Huma Finance Analysis: The World’s First PayFi Network

Discover how Huma Finance's PayFi network is revolutionizing global payments with blockchain technology, offering stable yields and instant liquidity while processing over $4 billion in transactions.

Crypto Rich

May 16, 2025

Table of Contents

What is Huma Finance?

Imagine a small business owner in Mexico who just shipped $50,000 worth of goods to a U.S. buyer. Under traditional finance systems, they might wait up to 45 days for a payment to arrive, creating a cash flow gap that threatens their ability to pay employees or purchase new materials. This real-world problem affects millions of businesses worldwide every day.

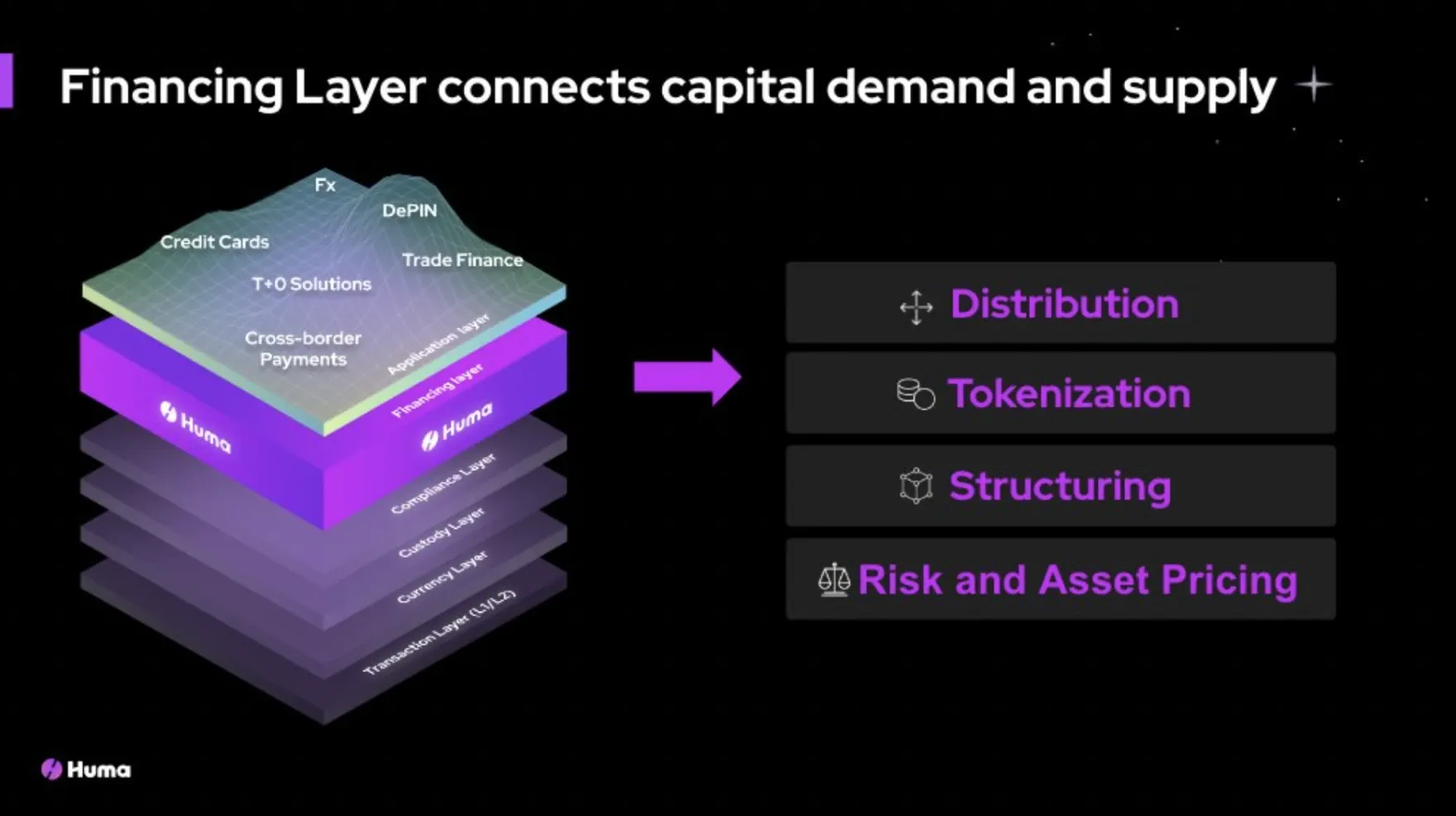

Huma Finance operates as the first PayFi (Payment Finance) Network, connecting payment receivables with global capital to provide instant liquidity. Founded in 2022 in Cupertino, California, Huma uses blockchain technology to create financial solutions that work faster than traditional systems.

The platform addresses three critical problems in global finance:

- Payment processing that takes 3-5 days even in developed markets

- Overseas money transfer fees averaging 6.5% (according to World Bank data)

- Financial services inaccessible to 1.7 billion unbanked people worldwide

By using stablecoins and smart contracts, Huma enables payments to settle in real time, bypassing the usual delays and reducing costs significantly.

Huma's mission focuses on "accelerating the movement of money for a world that's always on," targeting a $30 trillion market in global payment financing. The company aims to democratize access to steady, reliable income from payment financing – something previously reserved for large financial institutions like banks and private credit funds.

The Founders' Journey

Huma's founders bring significant technology experience to the project. Erbil Karaman, Chief Product Officer, previously led product teams at Facebook, Lyft, and Earnin. His interest in blockchain solutions dates back to 2014, when he first recognized their potential to reshape global finance.

Richard Liu serves as CTO, having formerly headed engineering at Google, where he worked on Google Fi and Trust Scores. He also founded Leap.ai, which Facebook later acquired. Both founders shared a frustration with the limitations of existing financial systems.

"We saw that while blockchain technology offered revolutionary possibilities, few solutions addressed everyday financial needs for average consumers and businesses," Karaman noted in a 2023 interview. This insight drove them to create Huma with a specific focus: making borrowing and liquidity accessible beyond the wealthiest 1% of the population.

Huma 2.0: A Major Platform Upgrade

In April 2025, Huma launched its 2.0 platform – a permissionless, compliant, and composable system built on Solana. By "permissionless," Huma means anyone can participate without requiring approval from a central authority – a key principle of decentralized finance that removes traditional gatekeepers.

The upgraded platform offers stable, double-digit yields in USDC (10.5% APY as of May 2025). These returns have attracted significant interest from users seeking reliable returns in an economic environment where traditional savings accounts typically offer less than 1% interest.

Classic and Maxi Modes

Huma 2.0 introduced two distinct investment approaches for users:

Classic Mode allows users to earn:

- 10.5% APY in USDC

- Huma Feathers (reward points) at different multipliers based on lock-up periods:

- 1x multiplier with no lock-up

- 3x multiplier with a 3-month lock-up

- 5x multiplier with a 6-month lock-up

Maxi Mode focuses on maximizing Huma Feathers without USDC yield:

- 5x Feathers rate with no lock-up

- 10.5x Feathers rate with a 3-month lock-up

- 17.5x Feathers rate with a 6-month lock-up

This second option appeals to users who believe in future token rewards and prefer accumulating Feathers rather than immediate yield.

PayFi Strategy Token

A key innovation in Huma 2.0 is the PayFi Strategy Token ($PST), a liquid, yield-bearing LP token. The token seamlessly integrates with other Solana DeFi protocols, including Jupiter for swapping, with planned support for Kamino (collateral) and RateX (trading future rewards).

The platform's adoption has been swift and substantial. Within just two weeks of launching Huma 2.0, users deposited more than $25 million. By April 2025, the platform had attracted over 33,000 depositors, demonstrating strong market interest in blockchain payment solutions and DeFi stable yields.

How Huma's Technology Works

Time Value of Money Model

Huma's proprietary Time Value of Money (TVM) model forms the core of its technology. This innovative system converts future expected payments into immediate liquidity, enabling unsecured loans based on predicted income streams without collateral requirements.

The TVM model operates through several sophisticated mechanisms:

- Income Pattern Analysis: Algorithms analyze historical transaction data to identify reliable payment patterns, accurately predicting future cash flows.

- Risk Assessment: The system evaluates multiple factors—payment history, counterparty reliability, and market conditions—to assess the likelihood of receivables being paid.

- Automated Valuation: Based on these assessments, smart contracts calculate appropriate advance rates for receivables, typically ranging from 70-90% of expected value.

This approach reduces financing barriers for small businesses and individuals lacking collateral assets. For instance, a freelancer expecting payment in 45 days can access a portion of that income immediately, solving short-term cash flow challenges.

The TVM model addresses liquidity constraints in traditional payment systems, where approximately $4 trillion sits idle in global prepaid accounts. Huma improves cash flow efficiency throughout the financial ecosystem by activating this dormant capital.

Unsecured Lending System

Huma automates unsecured loan issuance through smart contracts, reducing administrative costs by up to 80% compared to traditional lending while improving transparency for all parties.

This streamlined automation includes:

- Receivables verification

- Risk scoring

- Loan origination

- Payment collection

- Default management

Small businesses and unbanked populations gain access to funds they wouldn't qualify for in traditional systems, where approval processes often favor established businesses with extensive credit histories.

The merger with Arf, a cross-border payment platform, strengthened this capability. Huma manages deposits while Arf handles lending operations. Together, they've achieved a remarkable 0% default rate, demonstrating the effectiveness of their risk assessment methods. This perfect record stems from conservative lending practices and a strong focus on high-quality receivables rather than high-risk ventures.

Operating in the highly regulated spaces of cross-border payments and unsecured lending, Huma navigates a complex regulatory landscape. The company has adopted a compliance-first approach, working within established frameworks like FATF travel rules for cross-border transactions and obtaining necessary lending licenses in key jurisdictions. It also engages with regulators to shape evolving DeFi policies.

Blockchain Foundation

Huma operates on multiple blockchains to deliver its PayFi network:

- Solana: Powers Huma 2.0 with high-speed, low-cost transactions (65,000 TPS, $0.00025 per transaction), processing $4B in transactions.

- Stellar: Enables efficient cross-border payments via its Soroban smart contract platform.

- Ethereum L2s: Includes Polygon, Celo, and Scroll for EVM-compatible financing, with Scroll added in September 2024.

While Solana is a cornerstone of Huma 2.0, launched in April 2025 with $PST integrations, Huma's multi-chain approach leverages Stellar, Polygon, Celo, and Scroll to serve diverse use cases like cross-border payments and RWA financing.

The system utilizes stablecoins (particularly USDC) for settlement, enabling 24/7 operations without the delays typical of traditional banking systems. By eliminating intermediaries, Huma substantially reduces costs throughout the payment process.

Smart contracts automate the entire lending and payment process, creating auditable records that enhance transparency and reduce fraud risk. Like all blockchain systems, this architecture presents certain security considerations, including smart contract vulnerabilities and potential regulatory challenges. Huma addresses these through regular security audits and comprehensive compliance measures.

Market Positioning and Competitive Advantage

Addressing Key Market Gaps

According to World Bank data, traditional cross-border payments typically take 3-5 days and cost an average of 6.5% in fees. Huma dramatically reduces these costs while enabling instant settlement, a significant advantage for businesses operating internationally.

More importantly, Huma's TVM model activates approximately $4 trillion in global prepaid accounts that normally remain idle. This represents an enormous pool of capital that can now generate returns and facilitate commerce.

Stable Yield Model and Competitive Landscape

Unlike many DeFi platforms that depend on volatile token incentives, Huma's yields derive from real business fees paid for payment financing and settlement liquidity. This connection to actual economic activity provides greater stability and sustainability compared to competing models.

When examining the competitive landscape:

MakerDAO requires overcollateralized lending where borrowers must deposit more assets than they borrow. This approach limits accessibility for businesses without significant collateral reserves. Huma's unsecured lending model eliminates this barrier, making financing available to a broader range of participants.

Centrifuge specializes in tokenizing real-world assets but requires originators to provide substantial collateral. Huma's approach to receivables financing removes this collateralization requirement, making the platform more accessible to smaller businesses with limited assets.

Traditional Payment Processors like PayPal or Stripe offer instant settlement but typically charge 2.9-3.5% fees. Huma's blockchain-based architecture can deliver the same service at lower costs due to reduced overhead and intermediary elimination.

Huma's perfect 0% default rate and strategic partnerships with established entities like Circle and Stellar Foundation further strengthen its credibility with users and investors alike.

Social Impact

Beyond commercial success, Huma enhances financial inclusion by providing credit access to unbanked populations and small-to-medium enterprises. This mission aligns with global economic development goals for reducing poverty and increasing financial participation.

With approximately 1.7 billion adults worldwide lacking access to banking services, Huma's technology offers a viable pathway to financial inclusion that bypasses traditional banking infrastructure, allowing previously excluded individuals to participate in the global economy.

Recent Developments and Future Outlook

2024-2025 Milestones

Several key developments highlight Huma's recent progress:

- Huma 2.0 Launch (April 2025): The platform introduced permissionless access, the $PST token, and dual investment modes (Classic and Maxi). Simultaneously, the company rebranded its institutional services as "Huma Institutional" to distinguish between retail and enterprise offerings.

- Pool Reopening (May 2025): Responding to overwhelming demand, Huma 2.0 reopened deposits with a 100,000 USDC limit per wallet, democratizing access while managing growth.

- Expansion on Scroll (September 2024): Becoming the first PayFi network on Scroll, Huma expanded its RWA offerings to a new blockchain ecosystem.

- Funding Achievement (September 2024): The company announced a $38 million Series A funding round, following an earlier $8.3 million seed round in February 2023. With backing from investors like Circle, HashKey Capital, and Stellar Foundation, the $46.3 million total raised is specifically earmarked for scaling the PayFi Network globally.

- Transaction Milestone (April 2025): Reaching $4 billion in transaction volume cemented Huma's position as a leading Solana protocol by actual usage rather than speculative value.

Future Plans and Cross-Chain Strategy

Looking ahead, Huma has established ambitious targets for the remainder of 2025 and 2026:

- Credit Origination Expansion: After achieving $100 million in credit origination in 2023, the company is now targeting $2 billion by the end of 2025, representing a 20-fold increase in lending volume.

- DeFi Ecosystem Integration: Huma continues to expand integrations with Kamino, RateX, and other Solana protocols, creating a comprehensive financial services ecosystem where $PST serves as productive capital across multiple platforms.

- Strategic Cross-Chain Roadmap: The company's expansion strategy is following a phased approach:

- Phase 1 (Completed): Optimization of performance on Solana and Stellar

- Phase 2 (Current): Expansion to Ethereum L2 solutions (building on the Scroll integration)

- Phase 3 (2025-2026): Integration with additional L1 blockchains, potentially including Polygon or BNB Chain, to complement its Solana, Stellar, and Ethereum L2 deployments, broadening access to its $30T PayFi market

Huma plans to deepen Stellar's Soroban integration and expand to additional Layer 1 blockchains by 2026, ensuring broad interoperability across the blockchain ecosystem.

This methodical approach maintains system stability while expanding market reach and interoperability.

Token Economy Evolution

While HUMA tokens haven't launched on exchanges yet, the platform has laid groundwork for a sophisticated token economy:

- Feathers Program: Currently functions as a reputation and rewards system likely to convert into token allocations during a future distribution event.

- $PST Functionality Expansion: Plans include extending $PST beyond yield-bearing capabilities to incorporate governance rights, enabling stakeholders to influence platform development decisions.

- Potential Token Distribution: Community speculation on social platform X suggests a possible airdrop, with users analyzing transaction patterns to predict qualification criteria.

Industry analysts increasingly view PayFi as a foundational DeFi layer, with Huma's innovative model potentially reshaping a $30 trillion global payment financing market.

Conclusion

Huma Finance stands at the intersection of blockchain technology and traditional finance, offering innovative solutions to longstanding problems in global payment systems. By creating a PayFi network that connects payment receivables with capital, Huma enables instant liquidity in markets that have historically operated with inefficient delays and high costs.

The company's growth trajectory speaks volumes—processing $4 billion in transactions and attracting over 33,000 depositors demonstrates substantial market demand for these services. Unlike many blockchain projects that rely on speculation and token incentives, Huma's yields stem from real economic activity, providing stability in an often volatile sector.

As global commerce continues its digital transformation, Huma's approach becomes increasingly relevant. By addressing the fundamental challenges of speed, cost, and accessibility in financial infrastructure, the company is building payment rails better suited to an “always-on” global economy.

The future of finance appears to be moving toward hybrid models that combine traditional financial services' stability with blockchain technology's efficiency and transparency. Huma's PayFi Network represents a significant advancement in this evolution, potentially transforming how businesses access capital and how investors earn returns.

Ready to participate in this financial transformation? Join the 33,000+ depositors already shaping the future of global payments through Huma 2.0. Learn more at huma.finance or by following @humafinance on X.

Read Next...

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

Crypto Rich

Crypto RichRich has been researching cryptocurrency and blockchain technology for eight years and has served as a senior analyst at BSCN since its founding in 2020. He focuses on fundamental analysis of early-stage crypto projects and tokens and has published in-depth research reports on over 200 emerging protocols. Rich also writes about broader technology and scientific trends and maintains active involvement in the crypto community through X/Twitter Spaces, and leading industry events.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens