Ethereum ‘Under Threat’ as Solana and BNB Chain Gain Ground: Report

Ethereum’s shift to rollups boosts scalability but drains L1 revenue. Blob transactions (EIP-4844) cut fees but also income.

Soumen Datta

April 17, 2025

Table of Contents

Ethereum has long held the crown as the dominant smart contract platform, powering decentralized finance (DeFi), non-fungible tokens (NFTs), and much more.

However, a new report by Binance Research suggests that Ethereum's supremacy in the blockchain space is now ‘under threat.’ Solana and BNB Chain are closing the gap, challenging Ethereum’s long-standing dominance. This shift could be attributed to various factors, including Ethereum’s high transaction costs, slow speeds, and its evolving relationship with Layer 2 solutions (L2s).

The Growing Threat from BNB Chain and Solana

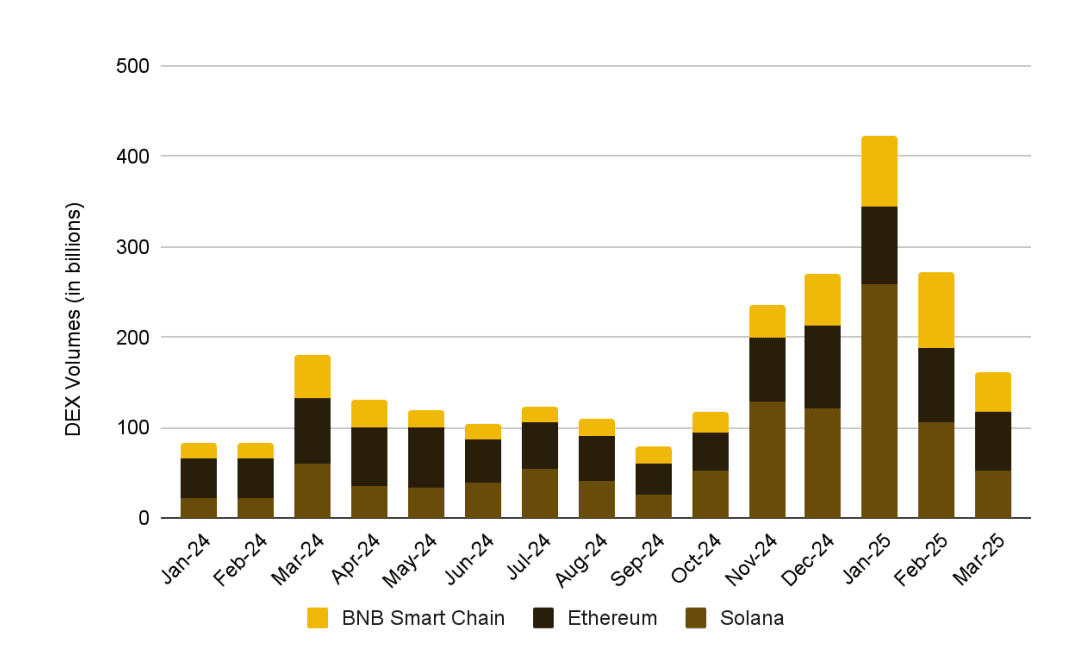

BNB Smart Chain and Solana are no longer just “Ethereum alternatives.” They are rapidly gaining market share, particularly in metrics that matter: DEX activity, developer attention, and user costs.

Solana has seen a sharp rise in both developer growth and network usage thanks to its low fees and high throughput. BNB Chain, backed by Binance’s massive user base, has quietly built out its ecosystem with competitive features and ease of access. Both chains now threaten to erode Ethereum’s share in the very domains it once dominated.

According to Binance, Ethereum is losing ground due to:

- Slow and expensive transactions on L1

- Fragmented developer mindshare across L1 and various L2s

- Liquidity thinning across multiple rollups

- Reduced fee capture by Ethereum mainnet due to rollups

This creates a value leakage problem. As more activity shifts to L2s, Ethereum the asset loses its ability to generate consistent on-chain revenue, weakening its role as "ultrasound money."

The Role of Layer 2 Solutions (L2s)

Ethereum's Layer 2 scaling solutions, such as rollups, have become a crucial part of the network’s strategy to address these challenges. These solutions allow for off-chain execution, reducing the load on the Ethereum mainnet. However, the rise of L2s has also raised concerns about Ethereum’s long-term competitiveness as a data availability layer.

The upcoming Pectra and Fusaka upgrades are aimed at scaling Ethereum’s L2 capabilities. Scheduled for release in May 2025 and late 2025, these upgrades will focus on improving staking, blobs, and account abstraction.

Pectra will bring:

- Staking upgrades (EIP-7251): Raising validator limits from 32 ETH to 2,048 ETH

- Blobs expansion (EIP-7691): Increasing blob capacity from 6 to 9 for cheaper L2 data submission

- Account abstraction (EIP-7702): Turning user wallets into smart contract wallets with advanced features

Fusaka, in contrast, focuses on Ethereum’s long-term competitiveness as a data availability layer:

- PeerDAS (EIP-7594): Lays the groundwork for full data availability sampling

- Ethereum Object Format (EOF): Makes smart contract development more secure and modular

Yet, despite these efforts, there’s growing doubt about Ethereum’s ability to stay ahead, especially on raw throughput and value capture.

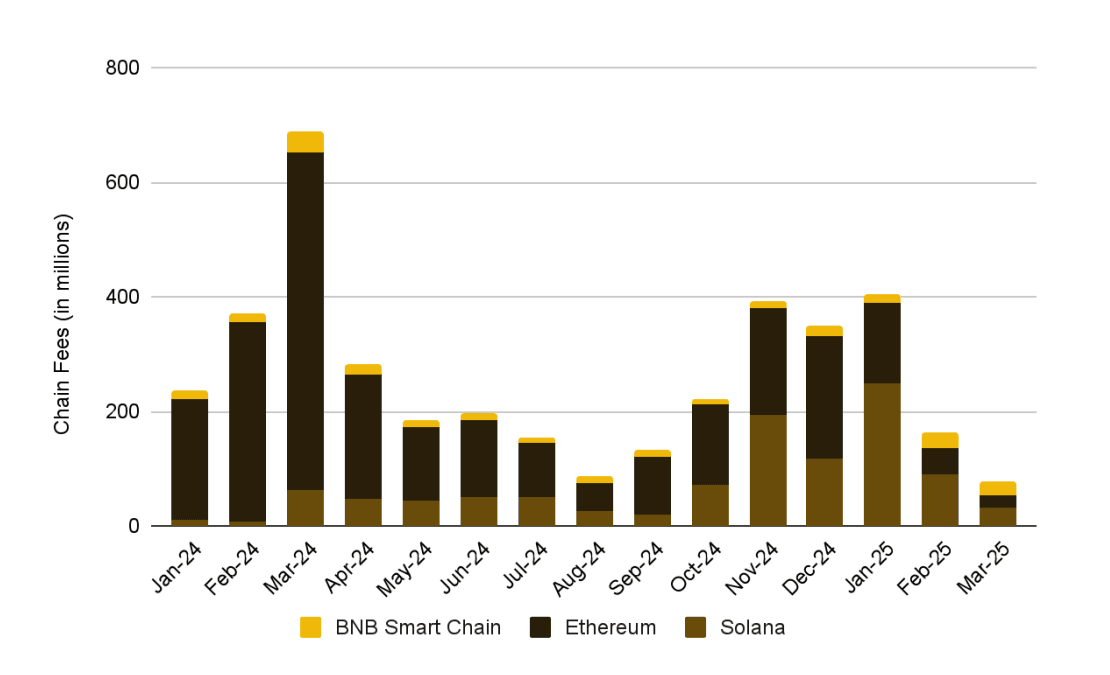

As Ethereum has shifted more responsibility to L2 solutions, much of the transaction fees and maximally extractable revenue (MEV) have moved away from the Ethereum mainnet. This shift has made it harder for Ethereum to maintain its position as the primary asset across both L1 and L2 ecosystems.

Research suggests that Ethereum could benefit from encouraging L2s to contribute a portion of their fees back to the L1. However, this would require buy-in from L2 projects, many of which may not be motivated to share their revenue with Ethereum.

The possibility of "repricing the blob market" and considering the introduction of a fee-sharing model could help Ethereum capture more value from its L2 ecosystem, but the effectiveness of such measures remains uncertain.

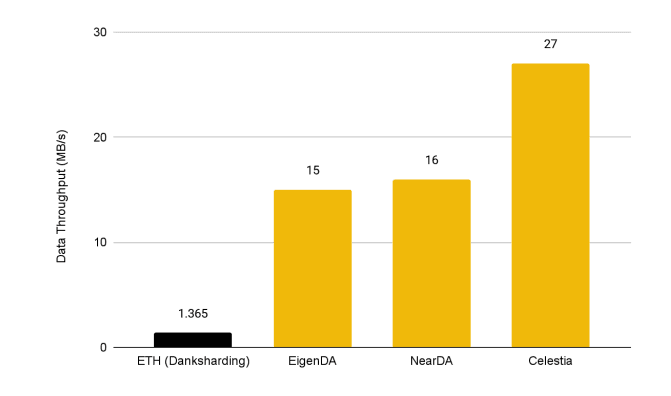

Competitors in Data Availability: Celestia, NearDA, and EigenDA

Ethereum’s commitment to L2 scaling has not gone unnoticed by its competitors, who have taken different approaches to data availability. Celestia, for example, is positioning itself as a specialized data availability layer. It recently launched the Mammoth mini upgrade, which boosted its data throughput capabilities.

Celestia has consistently increased its throughput, reducing block times and making data availability sampling much faster. This has enabled Celestia to scale effectively, making it a serious competitor to Ethereum in the data availability space.

Similarly, NearDA, which integrates with Polygon’s Chain Development Kit (CDK), offers cheap data availability solutions and can handle higher throughput than Ethereum at a fraction of the cost. EigenDA, another competitor, has also gained attention for its ability to offer data availability with native settlement on Ethereum.

For comparison:

- Celestia targets 27MB/s with upgrades like Mammoth and Shwap, aiming for 1GB/s

- NEAR DA can process 16MB/s today and is 85,000x cheaper than Ethereum’s blob market

- EigenDA launched with 15MB/s and 4.5M ETH staked via EigenLayer

Value Accrual Problem

Ethereum’s design choice to push most activity to L2s has succeeded technically. It’s delivering scalability without compromising the base layer. However, this has come at the cost of revenue loss on L1.

EIP-4844 introduced blob transactions that are cheaper but generate less revenue. Ethereum’s L1 fee income is now lower than before, and the asset has turned inflationary again—undermining the narrative of “ultrasound money.”

The core issue: Ethereum is scaling too well, at too low a cost.

While Vitalik Buterin has floated ideas to fix this, such as:

- Repricing blob markets to capture more value

- Encouraging L2s to share a portion of fees with L1

- Supporting based rollups that settle on Ethereum and return MEV to L1

Most of these depend on buy-in from L2s, which act as independent businesses. They may prefer cheaper DA options or avoid contributing fees altogether.

Based Rollups: A Ray of Hope for L1 Fee Capture

Based rollups like Taiko, Surge, and UniFi offer one possible path forward. These rollups allow Ethereum to capture fees from sequencing and MEV directly.

For instance, Taiko contributed nearly $12 million in fees with just 33.6GB of posted data—far outperforming other rollups like Base, which posted over 275GB of data but only paid $5 million in fees.

The catch? Based rollups are still rare, and Ethereum’s roadmap does not prioritize them yet. Without broader adoption, Ethereum will struggle to build a sustainable fee economy at the L1.

Can Ethereum Compete?

Ethereum’s development culture values security, decentralization, and community consensus, which naturally slows progress. This gives more agile projects—like Celestia and NEAR—room to outpace Ethereum on features and cost efficiency.

However, speed comes with trade-offs. Ethereum’s slower pace ensures a high degree of trust, which remains a vital feature for projects needing robust data availability. Not every project needs 1GB/s throughput if 90% of that capacity remains unused.

Ethereum still enjoys the Lindy effect—a long history, strong network effects, and broad integration across DeFi.

Ethereum remains the second-largest cryptocurrency by market capitalization and is widely used across all Layer 2 solutions. However, if Ethereum’s value continues to decline and its dominance wanes, the network could risk losing its position as the primary asset in the crypto space.

Read Next...

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

Soumen Datta

Soumen DattaSoumen has been a crypto researcher since 2020 and holds a master’s in Physics. His writing and research has been published by publications such as CryptoSlate and DailyCoin, as well as BSCN. His areas of focus include Bitcoin, DeFi, and high-potential altcoins like Ethereum, Solana, XRP, and Chainlink. He combines analytical depth with journalistic clarity to deliver insights for both newcomers and seasoned crypto readers.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens