading and liquidity for these physical assets.

Lombard Finance upgraded its BTC.b token infrastructure, shifting to cross-chain bridging via Chainlink's CCIP protocol for improved security, with $538 million in circulation.

JPYC launched what it described as the first legally recognized yen stablecoin on the network. In Latin America, OpenTrade and Glim launched a stablecoin platform in Colombia to address local currency devaluation by providing on-chain alternatives.

These steps aligned with broader trends in tokenizing traditional assets, where Avalanche's high throughput and low fees facilitated integration. The platform's support for multiple virtual machines, including the Ethereum Virtual Machine, allowed seamless deployment of these applications without requiring extensive code changes.

Avalanche ships.

— Avalanche🔺 (@avax) October 31, 2025

October was a month to remember. Regardless of challenges, builders on Avalanche continued to deliver.

If there are any updates missing, comment below.

Here’s what happened:

1. @DinariGlobal launched S&P Digital Markets 50 with S&P Dow on their Avalanche L1.… pic.twitter.com/aGAjiR0l5v

Advances in Payments and Infrastructure

Payment systems also saw notable expansions on Avalanche in October 2025. Visa enabled conversions to fiat using four stablecoins on the network, streamlining real-world payments. Gemini added support for USDT and USDC transfers, broadening access to stablecoins within the ecosystem.

Japan's TIS, a payment provider handling $2 trillion annually, deployed a multi-token platform using AvaCloud for stablecoin issuance and asset settlement. In Korea, PayProtocol announced a custom Layer 1 blockchain for payments, built on Avalanche's subnet technology to handle high-volume transactions.

On the technical side, the Avalanche Granite upgrade went live on the Fuji testnet. This update introduced cheaper interchain messaging, biometric authentication, and dynamic block times to reduce latency and improve performance. These changes aim to enhance cross-subnet communication, a core aspect of Avalanche's consensus mechanism, which relies on the Snowman protocol to achieve finality in under 2 seconds.

Gaming and Entertainment Sector Growth

Gaming applications accounted for a significant share of user activity. Titan Content launched the 2GATHR app on a custom Layer 1, targeting K-pop fans with missions and digital collectibles. Eclipse introduced GGdeck, an application offering cashback on game purchases to connect web2 and web3 experiences.

Spellborne updated its gameplay with Trails of Embervault, while Off the Grid released its largest patch since launch, including the Feardrop Halloween event. The latter's subnet, Beam, recorded 22,000 active users during this period. Leagues.fun debuted with sold-out football card packs on its dedicated Layer 1, rewarding user engagement through on-chain mechanics.

Avalanche's architecture, with its separate chains for different virtual machines, supported these gaming subnets by isolating traffic and preventing congestion on the main network. This design enabled customized gas fees and consensus rules tailored to the high-frequency interactions common in games.

Institutional Adoption and Broader Implications

Institutional integrations, such as those with BlackRock and Visa, highlighted Avalanche's role in bridging traditional finance and blockchain. The platform's focus on compliance, evident in stablecoin launches like JPYC, positioned it for regulated markets in Asia and beyond.

The network's total transactions and value locked figures from October 2025 reflect its capacity to handle scale, with the C-Chain's performance metrics serving as benchmarks for future upgrades. Subnets like those for payments and gaming demonstrated the flexibility of Avalanche's model, where developers can deploy sovereign chains without compromising the main network's security.

In summary, October 2025 demonstrated Avalanche's operational strengths through record metrics and targeted expansions in finance, payments, and entertainment. The developments reinforced the network's technical foundation, including its consensus protocols and subnet architecture, which enable high throughput and customization.

Sources

- Avalanche Subnet Beam reaches 22K active users: https://eng.ambcrypto.com/avalanche-subnet-beam-reaches-22k-active-users-assessing-ecosystem-growth-avax-demand/

- BlackRock Digital Liquidity Fund BUIDL on Avalanche: https://www.avax.network/about/blog/blackrock-launches-digital-liquidity-fund-buidl-on-avalanche-via-securitize

- TIS Multi-token Platform on AvaCloud: https://avacloud.io/blog/tis-deploys-multi-token-platform-on-avacloud-to-modernize-japan-s-financial-infrastructure

- Avalanche October Update: https://x.com/avax/status/1984262621957099958

- RWA Ecosystem on Avalanche: https://app.rwa.xyz/networks/avalanche

- Visa Expands Stablecoin offerings to four Blockchains, including Avalanche: https://finance.yahoo.com/news/visa-expand-stablecoin-support-across-063813603.html

Read Next...

Frequently Asked Questions

What were the key metrics for Avalanche in October 2025?

Avalanche recorded over 100 million monthly active addresses across Layer 1 chains, peak gas usage on the C-Chain, and over $2.2 billion in total value locked, with real-world assets growing to $1.24 billion.

What major upgrades occurred on Avalanche in October 2025?

The Granite upgrade launched on the Fuji testnet, featuring cheaper interchain messaging, biometric capabilities, and dynamic block times for improved performance.

How did gaming contribute to Avalanche's activity in October 2025?

Games like Off the Grid and Spellborne released updates, with subnets such as Beam reaching 22,000 active users, driving transaction volumes through events and collectibles.

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

UC Hope

UC HopeUC holds a bachelor’s degree in Physics and has been a crypto researcher since 2020. UC was a professional writer before entering the cryptocurrency industry, but was drawn to blockchain technology by its high potential. UC has written for the likes of Cryptopolitan, as well as BSCN. He has a wide area of expertise, covering centralized and decentralized finance, as well as altcoins.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens