Meteora Unveils Tokenomics Ahead of October 23 TGE

Meteora releases details of its Phoenix Rising Plan, outlining $MET tokenomics and full liquidity strategy ahead of the October 23 Token Generation Event.

Miracle Nwokwu

October 8, 2025

Table of Contents

Meteora, a Solana-based DeFi protocol, has released details of its tokenomics through the Phoenix Rising Plan, setting the stage for its Token Generation Event (TGE) on October 23. The announcement outlines a structure aimed at providing immediate liquidity to stakeholders while aligning long-term incentives.

This move comes as Meteora prepares to launch its native token, $MET, which will serve as both a utility and governance asset within the ecosystem. With the TGE approaching, the plan emphasizes community involvement and seeks to distribute tokens in a way that supports ongoing protocol development.

About Meteora

Meteora operates as a suite of dynamic liquidity protocols on the Solana blockchain, focusing on enhancing capital efficiency and yield opportunities for liquidity providers. At its core, the project builds on advanced mechanisms like Dynamic Liquidity Market Makers (DLMM) and Dynamic Automated Market Makers (DAMM), which allow users to adjust liquidity positions in response to market conditions. This flexibility helps mitigate risks such as impermanent loss, a common challenge in traditional AMMs, and enables providers to capture fees more effectively across volatile assets.

The protocol traces its roots to earlier Solana projects, including Mercurial Finance, which laid foundational elements for stablecoin liquidity. Over time, Meteora has evolved through partnerships, notably with Jupiter, a prominent aggregator on Solana, to integrate seamless swapping and staking features. For instance, recent initiatives have included stimulus packages for Jupiter stakers, distributing $MET allocations to encourage cross-ecosystem participation. Community-driven aspects, such as the LP Army—a group of liquidity providers sharing strategies and tools—have also played a key role in its growth. Members often post breakdowns of positions, discussing moves like adjusting ranges in DLMM pools to optimize returns, which fosters a collaborative environment for both new and experienced users.

Beyond technical features, Meteora’s manifesto highlights ambitions to democratize access to financial systems, envisioning a world where liquidity empowers everyday users to engage in markets traditionally dominated by institutions. Tools like vaults for passive yield farming and expert DAOs for governance decisions underscore this approach, drawing in participants who value sustainable, composable yields. As of recent updates, the protocol has facilitated significant TVL growth on Solana, with stimulus programs starting in early 2024 aimed at boosting adoption. Meteora's emphasis on innovation has attracted a dedicated user base, including those turning small stakes into substantial gains through strategic LPing.

The Phoenix Rising Plan

The Phoenix Rising Plan represents Meteora's strategy for the TGE, prioritizing full liquidity for stakeholders from day one. Unlike many token launches that impose vesting schedules or inflationary mechanisms on community allocations, this plan unlocks all designated tokens immediately, without ongoing emissions that could dilute value over time. The team has committed to not selling any tokens during the TGE, instead focusing on vesting their own share to demonstrate alignment with long-term goals. This structure breaks from the low-float, high-FDV models seen in some crypto projects, where limited initial supply can lead to price overhangs from future unlocks.

At its heart, the plan seeks to maximize $MET distribution to committed participants, fostering high trading volumes that benefit liquidity providers. By making $MET an "investible asset" free from constant vesting pressures, Meteora aims to create a stable foundation for growth. The approach also ties into broader objectives, such as expanding the LP Army and integrating with launchpads, to ensure the protocol's liquidity tools reach a wider audience.

One notable aspect is the emphasis on opportunity for all stakeholders. For example, the plan includes packages for off-chain contributors and ecosystem partners, recognizing their roles in Meteora's development. Overall, the Phoenix Rising Plan positions the TGE as a pivotal moment, transitioning Meteora from its stimulus-driven phase to a governance-focused era.

Token Allocation Details

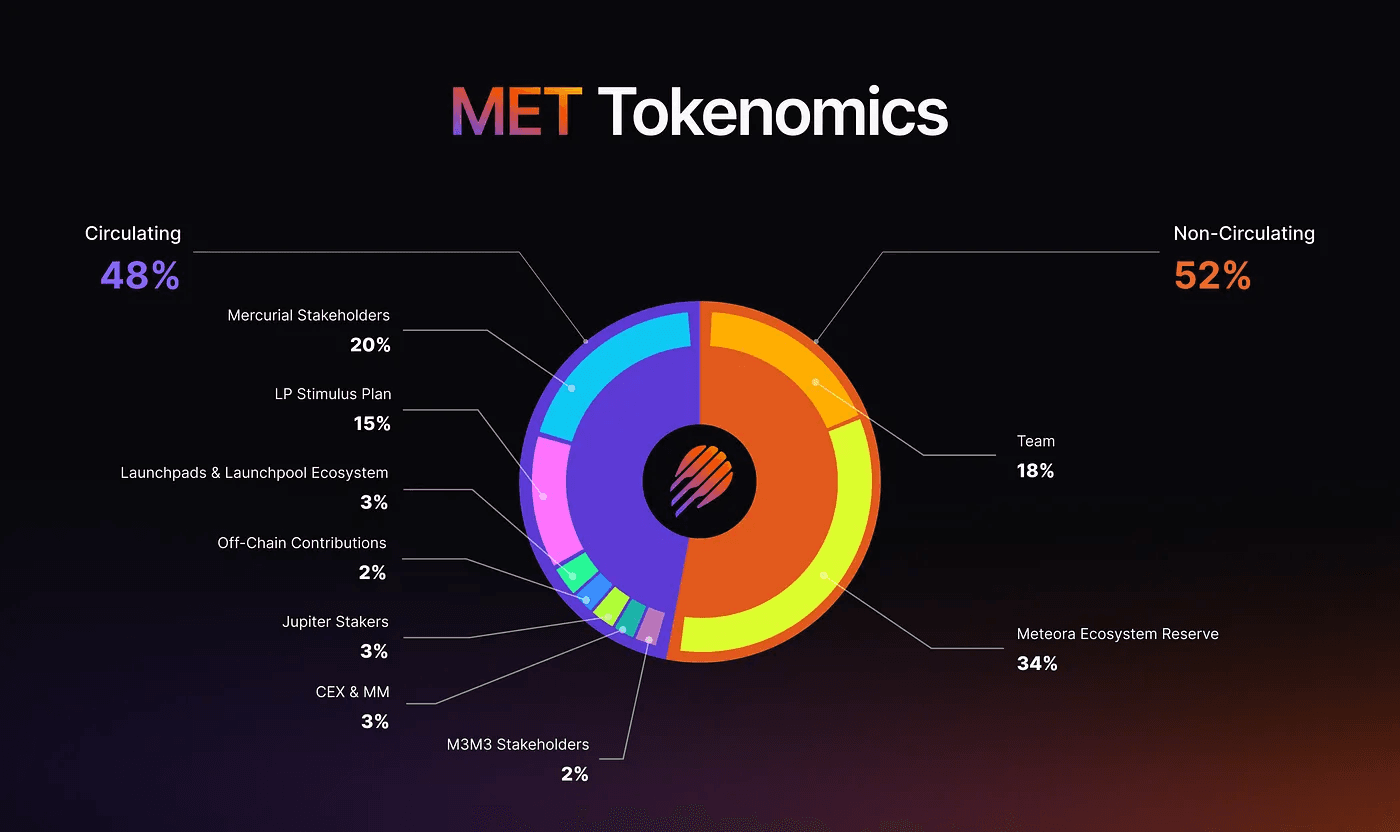

The tokenomics allocate 48% of the total $MET supply to circulate at TGE, a figure higher than comparable launches like Jupiter's 13.5% or others around 33%. This includes:

- 20% for Mercurial stakeholders, honoring the protocol's origins and early supporters who helped establish Solana's liquidity infrastructure.

- 15% for Meteora users through the LP Stimulus Plan, rewarding those who have provided liquidity and contributed to TVL.

- 3% for launchpads and launchpool ecosystems, facilitating integrations that could drive new token launches on the platform.

- 2% for off-chain contributors, acknowledging external efforts in marketing, development, and community building.

- 3% for Jupiter stakers, with a linear distribution weighted by average stake duration, aimed at expanding the user base tenfold.

- 3% for centralized exchanges, market makers, and related entities from the TGE reserve.

- 2% for M3M3 stakeholders, tying into recent airdrops and staking rewards.

The remaining 52% is vested linearly over six years: 18% for the team and 34% for the Meteora Reserve. This vesting ensures sustained commitment, with potential inflation limited to team unlocks and reserve-funded incentives. Users have highlighted how this setup avoids the pitfalls of rapid dilution, allowing $MET holders to focus on protocol utility rather than sell pressure. For context, the reserve could support future liquidity programs, similar to past stimulus efforts that boosted Solana's DeFi activity.

In practice, this allocation means airdrop eligibility checkers will soon be available, helping users verify qualifications based on historical activity. Community threads suggest focusing on consistent LPing, such as in DAMM v2 pools, to maximize shares, with examples of users turning modest positions into significant yields.

Liquidity Mechanisms and Distribution

A key innovation in the plan is the Liquidity Distributor, which delivers airdrops as liquidity positions rather than direct token claims. Recipients receive $MET paired with a stable asset like USDC, positioned across a wide price range in a DLMM pool. This setup allows users to earn trading fees passively while their allocation "sells" gradually through market activity, reducing immediate dump risks. Out of the initial circulating supply, 10% will use this mechanism, based on user preferences at TGE.

This method leverages Meteora's core technology to bootstrap liquidity organically. Instead of the team supplying tokens, the community drives it, aligning incentives for sustained participation. The wide ranges minimize impermanent loss, making it suitable for holders who believe in the protocol's future. It also introduces new users to Meteora's tools, potentially increasing adoption of features like vaults for compounded yields.

Broader mechanisms include governance via $MET, where holders can influence decisions through ve-locking for enhanced incentives. The plan's focus on fee generation ties back to the LP Army's strategies, where providers share tips on positioning—such as monitoring volatility to adjust bins in DLMM pools.

Final Thoughts…

As Meteora approaches its October 23 TGE, the Phoenix Rising Plan provides a clear roadmap for token distribution and ecosystem growth. By unlocking significant supply upfront and introducing novel distribution tools, the protocol sets up $MET for practical use in DeFi. Stakeholders, from LP Army members to Jupiter integrators, stand to benefit from this structure, which prioritizes alignment and opportunity. While the road ahead involves navigating market dynamics, Meteora's foundation in dynamic liquidity positions it to contribute meaningfully to Solana's DeFi scene. Readers interested in participating should monitor official channels for eligibility details and upcoming events.

Sources:

- Official Meteora Announcement (X/Twitter): https://x.com/meteoraag/status/1975550336367796397?s=46

- Introducing the Phoenix Rising Plan (Meteora Medium Article): https://meteoraag.medium.com/introducing-the-phoenix-rising-plan-3266aa5a5617

- Meteora Project Analysis (Token Metrics Research): https://research.tokenmetrics.com/p/meteora

Read Next...

Frequently Asked Questions

What is Meteora and how does it work?

Meteora is a DeFi protocol built on the Solana blockchain that enhances capital efficiency for liquidity providers through Dynamic Liquidity Market Makers (DLMM) and Dynamic Automated Market Makers (DAMM). These mechanisms allow users to adjust liquidity ranges based on market conditions, reducing impermanent loss and improving yield opportunities.

What is the Phoenix Rising Plan by Meteora?

The Phoenix Rising Plan is Meteora’s comprehensive tokenomics and liquidity framework for its upcoming $MET Token Generation Event (TGE) on October 23. It emphasizes full token liquidity from day one, no immediate team sales, and distribution methods that favor long-term ecosystem sustainability over short-term speculation.

How are $MET tokens allocated in the tokenomics?

Allocations include: 20% for Mercurial stakeholders, 15% for Meteora users via LP Stimulus, 3% for launchpads, 3% for Jupiter stakers, 3% for exchanges/market makers, 2% for off-chain contributors, 2% for M3M3 stakeholders; remaining 52% vested over six years (18% team, 34% reserve).

What makes Meteora’s liquidity distribution unique?

Meteora introduces a Liquidity Distributor mechanism where airdrops are delivered as liquidity positions instead of direct token claims. Recipients receive $MET paired with USDC, automatically placed into a DLMM pool. This approach encourages passive yield generation and reduces market dumping by allowing the liquidity position to gradually unwind through trading activity.

When is Meteora’s Token Generation Event (TGE)?

The $MET TGE will take place on October 23, 2025, marking Meteora’s transition from its stimulus-driven phase to a governance-focused era.

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

Miracle Nwokwu

Miracle NwokwuMiracle holds undergraduate degrees in French and Marketing Analytics and has been researching cryptocurrency and blockchain technology since 2016. He specializes in technical analysis and on-chain analytics, and has taught formal technical analysis courses. His written work has been featured across multiple crypto publications including The Capital, CryptoTVPlus, and Bitville, in addition to BSCN.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens