Analysing Infinex' $INX Token

Infinex launches $INX on Jan 30, 2026. Here's what crypto investors need to know about tokenomics, distribution, and risks before TGE.

Crypto Rich

January 27, 2026

Infinex's $INX token launches on January 30, 2026, at 19:00 UTC with a 10 billion total supply, revenue-linked buybacks, and up to 40% fee sharing for holders. The project, founded by Synthetix creator Kain Warwick, positions itself as a crypto superapp. The high implied valuations and substantial unlock schedules warrant careful consideration before TGE.

With the launch just days away, this breakdown focuses on the structural elements that matter beyond opening day volatility: token utility, distribution mechanics, and the risks baked into the model.

What Is Infinex Building?

Infinex calls itself a passkey-first wallet designed to unify the fragmented DeFi experience. Users can view and manage assets across 20+ chains without transferring them between wallets. The platform bundles several core functions:

- Perpetual futures trading with up to 40x leverage through Hyperliquid integration

- Cross-chain swaps and bridges via 25+ protocols

- Yield aggregation for ETH, SOL, and stablecoins

- NFT marketplace access through OpenSea, Blur, and Magic Eden

- Prediction markets powered by Polymarket

Security is non-custodial. Keys are secured through Turnkey technology and phishing-resistant passkeys, with onchain recovery options.

Infinex has generated over $2.6 million in cumulative revenue since launching perpetuals trading and hit $100 million in daily perps volume during its Craterun incentive campaign.

How Do the $INX Tokenomics Work?

The $INX token serves three primary functions: governance rights, revenue sharing, and ecosystem incentives.

Holders receive up to 40% of platform fees. Revenues fund INX buybacks, which then lock for at least one year. This creates sustained buy pressure rather than immediate burns. Staking unlocks additional APY rewards, fee discounts, and early access to new features.

The total supply sits at 10 billion INX. At TGE, approximately 1.99 billion tokens enter circulation. This includes allocations from the Patron Sale, Sonar Sale, vouchers, incentives, and team portions.

$INX launches on both Ethereum and Solana, with Infinex seeding onchain liquidity directly.

Who Gets What?

The distribution structure spreads tokens across six main categories:

- Patron Sale (44.04%): 4.404 billion tokens with a 12-month cliff that ended October 2025, now vesting linearly until October 2027. Daily claims begin at TGE.

- Team (20%): 2 billion tokens locked until October 2026, then linear vesting.

- Treasury (16.2%): 1.62 billion tokens fully unlocked at TGE, giving flexibility for growth but adding to potential sell pressure.

- Craterun Vouchers (up to 10%): Redeemable at a discount, unlock upon claim, expire January 30, 2027.

- Sonar Sale (5%): 500 million tokens with a 12-month lock from TGE. Early unlock available with a fee starting at 3 cents per token, decreasing linearly.

- Other incentives (4.76%): 476 million tokens fully unlocked.

Full supply unlocks by September 2027. Patron NFT holders receive 100,000 INX each, though these NFTs convert to non-utility PFPs after TGE.

What Happened With the Sonar Sale?

The Sonar Sale ran January 3 through 10, 2026, initially offering 5% of supply at a $300 million FDV for locked tokens (with an immediate unlock option at $1 billion FDV). Demand fell short of the $15 million target, prompting mid-sale adjustments that lowered the effective FDV to around $100 million. The pivot reflected both market conditions and community feedback.

For TGE, a Patron NFT snapshot occurs at 07:00 UTC on January 30. Holders must retract any marketplace bids to qualify for claims. Post-launch, $INX will trade on DEXs and centralized exchanges, including MEXC, with an INX/USDT pair.

What Are the Bull and Bear Cases?

The bull case centers on product-market fit. Real revenue and trading volume suggest users find value in the superapp model. Revenue-linked buybacks create a feedback loop where platform success directly supports token price. The Synthetix pedigree adds credibility, and integrations with Lighter and Mantle expand reach. Some analysts point to 10 to 20x potential if Infinex captures meaningful DeFi market share.

The bear case focuses on supply dynamics. The implied FDV of $300 million or higher at launch is substantial for a project still proving itself. Monthly emissions and eventual team unlocks create persistent sell pressure. Critics have called this one of the largest token supplies, sold by founders before TGE, which could limit upside.

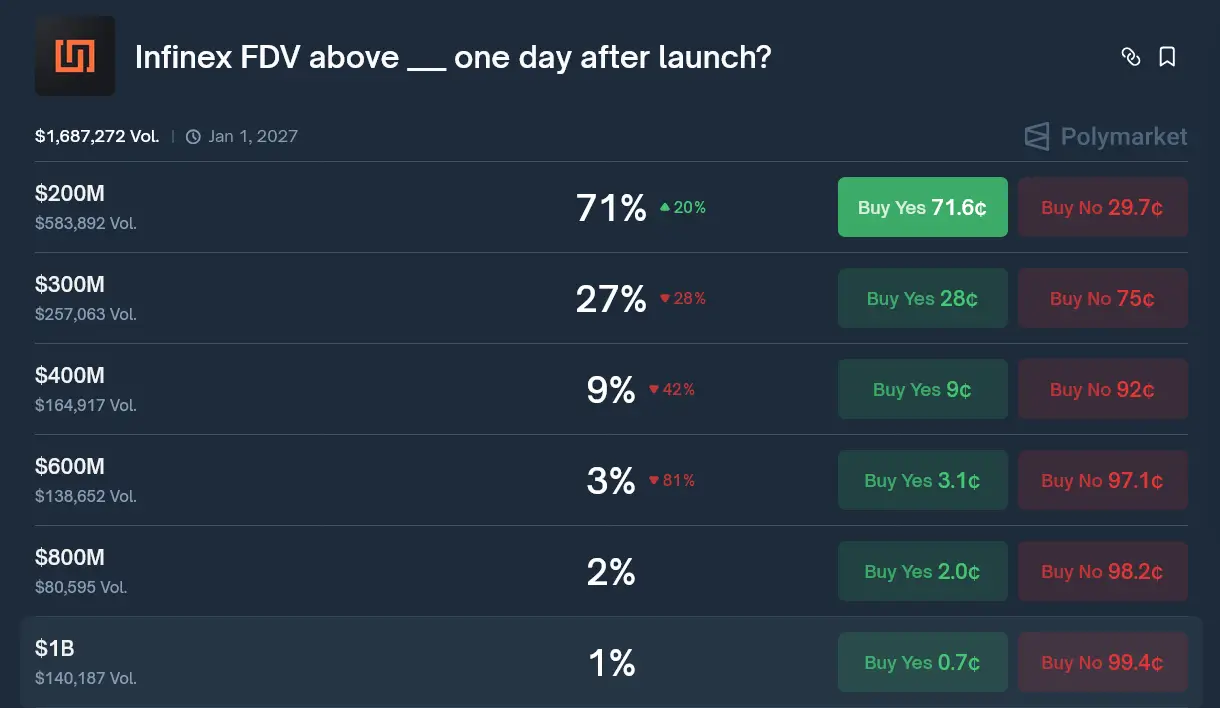

Polymarket odds suggest the market is not confident that FDV will exceed $300 million at launch. The 12-month lock on Sonar tokens and lottery-style allocations have drawn complaints about accessibility.

What Should Investors Watch Post-TGE?

Community sentiment is split between enthusiasm for the technical approach and concern about valuation. After January 30, the metrics that matter include daily trading volume on the platform, active user growth, and whether buybacks execute as promised.

If Infinex captures real DeFi market share, network effects could justify the valuation. If adoption stalls, the large supply and unlock schedule become headwinds.

The project has substance. Whether the tokenomics support the ambition depends on execution over the coming months, not launch day price action.

For official information, visit infinex.xyz or follow @infinex on X.

Sources:

- Infinex Official Documentation — main site with platform features, tokenomics overview, and sale details

- Infinex Sale Details — specific tokenomics, TGE timeline, and unlock mechanics

- Unchained Crypto: Infinex Changes INX Token Sale Terms After Low Demand — reporting on Sonar Sale adjustments and weak demand

- Kain Warwick's Blog on Paragraph — historical context on TGE plans, Patron distribution, and revenue goals

Read Next...

Frequently Asked Questions

What is the total supply of $INX tokens?

The total supply is 10 billion INX. Approximately 1.99 billion tokens will circulate at TGE, with full emission completing by September 2027 through scheduled unlocks and vesting.

How do $INX holders earn revenue share?

Holders receive up to 40% of platform fees. Infinex uses tracked revenues to buy back $INX tokens, which are then locked for at least 1 year. Staking provides additional APY and fee discounts.

When is the $INX Token Generation Event?

The TGE occurs on January 30, 2026, at 19:00 UTC. A Patron NFT snapshot happens earlier that day at 07:00 UTC, and claims become available in-app immediately after launch.

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

Crypto Rich

Crypto RichRich has been researching cryptocurrency and blockchain technology for eight years and has served as a senior analyst at BSCN since its founding in 2020. He focuses on fundamental analysis of early-stage crypto projects and tokens and has published in-depth research reports on over 200 emerging protocols. Rich also writes about broader technology and scientific trends and maintains active involvement in the crypto community through X/Twitter Spaces, and leading industry events.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens