Pi Token Unlocks: Navigating Price Volatility and Community Concerns

Discover all you need to know about PI Coin's token unlocks and their potential impact.

UC Hope

April 16, 2025

Table of Contents

Pi Network’s native $PI asset is a major talking point in the Decentralized Finance (DeFi) industry with its token unlock mechanism. Undoubtedly, these unlock schedules significantly influence market dynamics. With millions of Pi tokens entering circulation monthly, investors and community members are grappling with price volatility, transparency issues, and the project’s centralized control.

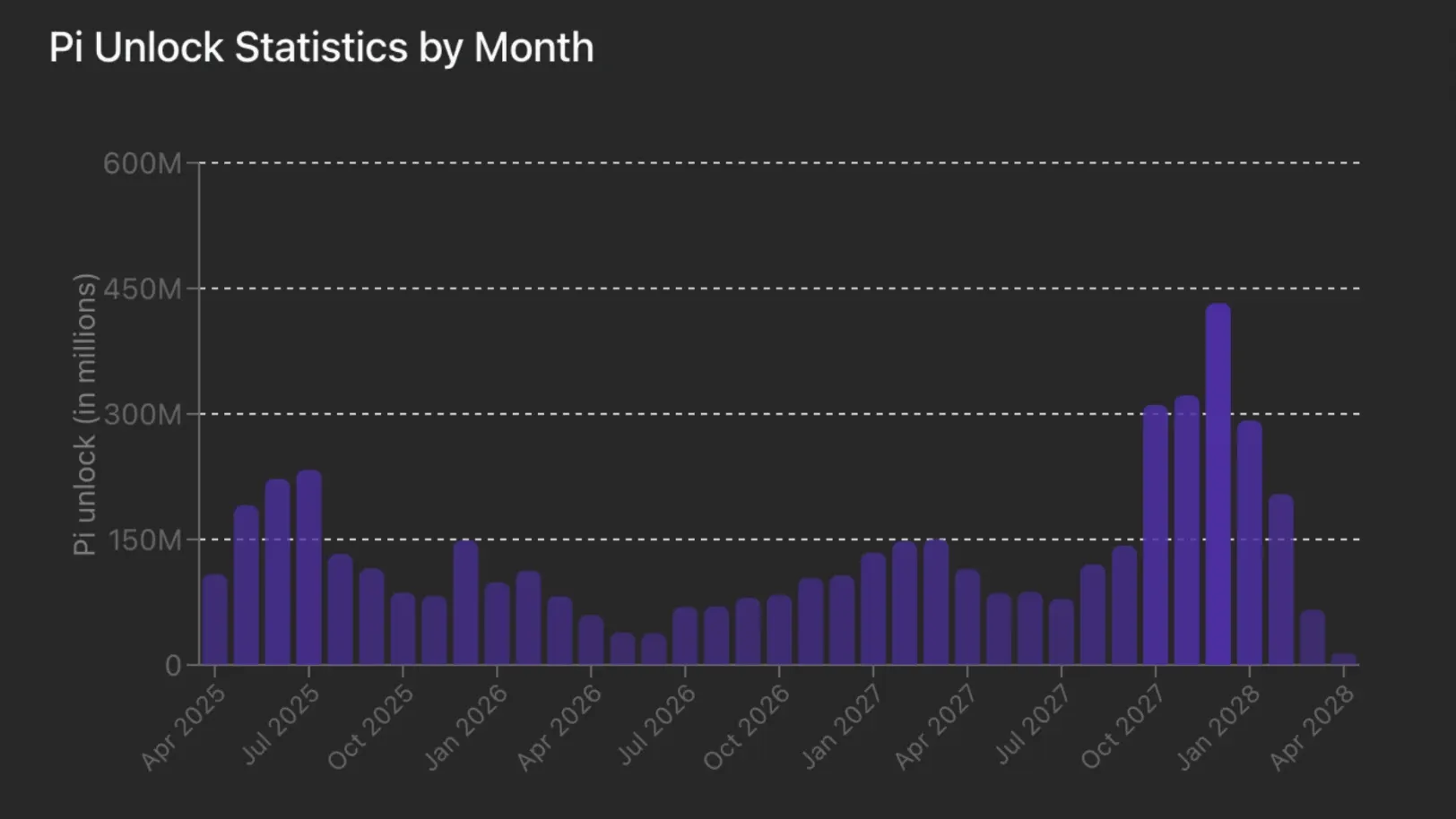

This article explores the latest developments surrounding Pi token unlocks and their impact on the market, based on data from PiScan’s monthly unlock statistics and broader discussions within the ecosystem.

What Are Pi Token Unlocks?

Pi token unlocks refer to the scheduled release of previously locked tokens into the circulating supply, allowing them to be traded or used within the Pi’s Open Network ecosystem. Unlike traditional cryptocurrencies, Pi Network employs a unique lockup mechanism where users voluntarily lock their tokens for one to three years to stabilize supply. Reports disclosed that 63.3% of users opt for three-year lockups, while 15% choose one-year terms, reducing immediate selling pressure from unlocks.

However, these unlocks still introduce a significant new supply. PiScan’s monthly unlock statistics reveal that in April 2025, approximately 108 million tokens will be unlocked. Over the next 12 months, projections estimate 1.56 billion tokens will enter circulation, averaging 129-143 million tokens per month.

Impact on Pi Token Price

The influx of new tokens has contributed to price volatility, with Pi trading near all-time lows in early April after a solid entry in February. The sentiment is that continued unlocks could push prices to $0.30-$0.60 if demand fails to match supply. Over the following 30 days, 268.48 million tokens, worth $478.79 million, were unlocked, intensifying selling pressure.

Despite these challenges, some positive developments offer hope. Growing adoption in regions like China and Vietnam, where Pi is increasingly accepted for payments, could bolster demand. Additionally, bullish forecasts suggest a potential price surge in April 2025 or a $10 target, contingent on anticipated token burns or major exchange listings. However, these remain speculative without concrete action.

Pi Network’s lockup strategy aims to mitigate the impact of unlocks by encouraging users to hold the asset long-term. This approach has partially succeeded, as evidenced by the high percentage of three-year lockups. However, delays in wallet migrations have frustrated users, leaving some tokens unusable. Social media platforms, including X, reflect mixed sentiments, with users praising the lockup model’s stability but criticizing the core team’s handling of migrations and communication.

Speaking of PI’s long-term price, community members and analysts have proposed token burns to address inflation from unlocks. Suggestions include burning 60-100 million tokens or destroying unmigrated tokens. These measures could reduce the maximum supply of 100 billion tokens, potentially stabilizing prices. However, no official burning mechanism has been confirmed, leaving uncertainty about long-term supply management.

Exchange Listings: A Potential Catalyst

The absence of listings on major exchanges like Binance remains a sore point. Despite an 87.1% community approval rate for a Binance listing in February 2025, no progress has been made, potentially leading to panic selling during unlock events.

Speculation about future listings persists, with some X posts hinting at upcoming announcements, but these remain unverified. A major listing could boost demand, offsetting unlock-related supply shocks, but delays continue frustrating investors.

What’s Next for Pi Network?

Balancing supply increases with demand growth, improving transparency, and addressing community concerns will be critical to Pi Network’s success. While adoption in new markets and potential exchange listings offer optimism, unresolved issues like centralized control and migration delays pose risks.

Investors and users are advised to monitor PiScan for real-time unlock data. However, all information, especially from social media, should be verified independently, as speculative claims are common. With 1.53-1.6 billion tokens set to unlock over the next year, the Pi Network’s ability to adapt will determine its place in the cryptocurrency landscape.

Read Next...

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

UC Hope

UC HopeUC holds a bachelor’s degree in Physics and has been a crypto researcher since 2020. UC was a professional writer before entering the cryptocurrency industry, but was drawn to blockchain technology by its high potential. UC has written for the likes of Cryptopolitan, as well as BSCN. He has a wide area of expertise, covering centralized and decentralized finance, as well as altcoins.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens