What Is PumpBTC and How Does it Work?

PumpBTC is a liquid staking protocol built on Babylon, letting Bitcoin holders stake their BTC without locking it up. Unlike traditional models, users get liquidity tokens that can be used across DeFi platforms—while still earning yield.

Soumen Datta

April 18, 2025

Table of Contents

BNB Chain recently wrapped up the second batch of its $100 million liquidity incentive program, awarding up to $280,000 in liquidity rewards to PumpBTC. This is a notable event, as

We're excited to announce the second round for our $100M Liquidity Incentive Program!

— BNB Chain (@BNBCHAIN) April 9, 2025

In the second round, 4 BSC Native projects were listed on these 11 CEXs, namely: PumpBTC ($PUMP), Bubb ($BUBB), JLaunchpad ($JLP), & Ailey ($ALE).

After a strict & thorough review, only $PUMP… pic.twitter.com/jjl3ppYnO6

But what exactly is PumpBTC, and why is it gaining attention in the decentralized finance (DeFi) space? Let’s dive into the details.

What Is PumpBTC?

PumpBTC is a liquid staking solution that leverages the power of Babylon, a decentralized finance protocol. Founded in 2024, PumpBTC offers Bitcoin holders the ability to stake their BTC while still maintaining access to their funds, a feature that is absent in traditional staking methods.

Unlike conventional staking models, which lock assets for a predefined period, PumpBTC allows users to earn rewards without compromising liquidity. This flexibility makes it an attractive option for Bitcoin investors looking to engage in DeFi without locking their capital.

Through its unique mechanism, PumpBTC integrates Bitcoin with Babylon's liquidity re-staking system. This process essentially turns Bitcoin into an interest-bearing asset, offering Bitcoin holders the opportunity to use their staked Bitcoin across various decentralized applications (dApps) for activities such as lending, liquidity provision, and collateralization.

The protocol’s native token is $PUMP which is distributed as staking rewards and used as liquidity incentives.

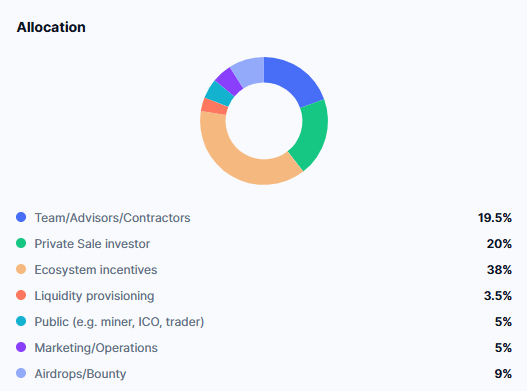

The token distribution for the PUMP token is strategically allocated across various stakeholders to ensure a balanced and growth-oriented ecosystem. Based on the allocation chart, here’s a detailed breakdown:

- Ecosystem Incentives (38%): The largest share of the token supply is dedicated to ecosystem incentives, aimed at fostering growth, adoption, and community participation. This allocation supports rewards, staking, and other incentive mechanisms to strengthen the platform.

- Private Sale Investors (20%): A significant portion is allocated to early backers and private investors, reflecting their role in providing early-stage funding and strategic support.

- Team/Advisors/Contractors (19.5%): This allocation rewards the core team, advisors, and contributors who are actively involved in the development and long-term success of the PUMP token ecosystem.

- Airdrops/Bounty (9%): To drive community engagement and promote awareness, a dedicated portion is reserved for airdrops and bounty campaigns.

- Marketing/Operations (5%): Allocated to promotional activities and operational needs, ensuring visibility and smooth project execution.

- Public Allocation (5%): Includes tokens for public participants like ICO contributors, traders, and miners, enabling broader community involvement.

- Liquidity Provisioning (3.5%): A smaller yet crucial share is allocated to provide liquidity, facilitating smooth trading and minimizing slippage on exchanges.

How PumpBTC Works

The functionality behind PumpBTC is relatively straightforward, yet its innovation lies in how it provides users with liquidity while still offering rewards.

When Bitcoin holders stake their assets through the Babylon protocol, they receive liquidity tokens in return. These tokens represent the staked Bitcoin, and users can leverage them in a range of DeFi platforms.

One of the aspects of this setup is that users do not need to lock up their assets for long periods. Instead, they can freely use the liquidity tokens, making their Bitcoin far more versatile.

Importantly, the security of staked Bitcoin is guaranteed by trusted custodians like Cobo and Coincover. For every Bitcoin staked, an equivalent amount is held in reserve to ensure that the system is operating on a 1:1 backing, minimizing risks associated with asset security.

The Size of the Opportunity

The liquid staking market for Bitcoin is still in its infancy, but it holds significant promise. By drawing comparisons with Ethereum's staking model, where about 4.2% of the total supply is staked in liquid form, analysts believe Bitcoin could see a similar level of adoption. This would mean that Bitcoin’s liquid staking market could potentially reach a massive $50 billion in Total Value Locked (TVL), providing new avenues for Bitcoin holders to earn yields while participating in DeFi ecosystems.

If Bitcoin’s liquid staking adoption mirrors Ethereum’s, PumpBTC could play a pivotal role in unlocking this market, offering a new way for Bitcoin holders to engage with decentralized finance. This forecast aligns with the broader push in the cryptocurrency space for more accessible and liquid staking solutions.

Key Features of PumpBTC

1. Safety:

PumpBTC ensures the safety of staked Bitcoin by working with licensed custodians such as Cobo and Coincover. The protocol guarantees that for every Bitcoin staked, an equivalent amount is held in reserve, offering transparency and security to users.

2. Multi-Chain DeFi Integration:

The platform allows users to leverage staked Bitcoin across a variety of Ethereum Virtual Machine (EVM) compatible chains and Layer 2 (L2) solutions. This multi-chain integration increases the utility of Bitcoin across different decentralized platforms, enhancing its value.

3. Native Yield Generation:

Participants can directly earn yields from the Babylon protocol. This system offers a simpler, less risky way for Bitcoin holders to generate returns compared to traditional yield farming methods.

4. Points Aggregation:

PumpBTC incentivizes users through a points system. By participating in various activities such as staking or liquidity provision, users accumulate points that can be redeemed for rewards or used to unlock additional features within the PumpBTC ecosystem.

The Launch of vePUMP

In addition to staking, PumpBTC has introduced a groundbreaking feature: vePUMP (Voting Escrowed PUMP). vePUMP is an ERC-721 non-fungible token (NFT) that allows holders to participate in governance decisions for the PumpBTC protocol. To obtain vePUMP, users need to lock their PUMP tokens for a period of 6 months to 4 years. The longer the lock-up, the greater the vePUMP rewards, and the more governance power users have.

Why Lock PUMP for vePUMP?

Locking PUMP tokens for vePUMP provides multiple benefits:

- Governance Participation: vePUMP holders can vote on crucial protocol decisions, such as liquidity incentives and ecosystem development.

- Earn Voter's APY: Participants in governance can earn a share of the protocol's rewards, incentivizing active involvement in decision-making.

- Increased Liquidity Pool Rewards: Providing liquidity to PumpBTC’s pools can increase rewards by up to 250% with vePUMP.

The PumpBTC Pre-Season

Before the full launch of PumpBTC, the platform ran an early engagement program known as the PumpBTC Pre-Season. This program was designed to introduce users to the platform and help them accumulate points by actively participating in the ecosystem.

During this pre-launch phase, participants could join as team captains or members, with captains earning a portion of the points accumulated by their team. This system incentivized users to recruit more participants and engage actively, further building the PumpBTC community.

The Pre-Season provided a valuable opportunity for early adopters to familiarize themselves with the platform and its functionalities. Team captains, for example, were required to stake at least 0.02 BTC to form their teams.

Read Next...

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

Soumen Datta

Soumen DattaSoumen has been a crypto researcher since 2020 and holds a master’s in Physics. His writing and research has been published by publications such as CryptoSlate and DailyCoin, as well as BSCN. His areas of focus include Bitcoin, DeFi, and high-potential altcoins like Ethereum, Solana, XRP, and Chainlink. He combines analytical depth with journalistic clarity to deliver insights for both newcomers and seasoned crypto readers.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens