Deepdive

What Are Blockchain Forks? Hard vs Soft Fork Guide

What is a blockchain fork? Learn hard fork vs soft fork mechanics and see which forks succeeded, like Bitcoin Cash, SegWit, and Ethereum Classic.

Crypto Rich

April 15, 2021

Last revision: September 24, 2025

Blockchain forks are software updates that modify the network's rules. Hard forks create permanent splits resulting in separate blockchains, while soft forks add backward-compatible features to existing networks. Both methods let blockchain networks evolve without central control.

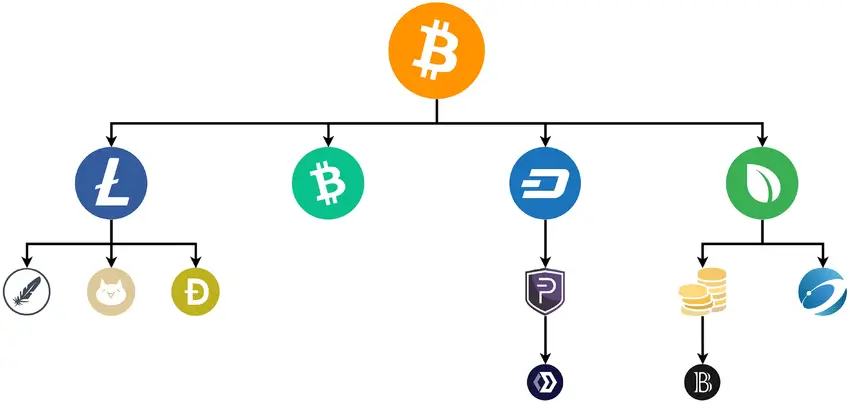

Since the launch of Bitcoin in 2009, the blockchain space has witnessed well over 100 documented forks. Major networks like Bitcoin, Ethereum, Litecoin, and BNB Chain have all used forks to implement critical upgrades, fix security issues, and add functionality.

Why Do Blockchains Need Forks?

Your smartphone updates its apps automatically. But what happens when thousands of computers (nodes and miners) worldwide need to agree on changes? This is where blockchain forks become essential.

Unlike traditional software controlled by companies, blockchain networks usually have no single authority pushing updates. Thousands of nodes worldwide must reach consensus before implementing changes. Forks solve this coordination challenge.

Without forks, blockchain networks would stay frozen in time. They provide the only way to add features, fix bugs, or improve performance while preserving the decentralized nature that makes blockchains valuable.

Understanding Network Consensus

Blockchains use different consensus models for upgrades. Bitcoin miners demonstrate their support through the allocation of hash power. Ethereum validators participate through stake-weighted voting mechanisms.

What Is a Hard Fork?

Hard forks force networks to split permanently when they introduce incompatible changes. Nodes must choose between upgrading to the new rules or continuing with the old blockchain. Users holding tokens before activation receive equivalent amounts on both resulting networks.

Communities typically pursue hard forks when they disagree about fundamental changes. The original blockchain continues to operate alongside the new version. Both networks share the same history up to the fork point, after which they diverge completely.

Major Hard Fork Examples

The Bitcoin Cash fork in August 2017 represents the most contentious hard fork in crypto history. Disagreements over scaling approaches led to a permanent split, with Bitcoin Cash implementing 8MB blocks versus Bitcoin's maintained 1MB limit.

Ethereum experienced a controversial hard fork in July 2016 following the DAO hack. The community voted to reverse $60 million in stolen funds, creating two chains: Ethereum (ETH) reversed the hack transactions while Ethereum Classic (ETC) maintained the original immutable ledger.

More recently, Ethereum's The Merge in September 2022 demonstrated how coordinated hard forks can succeed without community splits. The network successfully transitioned from proof-of-work to proof-of-stake consensus, maintaining network unity despite fundamental changes to its underlying mechanics.

BNB Chain shows a modern approach to hard fork governance, where upgrades are planned and coordinated rather than contentious. The Pascal Hard Fork in March 2025 introduced smart wallet features and account abstraction, enhancing user experience and security for decentralized applications. Unlike divisive forks such as Bitcoin Cash, BNB Chain's upgrades typically receive broad community support and developer coordination, minimizing split risks.

Several other networks have used hard forks for major upgrades. Litecoin Cash added mining algorithm changes in 2018. Bitcoin Gold switched from ASIC to GPU mining in 2017. Monero implemented enhanced privacy features through multiple hard forks between 2018 and 2019.

What Is a Soft Fork?

Soft forks implement backward-compatible upgrades that tighten existing rules without breaking compatibility. Old nodes can still participate in the network, though they may have limited functionality compared to upgraded nodes.

Soft forks work by making rules more restrictive, not more permissive. For example, reducing the maximum block size from 2MB to 1MB maintains compatibility because smaller blocks remain valid under the old rules.

The key advantage of soft forks is network unity. All participants remain on the same blockchain, preserving network effects and avoiding community splits.

Soft Fork Activation Methods

Soft forks require the support of miners or validators to activate safely. Bitcoin Improvement Proposals (BIPs) specify activation thresholds, typically requiring 95% miner signaling over specific time periods.

Notable Soft Fork Implementations

Pay-to-Script-Hash (P2SH) was activated in April 2012 as Bitcoin's first major soft fork. P2SH enabled more complex transaction types while maintaining backward compatibility with existing wallets and services.

Bitcoin's Segregated Witness (SegWit) activated in August 2017 as a soft fork. SegWit separated transaction signatures from transaction data, effectively increasing block capacity without changing the 1MB block size limit. The upgrade enabled Lightning Network development and fixed transaction malleability issues.

Bitcoin's Taproot upgrade was activated in November 2021, bringing enhanced privacy and smart contract capabilities. Taproot made complex transactions indistinguishable from simple transactions, improving fungibility and reducing fees for multi-signature transactions.

The emergence of Bitcoin's Ordinals protocol in 2023 demonstrates how innovation can occur within existing soft fork frameworks. By storing data in witness sections enabled by SegWit, Ordinals creates NFT-like inscriptions without requiring new protocol changes.

How Do Communities Decide on Forks?

Governance approaches vary significantly across blockchain networks. Bitcoin operates through rough consensus among stakeholders. Ethereum employs structured Ethereum Improvement Proposals (EIPs) for community coordination.

Networks like Tezos and Decred let token holders vote directly on proposed changes. This approach enables automatic protocol upgrades without requiring contentious community splits.

The Fork Decision Process

Successful forks need coordination between developers, miners, and users through multiple development phases:

- Technical specification and code implementation.

- Public discussion and community feedback.

- Network participant signaling and consensus building.

- Testnet deployment and mainnet activation scheduling.

What Are the Risks of Blockchain Forks?

Hard forks create both technical and economic risks that affect everyone in the network. When networks split, they divide mining power and users between chains, potentially weakening security on both sides.

Users face immediate practical challenges during fork events. Exchange and wallet support becomes complex when service providers must choose which chains to support. Some exchanges support only one chain, creating additional complications for users who want access to both.

Markets typically become volatile around fork events. The combined value of forked tokens often reflects the original token's pre-fork price; however, how that value is split between chains can vary dramatically based on community support and adoption.

Risk Mitigation Strategies

Thoughtful preparation can protect users during fork events. Control your private keys through hardware wallets or self-custody solutions. This ensures access to tokens on both chains after hard forks occur.

Timing matters during active fork periods. Avoid trading when networks are splitting, as volatility spikes and technical issues become more common. Many exchanges halt trading temporarily around major forks to prevent any potential issues.

Research helps predict outcomes before forks happen. Developer activity, miner commitment, and exchange announcements provide valuable indicators about which chain will maintain greater long-term support.

How Do Forks Affect Token Values?

Hard forks create new tokens, potentially doubling holdings for existing users. However, the combined value typically equals or falls below the original token's pre-fork price as markets adjust to increased supply.

Value distribution depends on community support, developer activity, and practical utility. Bitcoin Cash reached its peak at approximately $4,000 in December 2017, before declining as Bitcoin maintained its dominance.

Soft forks generally don't create new tokens, but can increase the value of existing tokens by adding functionality or improving efficiency. SegWit activation preceded Bitcoin's 2017 bull run, although multiple factors contributed to the price increase.

What Does the Future Hold for Blockchain Forks?

Modern blockchain networks increasingly implement governance mechanisms designed to reduce contentious forks. Layer 2 solutions, such as the Lightning Network and Ethereum rollups, offer upgrade paths that do not require changes to the base layer.

Interoperability protocols reduce the impact of network splits by enabling cross-chain functionality. Users can access applications and services across multiple blockchains regardless of fork outcomes.

Automated upgrade mechanisms in newer networks, such as Polkadot and Cosmos, enable runtime updates without traditional fork processes. These systems maintain backward compatibility while allowing continuous evolution.

Emerging technologies, such as zero-knowledge proofs, are being increasingly integrated through soft forks, enabling networks to add privacy and scalability features without compromising existing infrastructure. This trend suggests that future upgrades will become less disruptive while allowing more sophisticated functionality.

The trend toward modular blockchain architecture suggests fewer contentious forks in the future. Specialized layers handle different functions, reducing the need for monolithic network upgrades.

Summary

Blockchain forks serve as a primary mechanism for network evolution in decentralized systems. Hard forks create permanent splits, enabling radical changes but risking community division. Soft forks provide safer upgrade paths through backward-compatible changes.

Understanding fork mechanics helps users navigate network changes and protect their holdings. The most successful forks typically achieve broad consensus before implementation, while contentious forks often struggle with adoption and value retention.

Sources

- Nakamoto, S. (2008). Bitcoin: A Peer-to-Peer Electronic Cash System (pdf)

- Buterin, V. (2017). "Hard Forks, Soft Forks, Defaults and Coercion"

- Wikipedia. "Segregated Witness (BIP141)"

- Antonopoulos, A. "Mastering Bitcoin: Programming the Open Blockchain"

- BNB Chain. (2025). "Pascal Hard Fork Implementation Guide"

Frequently Asked Questions

Can blockchain forks be reversed?

Hard forks create permanent splits that cannot be reversed without another fork. Soft forks can be undone through subsequent upgrades, though this rarely happens in practice.

What happens to my tokens during a blockchain fork?

During hard forks, you keep your original coins and receive equivalent new coins on the forked network if you control your private keys. Some networks, like BNB Chain, implement coordinated hard forks that upgrade the existing blockchain without creating new tokens. Soft forks don't create new tokens but may add functionality to existing ones.

How do I prepare for a blockchain fork?

Move tokens to wallets where you control private keys, avoid trading during fork periods, and monitor official project communications for specific instructions and timeline updates.

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

Crypto Rich

Crypto RichRich has been researching cryptocurrency and blockchain technology for eight years and has served as a senior analyst at BSCN since its founding in 2020. He focuses on fundamental analysis of early-stage crypto projects and tokens and has published in-depth research reports on over 200 emerging protocols. Rich also writes about broader technology and scientific trends and maintains active involvement in the crypto community through X/Twitter Spaces, and leading industry events.

Latest News

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens