XRP ETFs Pull $1.22B in Inflows While Bitcoin and Ethereum Bleed

XRP ETFs pull $1.22B in cumulative inflows since November 2025 while Bitcoin and Ethereum ETFs post massive outflows in early 2026.

Crypto Rich

February 9, 2026

Table of Contents

US spot XRP ETFs have pulled in $1.22 billion in cumulative net inflows since launching on November 13, 2025, making them the second-fastest crypto ETF to cross the billion-dollar mark after Bitcoin. That number alone is impressive. What makes it remarkable is that this happened while Bitcoin and Ethereum ETFs were bleeding capital.

How Are XRP ETFs Performing Compared to Bitcoin and Ethereum?

The contrast is hard to ignore. In early 2026, Bitcoin ETFs posted $681 million in weekly outflows. Ethereum ETF inflows dropped near zero. During the same period, XRP ETFs raised $56.83 million.

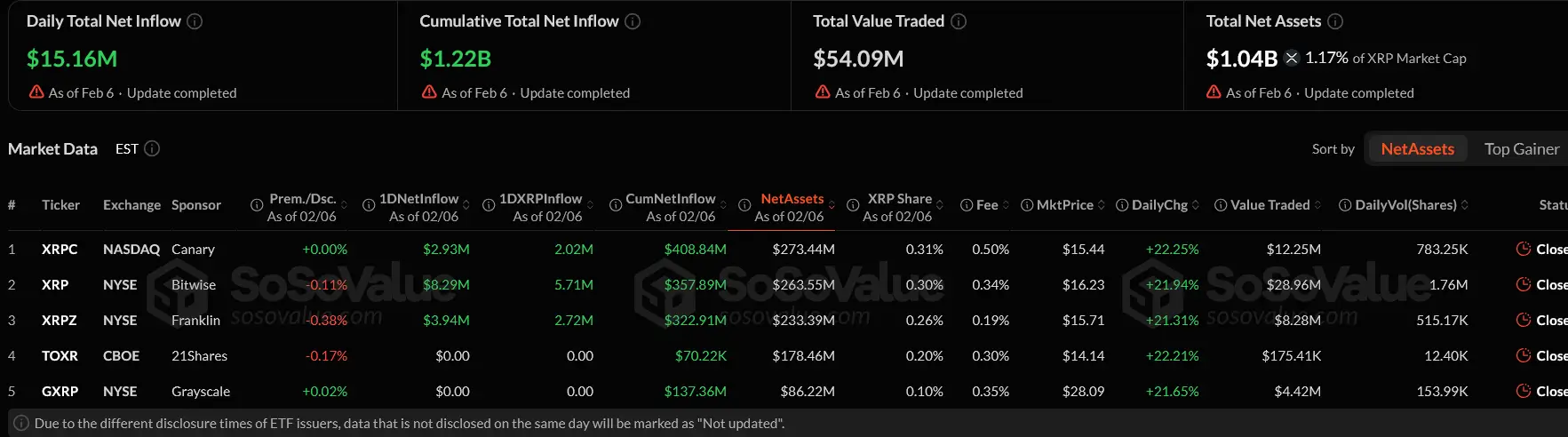

As of February 6, 2026, XRP ETF total net assets sat at $1.04 billion, roughly 1.17% of XRP's total market cap. Daily trading volume hit $54.09 million on that date, with a net inflow of $15.16 million. For context, DOGE ETFs hold less than $9 million in total assets. The gap between XRP and most altcoin ETF products is significant.

The growth trajectory tells the story. On launch day, cumulative inflows were $5.15 million. By late November, that figure climbed to $666.61 million. By late December, it crossed $1 billion. Post-launch, the funds ran 35 consecutive trading days without a single redemption, a streak unmatched by any other crypto ETF. That ended on January 7 with a $40.8 million outflow, driven almost entirely by 21Shares' TOXR. Capital returned within days, with $38.1 million flowing back the following week.

Then came a bigger test. On January 20, XRP ETFs posted their largest single-day outflow of $53.32 million, led by Grayscale's GXRP. But that happened during a broader $1.73 billion weekly exodus from crypto products. Bitcoin ETFs lost $426 million that same day. Even after that drawdown, cumulative XRP inflows held at $1.22 billion by early February, and the week ending February 6 saw $44.95 million in fresh inflows.

Which XRP ETFs Are Leading the Pack?

As of February 6, 2026, Canary XRP ETF (XRPC) on Nasdaq led with $408.84 million in cumulative net inflows and $273.44 million in net assets. The Bitwise XRP ETF (XRP) on the NYSE surged to second place, with $357.89 million in cumulative inflows and $263.55 million in net assets. Franklin XRP ETF (XRPZ) was close behind at $322.91 million in cumulative inflows and $233.39 million in net assets. 21Shares (TOXR) held $178.46 million in net assets, while Grayscale XRP Trust ETF (GXRP) sat at $137.36 million in cumulative inflows and $86.22 million in net assets after heavy outflows earlier this year.

The rankings have shifted fast. Back in December, Grayscale held the number two spot. Now Bitwise and Franklin have blown past it, with both funds consistently leading daily inflows in recent weeks. That kind of rotation signals growing institutional conviction from issuers with deep distribution networks.

Why Are Investors Buying XRP ETFs During Market Weakness?

XRP's price took a 17% hit at one point, dropping to $1.11 before partially recovering. Even with the token currently sitting around $1.39, ETFs continued adding between $24 million and $40 million weekly during the worst of the volatility. Compare that to Bitcoin, which saw a single-day outflow of $545 million. The broader crypto ETP market shed $454 million during one of those stretches. XRP ETFs kept accumulating.

That pattern suggests institutional investors are treating XRP differently from the rest of the market. Analysts point to several factors driving this resilience. Ripple's RLUSD stablecoin has reached a $235 million market cap. Real-world assets on the XRP Ledger now total $281 million. Ripple's acquisitions of Hidden Road and GTreasury expand its institutional footprint. On the regulatory front, OCC trust bank approval and a UK EMI license have removed some of the uncertainty that hung over XRP for years.

What Comes Next for XRP ETFs?

Projections from Standard Chartered analyst Geoffrey Kendrick suggest XRP could reach $8 by end of 2026, with estimates that ETF inflows could hit $4 billion to $8 billion if current trends hold. More conservative analyst forecasts cluster around $3 to $3.50.

The numbers paint a clear picture. While other crypto ETFs struggle with outflows, XRP products are attracting steady capital from institutions that appear to be rotating toward utility-focused assets. Whether that momentum holds through 2026 depends on broader market conditions and Ripple's continued ecosystem expansion, but the data since launch makes a strong case.

Sources:

- SoSoValue XRP ETF Dashboard — Cumulative inflow, net asset, and daily flow data as of February 6, 2026

- Yahoo Finance: XRP ETF Outflows Hit $53M — January 20 outflow data, Standard Chartered $8 price target, and recovery analysis

- Yahoo Finance: XRP ETFs See $40M of Outflows — January 7 outflow breakdown and 35-day streak data

- Yahoo Finance: Standard Chartered's $8 XRP Target — Geoffrey Kendrick's price projections and ETF inflow modeling

- The Block: XRP ETFs Hit Record Weekly Volume — Weekly BTC/ETH outflows vs XRP inflows comparison and individual fund AUM

- TheStreet: XRP ETFs Finally Break Their 55-Day Streak — Consecutive inflow streak details and fund-level breakdown

- European Business Magazine: XRP Surges 25% — Comparative crypto ETP outflow data and DOGE AUM comparison

- CoinGlass XRP ETF Tracker — Supplementary ETF flow and holdings data

Read Next...

Frequently Asked Questions

How much have US spot XRP ETFs attracted since launch?

US spot XRP ETFs have pulled in $1.22 billion in cumulative net inflows from their November 13, 2025 launch through February 6, 2026. Total net assets stood at $1.04 billion, making XRP the second-fastest crypto ETF to reach the billion-dollar mark after Bitcoin.

Which XRP ETF has the highest inflows?

As of February 6, 2026, Canary XRP ETF (XRPC) led with $408.84 million in cumulative net inflows. Bitwise XRP ETF (XRP) followed at $357.89 million, Franklin XRP ETF (XRPZ) at $322.91 million, and Grayscale XRP Trust ETF (GXRP) at $137.36 million. Bitwise and Franklin have surged past Grayscale in recent weeks.

Why are XRP ETFs outperforming Bitcoin and Ethereum ETFs?

XRP ETFs have attracted steady inflows even during periods when Bitcoin ETFs saw $681 million in weekly outflows and Ethereum inflows neared zero. Analysts attribute this to growing institutional confidence in XRP's utility for cross-border payments, Ripple's expanding ecosystem including the RLUSD stablecoin, and regulatory wins such as OCC trust bank approval and a UK EMI license.

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

Crypto Rich

Crypto RichRich has been researching cryptocurrency and blockchain technology for eight years and has served as a senior analyst at BSCN since its founding in 2020. He focuses on fundamental analysis of early-stage crypto projects and tokens and has published in-depth research reports on over 200 emerging protocols. Rich also writes about broader technology and scientific trends and maintains active involvement in the crypto community through X/Twitter Spaces, and leading industry events.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens

Latest Crypto News

Get up to date with the latest crypto news stories and events